A Report on the Hospital Indigent Care Pool

- A printable version of the "Report on the Hospital Indigent Care Pool" with appendices and slides is also available in Portable Document format (PDF, 1,358KB, 87pg.)

As Required by Chapter 58 of the Laws of 2007

Prepared by The New York State Department of Health

Commissioner Richard F. Daines, M.D .

January 2008

Table of Contents

Executive Summary

- Background on the Hospital Indigent Care Pool

- Background on the Patient Financial Aid Law

- Findings

- Recommendations

I. Statutory Mandate

II. Overview of the Hospital Indigent Care Pool

III. Overview of the Patient Financial Aid Law

IV. Findings

- Summary of Issues

- Lack of Clarity

- Lack of Transparency

- Lack of Accuracy, Uniformity and Consistency

- Lack of Relationship to Patient Financial Aid Law

V. Reform Recommendation

- Addressing Clarity Concerns

- Creating Transparency

- Strengthening Linkage to the Patient Financial Aid Law

- Improving Data Accuracy, Uniformity and Reproducibility

VI. Conclusion

Appendices

- Appendix A - Indigent Care Technical Advisory Committee Members

- Appendix B - Meeting Dates and Locations

- Appendix C1 - Indigent Care Pool Technical Advisory Committee (PDF, 486KB, 24pg.)

- Appendix C1 - Indigent Care Pool Technical Advisory Committee (PPT, 432KB, 24slides)

- Appendix C-2 - Key Issues For Discussion (PDF, 211KB, 5pg.)

- Appendix C-2 - Key Issues For Discussion (PPT, 915KB, 5slides)

- Appendix C3 - Reforming and Restructuring Indigent Care (PDF, 187KB, 17pg.)

- Appendix C3 - Reforming and Restructuring Indigent Care (PPT, 229KB, 17slides)

- Appendix D - Hospital Indigent Care Public Hearings

- Appendix E1 - Section 2807-k. General Hospital Indigent Care Pool

- Appendix E2 - Section 2807-w. High Need Indigent Care Adjustment Pool

- Appendix F - Section 2807-p. Comprehensive Diagnostic And Treatment Centers Indigent Care Program

Executive Summary

Since 1983, New York State has set aside a pool of money to underwrite a portion of the uncompensated care costs incurred by hospitals. Initially termed the Hospital Bad Debt and Charity Care (BDCC) Pool and more recently the Hospital Indigent Care Pool (the Pool), this Pool currently distributes $847 million in Medicaid funds to public and voluntary hospitals through multiple sub-Pools and multiple allocation formulas.

In an effort to assure greater transparency and accountability, in 2007, the Legislature, at the urging of the Governor, required the Commissioner of Health in conjunction with the Chairs of the Senate and Assembly Health Committees and with the assistance of a Technical Advisory Committee, to evaluate the types and amounts of services provided by hospitals and the costs incurred by hospitals in relation to the receipt of monies from the Indigent Care Pool. In addition, the 2007 legislation instructs the Commissioner to review the relationship between the Indigent Care Pool awards and the Patient Financial Aid Law (Section 2807-k(9-a)) of the Public Health Law). Enacted in 2006, the Financial Aid Law requires hospitals to offer steep discounts from typical charges to uninsured patients with incomes at or below 300 percent of the Federal Poverty Level (FPL). As required by the Legislation, this report sets out the Commissioner of Health's findings and recommendations.

Return to Table of ContentsA. Background on the Hospital Indigent Care Pool

The Hospital Indigent Care Pool funding is authorized in two different sections of the Public Health Law and distributed through seven sub-Pools: major public hospital pool ($139.3 million); voluntary and minor public hospital pool ($582.2 million); the voluntary high-need reserve pool ($72 million); supplemental voluntary hospital pool ($16.7 million); and the supplemental indigent care pool ($27.0 million) and rural forumulaic and grant pools ($20.3 million and $9 million respectively).

Funds in the seven sub-Pools are distributed using several different allocation formulas. However, with the exception of the supplemental indigent care pool and rural hospital grant sub-Pools, Pool allocation formulas start with the amounts hospitals report for "bad debt" and "charity care".

