Home Care Cost Report Instructions

- Instructions are also available in Portable Document Format (PDF)

Required for:

Licensed Home Care Services Agencies (LHCSA)

Certified Home Health Agencies (CHHA)

Fiscal Intermediaries (FI)

For the Period: January 1, 2021 to December 31, 2021

Contents

Introduction

The Home Care cost report is required to be completed by agencies who operate one or more of the following entities:

- Certified Home Health Agency (CHHA)

- Licensed Home Care Services Agency (LHCSA)

- Fiscal Intermediary (FI)

An agency is defined as an organization that operates one or more CHHA, LHCSA, or FI. Agencies that operate one or more of these facilities must complete certain parts of this cost report for each of these entities.

An entity is defined as a CHHA, LHCSA, or FI. An entity may be operated as part of a larger agency or may be free-standing.

Some of the schedules in the Home Care cost report will require information at the agency level, while other schedules require information at the entity level. The instructions explicitly state which schedules of the Home Care cost report require agency level information and which schedules require entity level detail (CHHA, LHCSA, or FI) to be reported. A note is included at the beginning of each section to indicate if agency or entity level information is required.

A The letter "A" indicates a schedule requires agency-level information to be reported.

E The letter "E" indicates a schedule requires entity-level information to be reported.

Reporting Guidance

Since Medicaid reimbursement rates for LHCSAs and FIs are calculated by county, entity level information will need to be broken out separately on schedules where this detail is required. For the purposes of this cost report, LHCSA and FI entities are required to be separated by county. For example, if a LHCSA provides services in two counties, then that agency is said to have two entities for the purposes of Home Care cost report submissions. This should not result in changes to the existing reporting practices, as the Personal Care Cost Report was previously completed by county for LHCSAs and FIs. Note that if an FI currently has a pending application status, has had an application approved, or has previously operated as part of a LHCSA, the FI entity should still be broken out separately for reporting purposes on the Home Care cost report. In addition, some agencies may have office locations that service multiple counties. An entity should not be identified based on the physical office locations, but rather the county served. A unique LHCSA or FI entity is associated with one county.

For CHHAs, the Operating Certificate will be used as the unique entity identifier and will be the driver for how the information should be reported on certain schedules. For example, if an agency holds three CHHA operating certificates, the agency is said to have three CHHA entities for the purposes of the cost report. CHHA entities are not classified based on county of operation, but rather solely based on their operating certificate.

Please note that all cost report schedules will be completed in the Home Care Tool. The Home Care Tool is a web-based platform that will create a customized view of only the schedules of the cost report required to be completed for your agency and the entities operated by the agency. Based on the information you enter in the "Reporting Hierarchy" tab of the Home Care Tool, only the required schedules will be visible to complete in the "Cost Report Schedules" tab. Note that further details related to the Home Care Tool can be found in the "Completion of Web-based Tool" portion of the Instructions tab.

The cost report schedule instructions specify that a standard set of rules be followed in order to provide consistent data for comparison purposes. The Department of Health (DOH) reserves the right to reject the information submitted if the instructions are not properly followed.

In addition to completing the Home Care cost report, agencies/entities will be required to provide questionnaire responses and participate in audit procedures performed by KPMG, LLP (KPMG).

Important Items to Note

- Allocation Methodology

There are some schedules of the cost report that require an allocation methodology to allocate agency costs or other information to the appropriate entities and service types. The DOH has prescribed the Total Operating Expenses allocation methodology to allocate information within the Home Care Cost Report. If a provider is unable to use this approach, they can explicitly document the allocation methodology they used (e.g., Hours of Service, Square Feet Occupied, Time Study). Note that this information will be reviewed by KPMG during the audit process. - Costs

Please note that you are required to report actual costs when completing the Home Care cost report. In addition, the Home Care cost report must include all agency costs (regardless of payor source, i.e., Medicaid, Medicare, third party insurance, or private pay). Revenue figures should not be reported in the Home Care cost report besides what is requested in Schedule 19 (Statement of Revenue and Expenses). - Contracting relationships

As part of the delivery of services, many agencies have contracting relationships with other agencies to perform direct care services. For example, there are instances where a CHHA will contract out the delivery of Home Health Aide (HHA) services to a LHCSA. If both the CHHA and LHCSA reported the costs of these services as allowable on the Home Care cost report, this would result in double counting. As such, only the agency contracting out the services should report them as allowable on the Home Care cost report. The agency acting as a subcontractor should not report these services as allowable. Instead, for all LHCSA schedules that require the reporting of information by service type, there is a line item for "Other non-allowable services." Any costs related to a LHCSA performing HHA services as part of a contract with a CHHA should be reported in this line. See below for detailed instructions on how to report costs on Schedule 3 as the subcontractor versus the contractor. Note that further instructions regarding contracting relationships are covered within the instructions for Schedule 3a, 3b, and 3c of this document.

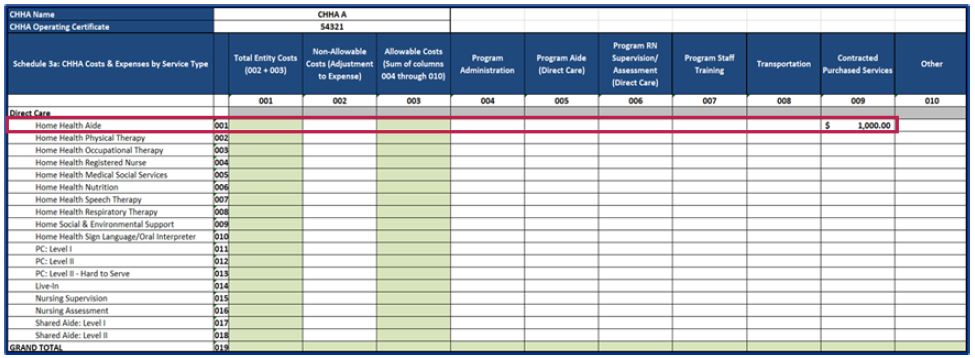

Agency purchasing a direct care service from another agency (contractor)

The agency contracting out the direct care services should report the costs they incurred purchasing the service (e.g., the amount they paid the subcontractor) in the "Contracted Purchased Services" Column 009, within the applicable service type row on Schedule 3, as shown in the screenshot below.Agency providing a direct care service to another agency (subcontractor)

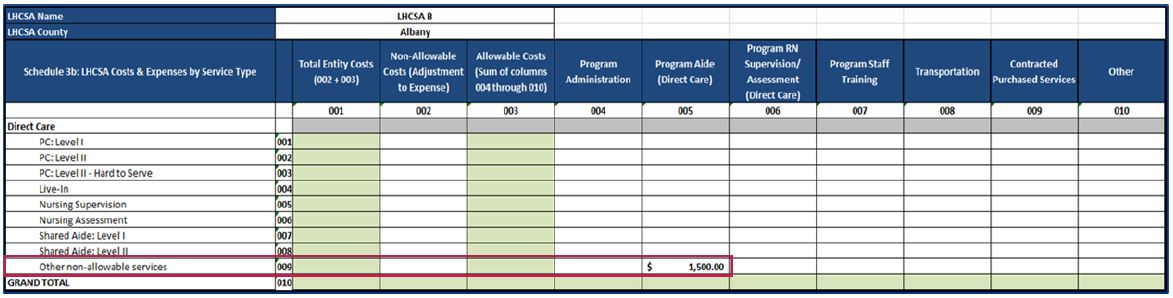

The agency acting as the subcontractor should report the expenses they incurred performing the direct care services (e.g., paying the direct care worker for the hours worked providing the service, transportation for the worker to get to the patient to provide the subcontractor services, etc.) in the "Other non-allowable services" row 009 in the "Program Aide (Direct Care)" Column 005 on Schedule 3, as shown in the screenshot below.