Bad debts are defined in Health Department regulations and include amounts charged to patients which remain unpaid and are determined by the hospital to be uncollectible. Charity care includes amounts hospitals determined not to bill the patient because a determination was made that the patient was medically indigent. Whether unpaid charges are treated as bad debt or charity care or a mixture thereof and when those amounts are reported to the Department of Health are a function of accounting procedures and financial policies which vary from hospital to hospital. For example, if a hospital determines, under its financial aid policies, that an uninsured patient is entitled to have its charges reduced from $200 charge to $50, it records a charity care loss (or charity care need) of $150. If the patient ultimately fails to pay the $50, that amount is then considered a bad debt. The charity care need might be reported to the Department several years before the bad debt need, depending on how quickly the hospital determines the $50 is uncollectible.

Hospitals' reported BDCC need includes uncompensated care provided to uninsured patients. It also includes any co-pays or deductibles that hospitals were unable to collect from insured patients.

In all cases, hospitals report their bad debt and charity care need using hospital charges which the Department then "converts" to costs by applying the hospital's overall ratio of cost to charges.

In 2006, the Pool covered approximately 63% of the BDCC losses reported by hospitals, with voluntary hospital coverage ratios ranging from 46% to over 100% of reported BDCC need. The wide variation in coverage ratios are primarily a result of: (1) a nominal payment scale which provides for a greater coverage ratio as a hospital's BDCC need increases; (2) hospitals' participation in multiple pools; and, (3) the distribution of some pool dollars independent of reported BDCC need. The coverage ratio for public hospitals is approximately 23%; however, that does not include supplemental payments of $411 million which are independent of the Indigent Care Pool.

Return to Table of ContentsB. Background on the Patient Financial Aid Law

The Patient Financial Aid Law was adopted in SFY 2006/07 and requires all hospitals to implement financial aid policies by January 1, 2007 that provide progressively scaled discounts to uninsured patients with incomes at or below 300% of the FPL that are benchmarked to the highest volume third-party payor for the specific applicable service. A hospital's compliance with these requirements is a condition of Pool participation on and after January 1, 2009. The Department of Health also issued guidance encouraging hospitals to extend financial aid policies to low-income insured patients who are unable to meet their copayment and deductible obligations.

Return to Table of ContentsC. Findings

This report reflects a review of hospital cost report data, public hearings in Syracuse and New York City, three meetings of the Technical Advisory Committee (TAC) and many discussions with hospitals, community health centers, consumers and other stakeholders. The Hospital Indigent Care Pool has evolved over 25 years. While a critical source of funding for both hospitals and patients, the Pool is now a black box with allocations based on awkward and vague definitions and multiple complicated formulas that are tied neither to care provided to uninsured patients nor the requirements of the Financial Aid Law. The report includes the following key findings of the Department of Health:

- Indigent care dollars do not follow services to individual patients and the BDCC need as currently reported by hospitals cannot be connected back to care delivered to specific patients, absolute numbers of patients, or the cost of care provided to uninsured patients.

- Indigent care funding formulas make no distinction between uncompensated care provided to uninsured patients and uncompensated care for insured patients who default on their co-pay and deductible obligations; patients' income status is likewise not a factor in Pool allocations.

- Hospitals separately report the number of units of service to uninsured patients, uninsured losses and BDCC need. However, there is no clear relationship between and among these variables.

- There is no consistent benchmark across hospitals for the cost of care provided to uninsured patients. Using each individual hospital's charges reduced to cost as the basis for most Pool allocations results in inequities in Pool allocations since they are driven by reported hospital costs that can vary significantly for comparable services.

- Existing sub-Pools are distributed using different methodologies. Distributions from the rural hospital grant pool and the supplemental indigent care pool are not related to hospital uncompensated care need. The supplemental indigent care pool targets money to teaching hospitals based on prior years shifts in professional education pool distributions and the rural hospital pool provides $140,000 grants to rural hospitals.

- There is no connection between the Financial Aid Law requirements that hospitals offer accessible sliding fee scales to low-income uninsured patients and the distributions from the Hospital Indigent Care Pool.

D. Recommendations

The report concludes with recommendations to address the problems and concerns identified by TAC members, the public and the Department. The key recommendations are as follows:

- The existing sub-Pools should be collapsed into three: a major public hospitals pool; a voluntary and minor public hospitals pool; and a rural pool.

- The indigent care need calculation should start with inpatient and outpatient units of service to uninsured patients under the hospital financial aid policies. The reported visits and discharges should be valued at the hospital's Medicaid rates.

- Pool dollars should be targeted first to uncompensated care provided to uninsured patients (defined as patients without any insurance or without insurance for the needed care). Hospital debt related to non-payment of co-pays and deductibles by insured patients should be a second priority.

- Allocation of Pool dollars should be consistent with and support the requirements of the Patient Financial Aid Law.