Note: Administrative-related contracted purchased services costs, such as cleaning, bookkeeping, administrative computer services, and other services not related to direct patient care, should be reported in Column 004 (Program Administration) within the Administration & General row. - CPA Certifications

The Home Care cost report does not need to be certified by a CPA prior to submission. DOH has engaged KPMG to conduct audits of the Home Care cost report submissions. Although CPA certification is no longer required, agencies may still use a vendor to assist with Home Care cost report preparation and submission. If an agency uses a vendor to support the cost report and/or audit process, the agency is still responsible for accurate and timely submissions and responses to any inquiries. Please also note that an executive-level individual will need to sign off on the completeness and accuracy of the cost report data prior to submission (e.g., CEO or CFO). - Accounting Methodology

The Home Care cost report should be completed using the accounting methodology used for your agency's financial statements (e.g., accrual or cash basis).

In addition, the Financial Statement Schedules of the Home Care cost report (Schedule 17, Schedule 18, and Schedule 19) should be completed using the reporting period of your agency. For example, if your agency's fiscal year is July 1st through June 30th, then Schedules 17, 18, and 19 can be completed in line with this reporting period. It is important to note that no matter the fiscal reporting period of your agency, all other schedules of the Home Care cost report (Schedule 1 through Schedule 16) should be reported on a calendar year basis. - Providers not required to complete the Home Care Cost Report

The following providers are not required to complete the Home Care Cost Report:- Assisted Living Program (ALP) only agencies

- Private pay only agencies

- Hospital-based CHHAs or LHCSAs

- Private duty nursing only agencies

- Agencies receiving no Medicaid reimbursement (through Fee-for-Service (FFS) or MLTC)

- LHCSAs who contract with CHHAs and provide no other home care services

- CHHAs who provide ONLY Hospice services

- Programs of All-Inclusive Care for the Elderly (PACE) program only facilities

- Nursing Home Transition and Diversion (NHTD) and Traumatic Brain Injury (TBI) program only facilities

- Procedural Recommendations

- Agencies should develop internal cost report policies and procedures to help ensure that costs and statistics are reported properly. Documented cost report policies and procedures will allow for consistent year-over-year reporting compliance in the event of staff turnover at the agency. The policy and procedures document should include cost report preparation instructions that are specific to the agency, such as the sources of data that are necessary to complete the cost report, how costs should be allocated on different schedules, and who is responsible for preparing and reviewing the report.

- A cost report policies and procedures template that agencies may leverage to prepare this document is located within the "Instructions" tab of the Tool, under the "Useful Links" section on the right-hand side of the screen.

- In an effort to demonstrate segregation of duties during the cost report submission process, agencies should have multiple individuals involved in the cost report preparation, review, and submission of the cost report.

- Agencies should develop internal cost report policies and procedures to help ensure that costs and statistics are reported properly. Documented cost report policies and procedures will allow for consistent year-over-year reporting compliance in the event of staff turnover at the agency. The policy and procedures document should include cost report preparation instructions that are specific to the agency, such as the sources of data that are necessary to complete the cost report, how costs should be allocated on different schedules, and who is responsible for preparing and reviewing the report.

- Workers' Recruitment & Retention (WR&R) Costs and Revenue

Per PHL - S.3614 (9) and SSL 367-q, all home care agencies receive an annual WR&R rate add-on. The WR&R rate add-on is additional revenue for home care agencies to spend on recruitment, training, and retention costs. On Schedules 3 and 4 of the Home Care Cost Report, only WR&R costs in excess of the WR&R revenue received through the WR&R rate add-on may be reported as allowable. Any portion of WR&R expenses that was covered by the WR&R rate add-on revenue should be reported as non-allowable in Column 002 on Schedules 3 and 4.

To calculate WR&R costs, the agency should sum all recruitment, training, and retention expenses from the specific cost report year. To properly report the WR&R costs on Schedules 3 and 4, the agency should subtract the WR&R revenue received in the specific cost report year from their total WR&R costs. The net amount of WR&R costs should be reported as allowable (in Column 004 Program Administration or Column 007 Program Staff Training), and the amount covered by the WR&R revenue should be reported as non-allowable (in Column 002 Non-allowable Costs) on Schedule 3 and Schedule 4.

Agencies can identify their WR&R rate add-on on their Medicaid FFS rate sheet. DOH understands that agencies may need to estimate their WR&R revenue for the 2021 Home Care Cost Report. Agencies may determine their own method of estimating the WR&R revenue for the 2021 cost report year; however, they must provide supporting documentation that documents how their WR&R revenue was calculated.

If an agency is unsure of how to estimate their WR&R revenue, DOH has provided an optional approach that agencies may leverage. This method is summarized below:- Assume that the WR&R rate add-on percentage in 2021 was 4.56%1 of your agency's Medicaid reimbursement rate.

- Divide the reimbursement rate (dollar value) by 1.0456. Then, subtract that value from the reimbursement rate (dollar value) to arrive at the WR&R rate add-on dollar value.

- Multiply the WR&R add-on dollar value by the units of service provided in 2021, to arrive at the total WR&R revenue dollar amount for the year.

- If your agency provides multiple services (e.g., PC Level I and Nursing Supervision), then you will need to complete these steps for each service type and sum the total WR&R revenue dollar amounts.

- Agency A assumes that the WR&R rate add-on percentage in 2021 was 4.56%. of their Medicaid reimbursement rate.

- Agency A divides their Medicaid reimbursement rate by 1.0456 ($50/1.0456=$47.82). Then, Agency A subtracts that value from the Medicaid reimbursement rate to calculate their WR&R dollar value of $2.18 ($50-$47.82=$2.18).

- Agency A multiples 65,000 units of service by the rate add-on dollar value of $2.18 to calculate their total WR&R revenue dollar value of $141,700.

- This $141,700 should be offset from total WR&R costs and reported as non-allowable in Column 002 of Schedules 3 and 4. The remaining $58,300 that is net of the WR&R revenue should be reported as allowable in Column 004 (Program Administration) or Column 007 (Program Staff Training) on Schedules 3 and 4.

- Since Agency A only provided one service type in 2021, step 4 is not applicable. Note: Any WR&R costs in excess of this WR&R revenue may be reported as allowable on Schedule 3.

Note: Failure to submit all required schedules or failure to resubmit corrected schedules when requested may result in the imposition of sanctions or penalties.

Schedule 1: General Information - Agency

A Note: Schedule 1 contains agency-level information.

This General Information Schedule contains information on the agency-level. Information that will appear on this schedule includes the following:

Agency Information

- Name of Agency: Enter the legal name of the organization.

- Alternative agency name or DBA (if applicable): Enter any DBAs ("doing business as") or alternative names the agency may be used for identification purposes.

- Federal Tax ID: Enter the Federal Tax ID of the organization.

- Agency Type: Select the agency type (Proprietary, Voluntary, or Public).

- Address: Enter the street address of the agency headquarters.

- City: Enter the name of the city where the agency headquarters is located.

- State: Enter the state where the agency headquarters is located.

- Zip: Enter the zip code for the agency headquarters.

Contact Person Information

The name of the person that can answer questions regarding the cost report submission. Include this person's first and last name, job title, telephone number, and email address (required fields).

Entity Types

Information should be entered in for the total quantity of unique CHHA, LHCSA, and FI entities operated by the agency. For example, if an agency operates 2 CHHA, 2 LHCSA, and 2 FI entities, "2" should be entered for the CHHA, LHCSA, and FI line items. If an agency operates zero of one of the entity types, enter a value of "0." Do not leave any of these fields blank.

Notes: If an entity was not in operation during the given cost report year, then the entity should not be reported.

Please note that this information for Schedule 1 will be entered in the "Reporting Hierarchy" tab of the Home Care Tool. All information entered in this location will automatically populate in the "Cost Report Schedules" tab (location where the cost report schedules are to be completed).

Schedule 2: General Information - Entity

E Note: Schedule 2 contains entity-level information.

This General Information Schedule contains information at the entity level and will populate the below information for each of the entities (CHHA, LHCSA, or FI) operated by the agency. The number of tables that appear on this schedule will correlate with the total number of CHHA, LHCSA, and FI entities that appear on Schedule 1. For example, having 2 CHHA, 2 LHCSA, and 2 FI entities in Schedule 1 would result in six Schedule 2 tables appearing. These tables will populate automatically based on the information entered in the "Reporting Hierarchy" tab of the Home Care Tool.

Information that will appear on this schedule (depending on entity type) includes the following:

Entity Information

- Name of Entity: Enter the legal name of the organization.