- Existing "nominal" coverage scales which provide a progressively higher coverage ratio as a hospital's indigent care need to total cost ratio increases should be maintained.

- Requirements that patients document their income and insurance status should be practical and reasonable so as not to unduly burden hospitals and patients alike.

- Changes to the Indigent Care Pool allocation formulas should be phased in over a multi-year period to permit hospitals to improve data collection and reporting, and accommodate shifts in funding among hospitals.

I. Statutory Mandate

Chapter 58 of the Laws of 2007 (Chapter 58) requires the Commissioner of Health, in conjunction with the Chairs of the Senate and Assembly Health Committees, to review the current basis for determining distributions under the Hospital Indigent Care Pool (Pool) established by Sections 2807-k and 2807-w of the Public Health Law. The Indigent Care Pool currently provides $847 million in annual subsidies to hospitals for inpatient and outpatient uncompensated care services. Chapter 58 also requires an evaluation of the relationship between Pool distributions and the recently enacted Patient Financial Aid Law that requires hospitals to provide discounts to uninsured patients with incomes at or below 300% of the Federal Poverty Level (FPL) as a condition of Pool participation on and after January 1, 2009.

Enacted as part of the 2007/08 State Budget, Chapter 58 requires the Commissioner of Health and the Chairs of the Senate and Assembly Health Committees to appoint an Indigent Care Technical Advisory Committee (TAC) to assist in the Pool evaluation. The TAC's specific duties are to assist in an evaluation of the type and amount of indigent care services provided by hospitals and the costs they incur in relation to the receipt of Pool subsidies. The TAC is also charged with evaluating the relationship between allocations from the Indigent Care Pool and the requirements of the new Patient Financial Aid Law authorized in Section 2807-k(9-a) of the Public Health Law. A listing of TAC members, meeting dates/locations, and meeting materials provided to TAC members are included as Appendices A-C.

As part of its review, the Commissioner, along with the Chairs of the Senate and Assembly Health Committees, convened public hearings in New York City and Syracuse during the summer of 2007, where consumers, community health centers, mental health agencies, physicians and hospital representatives, among others, testified. In addition, TAC members met on three occasions between June and November 2007 to review the relevant governing provisions, policies, and data underlying hospital indigent care awards. A draft of this report was also shared with TAC members and the Committee Chairs in December 2007 to solicit comments. A listing of the public hearing dates, locations, and witnesses are included as Appendix D. Copies of the testimony are available from the Department.

Return to Table of ContentsII. Overview of the Hospital Indigent Care Pool

A. Purpose

In 1983, New York State established a Hospital Bad Debt and Charity Care (BDCC) Pool to underwrite a portion of hospital losses associated with uncompensated care1. This Pool was created, in large part, to address escalating charges hospitals were imposing on third party payers to cross-subsidize losses from uncompensated care provided to uninsured patients. Over time, the Pool's initial purpose has been tempered by the inclusion of additional funding for selected groups of hospitals (e.g., rural hospitals and teaching hospitals) that are not premised on uncompensated care losses.

Return to Table of ContentsB. Funding Sources

Initially, the Pool was funded by payer "add-ons" to regulated inpatient hospital rates and an assessment on hospital inpatient revenues. The Department collected and distributed these Pool resources.

In 1996, the Health Care Reform Act (HCRA) replaced these inpatient payer add-ons with a more comprehensive system of payer surcharges on both inpatient and outpatient hospital services, services provided by comprehensive diagnostic and treatment centers (D&TCs), freestanding ambulatory surgery centers, and New York State licensed laboratories.2 Presently, the surcharge on Medicaid payments is set at 6.54% and for all other non-Medicare payers at 8.95%. Hospitals also continue to pay a 1% annual assessment on all inpatient revenues. Subsequent HCRA legislation added other revenue sources (e.g., cigarette taxes and Empire BlueCross and BlueShield conversion stock proceeds) that further increased Pool subsidy resources. Similar to the previous rate add-ons and assessment, these proceeds are collected and pooled by the State to finance a number of important health care initiatives, including both the Hospital and D&TC Indigent Care Pools.

Return to Table of ContentsC. Distribution Methodologies

The Pool provides $847 million in annual subsidies to qualifying public and voluntary hospitals to partially defray the costs of uncompensated care provided to both uninsured and insured patients primarily based on hospital reported BDCC write-offs. Award distributions qualify as Medicaid Disproportionate Share (DSH) payments making them eligible for Title XIX federal matching funds within federally imposed DSH payment limits. The Pool statutes are included as Appendix E.