- Type: Select the entity type (Proprietary, Voluntary, or Public) from the drop-down menu.

- Address: Enter the street address of the entity headquarters.

- City: Enter the name of the city where the entity headquarters is located.

- State: Enter the state where the entity headquarters is located.

- Zip: Enter the zip code for the entity headquarters.

- County Served: Select the county where services are provided by this entity from the drop-down box.

- MMIS ID Number: Enter the MMIS ID Number of each CHHA, LHCSA, or FI entity.

- Note: All Medicaid Management Information System ID numbers should be eight digits.

- Operating Certificate: Enter the Operating Certificate of any CHHA entities.

- Note: All operating certificates should be seven or eight digits.

- License Number: Enter the License Number of any LHCSA entities.

- Direct Care Standard Hours Per Work Week: Enter your entity's standard work week for a direct care worker (e.g., 40 hours per week). This would be the standard hours for an individual and would not include items like overtime.

- Program Administration Standard Hours Per Week: Enter your entity's standard work week for an administrative worker (e.g., 37.5 hours per week). This would be the standard hours for an individual and would not include items like overtime.

- Reporting Period (From and To): Enter time period during the cost report year that the data will be reported for the entity. For example, if an entity was only operational for July through December of the cost report year, this should be indicated here.

Contact Person

The name of the person that can answer questions regarding the cost report submission. Include this person's first and last name, job title, telephone number, and email address (required fields).

Schedule 3a, Schedule 3b, and Schedule 3c: Costs and Expenses

E Note: Schedule 3a, 3b, and 3c require entity-level information.

Schedule 3a, Schedule 3b, and Schedule 3c require the reporting of costs and expenses by service type for each CHHA, LHCSA, and FI entity operated by the agency. Note that an agency is required to complete more than one of the following schedules if they operate more than one of these entity types:

- Schedule 3a (for CHHA costs and expenses) - A separate Schedule 3a table should be completed for each unique CHHA entity.

- Schedule 3b (for LHCSA costs and expense) - A separate Schedule 3b table should be completed for each unique LHCSA entity.

- Schedule 3c (for FI costs and expenses) - A separate Schedule 3c table should be completed for each unique FI entity.

Please follow the below instructions while completing Schedule 3a, Schedule 3b, and Schedule 3c.

Note that in order to best complete these schedules, you should reference your facilities' trial balance, general ledger detail, payroll register, FTE report, and reconciliation between the general ledger and financial statements.

Note that you should enter data in Columns 002 and 004 through 010. Columns 001 and 003 will be automatically calculated based on the information entered into Columns 002 and 004 through 010.

Please note that you should report all costs on Schedules 3a, 3b, and 3c (includes direct care costs, administrative personnel costs, and nonpersonnel costs). These costs need to be allocated to the appropriate service type rows. The "Total Entity Costs" on Schedule 3 should reconcile to the total expenses per your agency's financial statements. Agencies are encouraged, but not required in 2021, to complete the "Financial Reconciliation" tab of the Tool after all cost report schedules have been completed. This tab will provide you with an opportunity to identify any reconciling items that may be causing the total expenses on Schedule 3 to differ from the total expenses per your financial documentation. Note that agencies selected for audit will be required to complete the "Financial Reconciliation" tab of the Tool.

- Column 001: Total Entity Costs - Column 001 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 002 (Non-Allowable Costs) and Column 003 (Total Allowable Costs). The Total Entity Costs value should reconcile to the total expenses per the agency's financial statements.

- Column 002: Non-Allowable Costs (Adjustment to Expenses) - Include in this column the reconciliation of interest offsets and recoveries of expense and non-allowable costs, which should not be included in Columns 004 through 010. To be considered as allowable in determining reimbursement rates, costs shall be properly chargeable to necessary patient care. Allowable costs shall be determined by the application of the principles of reimbursement developed for determining payments under Title XVIlI of the Federal Social Security Act (Medicare) program. Cost that are non-allowable in nature include, but are not limited to, the below list. When assessing whether or not a cost is allowable, note that allowable costs shall not include the following:

- Amounts in excess of reasonable or maximum title XVIII of the Federal Social Security Act (Medicare) costs or in excess of customary charges to the general public. This provision shall not apply to services furnished by public providers free of charge or at a nominal fee.

- Expenses or portions of expenses reported by individual entities which are determined by the commissioner not to be reasonable related to the efficient production of patient care services because of either the nature or the amount of the particular item.

- Costs not properly related to patient care or treatment which principally afford diversion, entertainment or amusement to owners, operators or employees of agencies or entities.

- Meal expenses and advertising costs for the purposes of attracting patients.

- Cash receipt assessment tax.

- Any interest charged related to rate determination or penalty imposed by governmental agencies or courts, and the costs of policies obtained solely to insure against the imposition of such a penalty.

- Costs of contributions or other payments to political parties, candidates or organizations and charities.

- The interest paid to a lender related through control, ownership, affiliation, or personal relationship to the borrower, except in instances where the approval of the Commissioner of Health has been obtained (For costs incurred on or after January 1, 1992).

- The expenses which were required to be funded from the Worker Recruitment and Retention Revenue received through the rate add-on. The CHHA Worker Recruitment and Retention add-on is calculated in accordance with Public Health Law 3614, Section 8. The CHHA Worker Recruitment, Training and Retention add-on is calculated in accordance with Public Health Law 3614, Section 9. The LHCSA Worker Recruitment and Retention add-on is calculated in accordance with Chapter 1 of the Laws of 2002, which added Section 367-q of the Social Services Law.

Note that non-allowable costs should be recorded as positive values. The portion of total costs that is non-allowable should be separated from the costs reported in Columns 004-010 and reported in Column 002. The total allowable plus non-allowable costs should add up to the agency's total costs. - Column 003: Allowable Costs - Column 003 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 004 through Column 010. Below is a description of allowable costs which are to be used when completing Columns 004 through 010. Allowable costs shall include, but are not limited to, the following:

- A monetary value assigned to services provided by religious orders and for services rendered by an owner or an operator of an entity

- The portion of the dues paid to any professional association which has been demonstrated, to the satisfaction of the commissioner, to be allocable to expenditures other than for public relations advertising or political contributions

- Costs reduced by income earned for Medicare Part B eligible services

- Those costs allocated to the patient care entity from a related organization to the extent that:

- Those costs are reasonably related to the efficient production of patient care services; and

- The base of allocation of such costs are consistent with regulations applicable to the cost reporting of the related organization.

- Column 004: Program Administration - All Program Administration (Personnel and Non-Personnel) costs should be reported in Column 004 on Schedule 3. This includes, but may not be limited to, the following:

- Criminal Background Check & Fingerprinting

- Capital Related - Building & fixtures, movable equipment

- Plant Operations & Maintenance

- Costs of operations, maintenance, and repairs to the provider entity facility

- Rent - Building, furnishings, vehicles

- Interest-Property

- Depreciation - Plant, equipment & furnishings, vehicles

- Administrative Worker Transportation

- Utilities - Gas, electricity, fuel, water

- Office Supplies & Materials

- Office Supplies and Expenses

- Postage/Freight/Messenger Service

- Copying/Printing

- Pencils/pens, folders, note pads, and the printing of office forms, letterhead and envelopes.

- Administrative employee physicals/uniforms/immunizations

- Administration & General expenses (examples in the sub-bullets below)

- Program Administration Worker salary/compensation costs

- Program Administration Worker fringe benefits and payroll tax:

- FICA taxes (Social Security + Medicare)

- Insurance (Life/Health)

- Pension & Retirement

- Workers' Compensation UID/Disability

- Employee Physicals

- Vacation Accrual

- Metropolitan Commuter Transportation (MTA) Tax

- Electronic Data Processing (EDP)/Computer Expenses

- Telephone Expenses

- Professional Fees (e.g., accounting services, legal services, maintenance services, cleaning, bookkeeping, administrative computer services, and other administrative-related contracted purchased services not related to direct patient care)

- Training/Education/Recruitment

- Books/Dues/Subscriptions

- Travel Expenses & Reimbursement

- Interest (non-capital)

- Insurance (non-capital)