The Pool has evolved into a patchwork of sub-Pools that include sub-Pools for major public hospitals;3 voluntary and minor public hospitals; high-need voluntary hospitals; rural hospitals; and targeted funding to certain hospitals that lost graduate medical education subsidies through statutory changes to the HCRA Professional Education Pool.

The allocations from the major public hospital pool are based on the percentage of total major public hospital reimbursable costs to total statewide hospital reimbursable costs. In 1997, HCRA froze the major public hospital pool allocation at the 1996 level of $139 million. Each major public hospital's portion of this allocation is then determined by its relative share of total reimbursable costs to total reimbursable costs for all major public hospitals as applicable in 1996.4

Indigent care awards to voluntary and minor public hospitals are based on the amounts each hospital writes-off for "bad debts" and "charity care." Specific write-off decisions, in terms of amounts and timing, can and do vary among hospitals. The regulations define "bad debts" to include amounts charged to patients which remain unpaid and are determined to be uncollectible; and "charity care" to include amounts hospitals determined not to bill the patient because they have determined that the patient is medically indigent. (See Department of Health Regulations Part 86-1.11.) Unpaid amounts by any one patient can be considered either, or both, a bad debt or charity care.

The uncompensated care need determination for each hospital is initially based on the write-off of specific charges established by a hospital. The Department reduces each hospital's reported charge-based BDCC need through a converter that adjusts these charges to costs. Consequently, each hospital's reported BDCC need is influenced by the accounting firm it hires; the write off policies it adopts; and the unreimbursed costs it incurs in providing care to uninsured patients and insured patients. This variability has also been further exacerbated by the lack of clear and uniform definitions. For all of these reasons, as discussed further in Section V, currently there is little, if any, relationship between a hospitals' reported BDCC need and its reported volume of services provided to uninsured patients.5

From 1983 until 1987, each voluntary and minor public hospital received a flat coverage rate for their reported BDCC losses, adjusted to costs, ranging from 40% to 46%. Then in 1988, the Legislature adopted a progressive coverage scale so that a hospital's Pool allocation would increase as its reported BDCC need to total hospital cost increased. This scaled coverage is still in use today, with the added requirement that hospitals may only receive funds from the Pool if their BDCC need equals or exceeds .5% of reported hospital costs. In 1997, the Legislature also eliminated coverage for outpatient losses and established a sub-Pool for hospitals with the highest proportion of uncompensated care need. In 2000, another sub-Pool to supplement coverage for rural hospitals was also created. By 2006, the Pool covered approximately 63% of statewide BDCC losses reported by hospitals, with the highest coverage available to hospitals that participated in multiple sub-Pools.

In addition to the two major sub-Pools for major public hospitals and voluntary/minor public hospitals, there are three additional sub-Pools, each distributed pursuant to a different allocation methodology. The first is a $72 million Voluntary Hospital High Need Reserve Pool that provides supplemental BDCC funding to hospitals whose BDCC need exceeds 4% of reported reimbursable costs. The second is a $29 million sub-Pool for rural hospitals that distributes monies through a combination of a fixed grant of $140,000 per hospital, supplemented by a BDCC need-based award weighted by bed size. Lastly, certain voluntary teaching hospitals participate in a $27 million Supplemental Indigent Care sub-Pool where awards are based on each qualifying hospital's proportionate loss of graduate medical education funding due to statutory reductions in HCRA Professional Education Pool allocations.

Public Health Law Section 2807-k excludes the costs of uncompensated referred ambulatory care from the BDCC need calculation for all pools. Referred ambulatory services include hospital rendered ancillary services that are ordered by medical professionals not affiliated with the hospital.

Return to Table of ContentsIII. Overview of the Patient Financial Aid Law

The Patient Financial Aid Law was adopted in SFY 2006/07 and requires all hospitals to implement financial aid policies that conform with specified requirements by January 1, 2007. These provisions require hospitals to provide progressively scaled discounts to uninsured patients at or below 300% of the Federal Poverty Level that are benchmarked to the highest volume third-party payor for the specific applicable service. A hospital's compliance with these requirements is a condition of Pool participation on and after January 1, 2009. Guidance has been issued by the Department to assist hospitals in developing compliant procedures and to encourage them to extend financial aid beyond the minimal statutory requirements.