- Billing services

- Medicaid Processing & Collections Services

- Payroll Processing Services

- Costs of advertising, public relations or promotion when such costs are specifically related to the provision of personal care services and are not for the purpose of attracting patients

The Grand Total row of Column 004 (Program Administration) on Schedule 3 should equal the Grand Total row of Column 004 (Program Administration) on Schedule 4. The Program Administration costs are the same on Schedules 3 and 4, but are being allocated in different ways. On Schedule 3, program administration costs should be allocated across the different service type rows that the agency provides using an allocation methodology (see on page 4 of this document for a description of allocation methodology). Note that an edit check exists within the Web-based Tool that will warn agencies if the values in Column 004 on Schedule 3 and Column 004 on Schedule 4 are not equal (at both the agency and entity level).

Additionally, note that taxes and benefits should be allocated appropriately to program administration workers in this column. Taxes and benefits for direct care workers should not be reported in this column.

- Direct care worker salary/compensation

- Direct care worker benefits & payroll taxes:

- FICA taxes (Social Security + Medicare)

- Life/Health Insurance

- Pension & Retirement

- Disability/Unemployment/Workers’ Compensation taxes

- Employee physicals

- Medical Supplies

- Other costs that can be directly attributable to the provision of care

- Program RN Supervision/Assessment worker salary/compensation

- Program RN Supervision/Assessment worker benefits & payroll taxes:

- FICA taxes (Social Security + Medicare)

- Life/Health Insurance

- Pension & Retirement

- Disability/Unemployment/Workers’ Compensation taxes

- Employee physicals

- Other costs that can be directly attributable to the provision of care related to nursing supervision and nursing assessment

Note: This Grand Total of this column does not need to equal the Grand Total of Column 007 (Program Staff Training) on Schedule 4.

- Direct care only costs (e.g., direct care wages associated with attending training) would not need to be reported in Column 007 (Program Staff Training) on Schedule 4.

- Only the associated administrative personnel and non-personnel portion of the costs would appear in Column 007 (Program Staff training) on Schedule 4.

Note: Costs associated with paying direct care workers to travel (travel time wages) should not be reported here, but rather should be reported in Column 005 (Program Aide [Direct Care]).

Important information on contracting relationships:

In a direct care contracting service relationship, only one of the two agencies involved in the relationship may report the expenses on the Home Care Cost Report.

- The subcontractor should report the expenses they incurred performing the direct care services (e.g., paying the direct care worker for the hours worked providing the service, transportation for the worker to get to the patient to provide the subcontractor services, etc.), not the revenue received for the services, on Schedule 3 within the “Other non-allowable services” row in Column 005 (Program Aide Direct Care).

- The agency contracting out the direct care service should report the cost they incurred purchasing the service (e.g., the amount they paid the subcontractor) in Column 009 Contracted Purchased Services, within the appropriate service type row on Schedule 3.

Example: For LHCSA entities acting as the subcontractor to a CHHA for the delivery of Home Health Aide services, these costs would be reported in the "Other non-allowable services" row in the "Program Aide (Direct Care)" column (Column 005).

Note: All administrative contracting service expenses (e.g., accounting services, legal services, maintenance services, etc.) should be reported in Column 004 (Program Administration) on Schedules 3 and 4.

For more information related to the Direct Care line items, please reference the Universal Billing Codes for Long Term Care Services in Appendix A. Note that Appendix A is related to Managed Care and does not contain information related to Fee-for-Service rate codes.

Schedule 4a, Schedule 4b, and Schedule 4c: General Service Cost Centers

E Note: Schedule 4a, 4b, and 4c require entity-level information.

Schedule 4a, Schedule 4b, and Schedule 4c require the reporting of general service cost centers for each CHHA, LHCSA, and FI entity operated by the agency. Note that an agency is required to complete more than one of the following schedules if they operate more than one of these entity types:

- Schedule 4a (for CHHA general service costs) - A separate Schedule 4a table should be completed for each unique CHHA entity.

- Schedule 4b (for LHCSA general service costs) - A separate Schedule 4b table should be completed for each unique LHCSA entity.

- Schedule 4c (for FI general service costs) - A separate Schedule 4c table should be completed for each unique FI entity.