Return to Table of ContentsIV. Findings

A. Summary of Issues

Over the past 25 years, the Hospital Indigent Care Pool grew from $162 million to the $847 million Pool of today. The funding additions and establishment of new sub-Pools addressing discrete hospital financial needs were each important at the time of enactment. As this nine-month inquiry revealed however, the end result is an opaque Pool where hospital reported BDCC need and Pool allocations are not traceable to care rendered to uninsured patients. There is also no objective data to compare, contrast, and equitably subsidize hospitals for uninsured patients' service losses. These problems became more pronounced with the 2006 passage of the Patient Financial Aid Law requiring hospitals to provide steep discounts to uninsured patients with incomes below 300 percent of the federal poverty level and in 2007 when Governor Spitzer initiated the Partnership for Coverage, a year-long process to identify mechanisms to extend health insurance coverage to 2.6 million uninsured New Yorkers.

Common concerns about the current Pool echoed by TAC members and by witnesses at the public hearings are:

- A lack of clarity on the overarching purpose of the Hospital Indigent Care Pool, the types of services, patients, and hospital losses eligible for Pool coverage and the methodologies for distributing funds to hospitals.

- A lack of transparency with respect to awards from the Pool and the volume, value, site of service and patient status for which hospitals receive awards.

- A lack of consistency, uniformity and accuracy of the reported data underlying awards from the Pool.

- A lack of connection between the Hospital Indigent Care Pool award formulas and the mandates of the Patient Financial Aid Law (Public Health Law Section 2807-k (9-a)).

B. Lack of Clarity

There was significant discussion at the public hearings and TAC meetings as to the primary purpose of the Hospital Indigent Care Pool. All agreed that the primary purpose of the Pool is to subsidize hospital costs for rendering uncompensated care to uninsured patients. There was less consensus regarding the extent to which Pool funds should subsidize co-pay and deductibles of insured patients. Currently, the Pool definitions and distribution formulas make no distinction based on the insurance status or income levels of the patients whose unpaid bills are captured in hospital reported BDCC need. The Department recognizes that for some low-income patients' deductibles and co-pays can be quite burdensome and that for hospitals unpaid co-pays and deductibles reflect uncompensated care regardless of the patient's insurance status. Pool resources, however, are limited and should, in the Department's view, be primarily targeted for hospital care provided to uninsured patients. Using substantial Pool resources to subsidize high-deductible or otherwise inadequate insurance policies, masks and perpetuates a different problem, requiring a different solution.

As previously stated, the current definition of uncompensated care need is largely based on hospital reported bad debt and charity care accounting write-offs reduced to costs for inpatient and outpatient services. There is a substantial amount of variability on how and when hospitals determine such annual levels of bad debt write-offs. Part 86-1.11 defines bad debts as amounts considered uncollectible from payers, including self-pay, for services provided to patients. Since accounting principles determine when bad debts are written off, a facility's specific write-off method (e.g., reserve method, direct write-off method, or a combination of the two methods) affects when these bad debts are actually reflected in annual Pool calculations. Bad debts may also include unpaid co-pays and deductibles for insured patients, regardless of their income status, and other uncollected receipts from third-party billings.

Part 86-1.11 defines charity care as a reduction in charges made by the provider after a determination is made that the patient is indigent or medically indigent. In practice, however, hospital charity care policies have varied widely with certain minimums now established through recent adoption of the Patient Financial Aid Law. Thus, it will be both easier and more important going forward to tie Pool allocations directly and clearly to uncompensated care provided to patients targeted by this Patient Financial Aid Law.

The lack of clarity as to the purpose of the Pool and the definitions and calculations used to allocate limited Pool dollars, is exacerbated by multiple sub-Pools that use their own complex methodologies to allocate large shares of Pool monies to hospitals which conceal their true impact in rendering care to uninsured patients. There are also distribution methodologies in use for certain sub-Pools that are not even remotely connected to uncompensated care costs.

Return to Table of ContentsC. Lack of Transparency

Each hospital's BDCC amounts are currently reported in the aggregate based on hospital charges. They cannot be tied back to a related rendered service or to a patient, much less a patient's insurance or income status. Indeed, there appears to be little relationship between the amount a hospital reports in BDCC need in any given year and the units of service it reports to uninsured ("self-pay") patients. This is highlighted in the testimony of Professor Jack Zwanziger, Ph.D, Director of Health Policy and Administration and The Center for Health Services Research, University of Illinois, formerly the Associate Professor of Community and Preventive Medicine at the University of Rochester.

"Despite the longstanding use and review of BDCC expense data, I found similarly high levels of unexplained and implausible year-to-year variability in both data sources." (Table below) About half of hospitals had year-to-year fluctuations in self-pay/free service measures greater than +/- 20 percent (with the exception of ED visits), and over 40 percent of hospitals had this level of variability in BDCC measures. At the same time, few hospitals had large year-to-year variation for other key measures of hospital expenses and services (total expense, total discharges, and percent of discharges covered by Medicaid)."

The Department of Health has performed its own analysis of data reported by hospitals throughout the state with findings similar to Dr. Zwanziger's. There is no correlation in year-to-year changes in reported BDCC to changes in self-pay and free units of service and the reported data varies significantly year to year. This is demonstrated by a random sample of hospital data in the chart below.

| 2003 versus 2002 | 2004 versus 2003 | |||

|---|---|---|---|---|

| Hospital | % Change in Inpatient BDCC |

% Change in Self-Pay and Free Discharges |

% Change in Inpatient BDCC |

% Change in Self-Pay and Free Discharges |

| Hospital A | 7.3% | -10.0% | 24.8% | 52.5% |

| Hospital B | 34.9% | 29.8% | 4.1% | -16.5% |

| Hospital C | -4.8% | -12.8% | -31.8% | -13.2% |

| Hospital D | -37.4% | 1.7% | -23.3% | -5.2% |

| Hospital E | 133.0% | 0.2% | 41.5% | -67.3% |

D. Lack of Consistancy, Uniformity and Accuracy

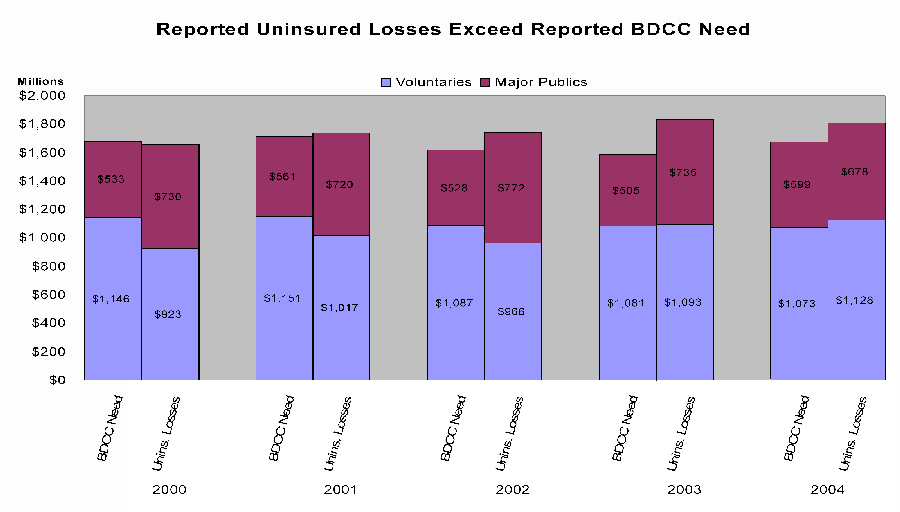

Given the definitional issues noted above, there is considerable uncertainty about the accuracy of the data being reported and used for determining existing awards. As shown in the following charts, since 2001, reported uninsured losses have exceeded BDCC losses. The is counterintuitive because BDCC includes uncompensated care rendered to both uninsured and insured patients and, therefore, should be greater than uninsured losses. This strongly suggests that the reported data is not a reliable basis on which to determine Pool distributions.

| * | Consistent with PHL 2807-k(1)(e) for cost reporting purposes, uninsured is defined as patients without insurance or other third party coverage for the unit of service billed, including units of service, which, although provided to patients who are insured, are not covered. It shall not encompass instances of underinsurance for patients who may have some insurance. |

| * | Uninsured losses are determined as the difference between cost and revenue related to service provided to the uninsured patients for inpatient and outpatient services. |

E. Lack of Relationship to Patient Financial Aid Law

The Patient Financial Aid Law enacted in 2006 (PHL §2807-k (9-a)) requires hospitals to provide discounts to uninsured patients with incomes at or below 300% of the federal poverty level (FPL) as a condition for Pool funding on and after January 1, 2009. Department guidance encourages hospitals to go further by extending greater discounts and subsidizing care for patients above 300% of the FPL. Although the Financial Aid Law requires hospitals to provide significant discounts to low-income, uninsured patients, there is currently no correlation between Pool payments and the services and discounts provided under the Financial Aid Law. The only direct connection between the two laws is a requirement that makes receipt of Pool funds conditioned on meeting the requirements of this Financial Aid Law.

The lack of connection between Pool distributions and the requirements of the Financial Aid Law is problematic in a number of respects. The Patient Financial Aid Law represents a comprehensive effort by the Legislature to ensure that uninsured patients have access to care at reasonable costs. It imposes a significant burden on hospitals and represents a critically important mandate for patients. By failing to establish a connection between Pool payments and the requirements of the Patient Financial Aid Law, the State is losing an opportunity to facilitate full compliance and to support hospitals that voluntarily implement procedures which go beyond the law's minimal requirements.

Return to Table of ContentsV. Reform Recommendations

A. Addressing Clarity Concerns

The patchwork manner in which sub-Pools and supporting methodologies have evolved has obscured any reasonable understanding of the volume, level, and costs of services hospitals render to low-income, uninsured patients. Reported bad debt accounting write-offs provide no distinction between amounts attributable to insured patients who fail to pay their co-pays and deductibles and uninsured patients. Further, losses from rendering services to uninsured patients can be reported as either bad debt or charity care based on each hospital's separately established billing policies.

This lack of clarity has been further exacerbated by the continued use of misleading data, unclear definitions, and overly complex methodologies which misdirect a large proportion of pool subsidy funding to hospitals, which according to hospital reported data, serve relatively few uninsured patients.

Consequently, the Department recommends that the existing multiple sub-Pools be collapsed into three sub-allocations:

- A major public allocation remaining at its existing sub-Pool level of $139.3 million/year with the continuation of supplemental subsidies outside the Hospital Indigent Care Pool.

- A voluntary/minor public hospital allocation that would combine the existing $562.7 million Voluntary Hospital, $72 million Voluntary High Need Hospital, $27 million Supplemental Indigent Care, and $16.7 million Supplemental Voluntary hospital sub-Pools.

- A rural hospital allocation that combines resources from the existing $20.3 million Rural Distribution and $9 million Rural Grant sub-Pools to supplement rural hospital coverage available through the above-referenced allocations.

The Department further recommends that, to the maximum extent possible, monies within each pool be distributed based on uniform and appropriately targeted methodologies as described below.

Return to Table of ContentsB. Creating Transparency

Transparency starts with clear definitions and uniform data which is reliable. Current shortcomings in these areas have made it impossible to quantify hospital efforts to serve uninsured patients and have contributed to inequities in award allocations. Transparency in the data and methodologies used to establish awards will advance the State's overriding objective of subsidizing reasonable costs hospitals incur in providing care to uninsured patients. This transparency can only be created by linking Pool allocations to discretely defined utilization indicators which can be collected and reported by hospitals and independently verified by the State. This approach is currently used to determine annual indigent care subsidy awards for D&TCs. Adoption of uniform data collection requirements will also permit the State to analyze where uninsured patients are getting their outpatient care (i.e., hospital clinics, emergency departments, D&TCs) and also their inpatient care. Ultimately, it will inform decisions on insurance expansions.

Consequently, the Department recommends that reported inpatient and outpatient units of service (including referred ambulatory services) for patients eligible for financial aid be used as a primary basis for establishing annual award levels (within in each sub-Pool) and that each service unit be multiplied against a fair price (rate). The current use of charges, reduced to costs, values the same service provided by different hospitals at widely varying rates. The Department recommends that each hospital's unit of service be valued by the hospital's appropriate Medicaid rate. This recommendation was the source of much discussion at the TAC meetings. The primary objection seemed to be the flawed methodology Medicaid currently uses for clinic, ambulatory surgery and emergency services. The Department intends to address those flaws starting in 2008 and believes that Medicaid is the most appropriate proxy for valuing services provided to uninsured patients. By valuing services to uninsured patients at higher amounts than services to Medicaid patients, hospitals could be encouraged to forego appropriate third-party billing or assisting uninsured patients in obtaining Medicaid coverage. Moreover, by using reformed Medicaid rates, the Department will align incentives for hospitals serving both Medicaid and uninsured patients.

After multiplying a unit of service against the applicable Medicaid reimbursement rate, such amount should be offset by out-of-pocket amounts received from the patient. The resulting net amount would then be applied to a progressive sliding scale, as currently used, to increase subsidy coverage as a hospital's proportional relationship of calculated uncompensated care costs to total patient service costs increases.

While the Department believes that most of the indigent care pool monies should be used to underwrite the costs of care provided to uninsured patients, it recommends that some portion of each sub-Pool continue to be available to subsidize the uncompensated costs of care provided to low-income, insured patients (that is, losses due to non-payment of co-pays and deductibles) where the hospital has determined to extend its financial aid policies to such patients. This can be accomplished through the continued use of more discretely defined accounting write-offs.

Return to Table of ContentsC. Strengthening Linkage to the Patient Financial Aid Law:

The Patient Financial Aid Law that became effective on January 1, 2007, requires every hospital to implement discounting policies for uninsured patients that conform to the minimal requirements specified in governing statue. In its implementation of this law, the Department encouraged hospitals to consider discounting policies and procedures which would exceed minimal requirements to further improve access to care for uninsured New York State residents.

Consequently, the Department believes that the State's Pool resources should be used to support hospitals that comply with this statute and expand their policies to improve access to care for other needy uninsured patients. To create this linkage, the Department believes that the majority of Pool funds should be disbursed based on reported uninsured units of service for patients that qualify for hospital financial aid. The Patient Financial Aid Law also permits a hospital to consider financial aid for co-payments and deductibles owed by otherwise insured patients. Since it is difficult to specifically link and value these obligations to a specific rendered service, the Department would suggest that a smaller share of the Pool be separately allocated to subsidize a hospital's reported annual co-payment and deductible losses, based on a direct accounting write-off method, for patients which qualify for financial aid pursuant to a hospital's established financial aid policies.

In requiring hospitals to determine a patient's insurance and income status as a prerequisite to Pool payments, the Department is aware of the difficulties in securing this data from some patients, especially those served in the emergency department and those with unclear immigration status. Consequently, linking subsidies to each hospitals established financial aid policies allows requisite information to be secured without unduly burdening patients and staff and ensures that needed patient care is not deterred.

Return to Table of ContentsD. Improving Data Accuracy, Uniformity and Reproducibility:

The annual reported data required to support the Department's recommendations for a revised award distribution methodology are:

- uninsured units of service, by service category, for patients who are eligible for financial aid;

- out-of-pocket collections received from such services; and,

- reported co-payment and deductible accounting write-offs for patients eligible for financial aid under a hospital's established policies.

Ensuring accuracy in this reported data is critical for appropriately directing limited subsidy funding to hospitals serving the largest numbers of low-income, uninsured patients. Since a refinement and improvement in the data currently reported by hospitals would be required to reform $847 million in Pool allocations, such reforms should be phased-in over a multi-year period to permit hospitals to improve the accuracy of the reported data and to respond to the shifting emphasis on care to uninsured, low-income patients. Indeed, with clarifications enunciated by the Department in 2007, the Department expects the 2007 data will be better than earlier years' data. We would also propose that this reported data be independently verified as part of the hospital's Institutional Cost Report (ICR) certification process and audited by the State to ensure compliance with applicable reporting instructions.

Return to Table of ContentsVI. Conclusion

The Department's recommendations address key issues raised by TAC members and public hearing witnesses regarding existing methodologies used for allocating the $847 million Pool. Most significantly, recommended reforms will ensure that Pool funds are allocated through the use of uniform and accurate data, are subject to transparent allocation formulas, and are primarily targeted to subsidize hospitals for losses incurred in serving to low-income patients that qualify for assistance under hospital patient financial aid policies. Consequently, these reforms align and reinforce the goals of the Indigent Care Pool statute and the Patient Financial Aid Law through the use of distribution methodologies that will reward hospitals for tailoring financial aid policies that meet all legal requirements and are responsive to the needs of the communities and patient populations they serve.

A multi-year phase-in of these changes will also ensure access to the appropriate data needed to effectively implement proposed formula modifications and allow hospitals time to adjust to potential shifts in Pool subsidy allocations.

Return to Table of Contents1In 1997, the Hospital Bad Debt and Charity Care Pool was renamed the Hospital Indigent Care Pool.

2Surcharges on NYS Licensed Laboratories were repealed as of October 1, 2000.

3Major Public Hospitals are all State operated general hospitals, all general hospitals operated by the New York City Health and Hospital Corporation and all other public general hospitals having annual inpatient operating costs in excess of twenty-five million dollars.

4 In addition to the amount received from their share of the $847 million Pool, major public hospitals also receive an indigent care annual Medicaid subsidy of $411 million to cover the disparity which exists in uncompensated care coverage due to the use of a different award formula.

5Hereafter, in this report, the term "uninsured" is used to refer to patients who have no health insurance coverage or lack health insurance coverage for the services they require (e.g., their health insurance does not cover dental services).

Return to Table of Contents