Please follow the below instructions while completing Schedule 4a, Schedule 4b, and Schedule 4c.

Note that in order to best complete these schedules, you should reference your facilities' trial balance, general ledger detail, square footage reports, mileage logs, and allocation methodology.

Please note that Schedule 4 should contain administrative personnel costs and non-personnel costs. Direct care worker wages and benefits should not appear on Schedule 4. Costs in this schedule need to be allocated to the appropriate general service cost center.

- Column 001: Total Entity Costs - Column 001 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 002 (Non-Allowable Costs) and Column 003 (Total Allowable Costs). The "Total Entity Costs" amount should be greater on Schedule 3 than on Schedule 4, as Schedule 4 should not include any direct care worker wage and benefit costs.

- Column 002: Non-Allowable Costs (Adjustment to Expenses) - Include in this column the reconciliation of interest offsets and recoveries of expense and non-allowable costs. Allowable costs shall be determined by the application of the principles of reimbursement developed for determining payments under Title XVIlI of the Federal Social Security Act (Medicare) program.

For further guidance related to allowable costs, reference "Column 002: Non-Allowable Costs (Adjustment to Expenses)" in the instructions for Schedule 3a, Schedule 3b, and Schedule 3c.

Non-allowable costs should be recorded as positive values. The portion of total costs that is non-allowable should be separated from the costs reported in Columns 004-010 and reported in Column 002. - Column 003: Allowable Costs - Column 003 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 004 (Program Administration), Column 005 (Program Aide [Direct Care]), Column 006 (Program RN Supervision/Assessment [Direct Care]), Column 007 (Program Staff Training), Column 008 (Transportation), Column 009 (Contracted Purchased Services), and Column 010 (Other).

Note that bad debt should be reported as an offset to revenue and should not be reported with costs on Schedule 4a, Schedule 4b, or Schedule 4c. - Column 004: Program Administration - All Program Administration (Administrative personnel and non-personnel) costs should be reported in Column 004 on Schedule 4, within the appropriate cost center row. Examples of program administration costs include the following:

- Criminal Background Check & Fingerprinting

- Capital Related - Building & fixtures, movable equipment

- Plant Operations & Maintenance

- Costs of operations, maintenance, and repairs to the provider entity facility

- Rent - Building, furnishings, vehicles

- Interest-Property

- Depreciation - Plant, equipment & furnishings, vehicles

- Administrative Worker Transportation

- Utilities - Gas, electricity, fuel, water

- Office Supplies & Materials

- Office Supplies and Expenses

- Postage/Freight/Messenger Service

- Copying/Printing

- Pencils/pens, folders, note pads, and the printing of office forms, letterhead and envelopes.

- Administrative employee physicals/uniforms/immunizations

- Administration & General expenses (examples in the sub-bullets below)

- Program Administration Worker salary/compensation costs

- Program Administration Worker fringe benefits and payroll tax:

- FICA taxes (Social Security + Medicare)

- Insurance (Life/Health)

- Pension & Retirement

- Workers' Compensation UID/Disability

- Employee Physicals

- Vacation Accrual

- Metropolitan Commuter Transportation (MTA) Tax

- Electronic Data Processing (EDP)/Computer Expenses

- Telephone Expenses

- Professional Fees (e.g., accounting services, legal services, maintenance services, cleaning, bookkeeping, administrative computer services, and other administrative-related contracted purchased services not related to direct patient care)

- Training/Education/Recruitment

- Books/Dues/Subscriptions

- Travel Expenses & Reimbursement

- Interest (non-capital)

- Insurance (non-capital)

- Billing services

- Medicaid Processing & Collections Services

- Payroll Processing Services

- Costs of advertising, public relations or promotion when such costs are specifically related to the provision of personal care services and are not for the purpose of attracting patients

The Grand Total row of Column 004 (Program Administration) on Schedule 3 should equal the Grand Total row of Column 004 (Program Administration) on Schedule 4. The Program Administration costs are the same on Schedules 3 and 4, but are being allocated in different ways. On Schedule 3, program administration costs should be allocated across the different service type rows that the agency provides using an allocation methodology (see on page 4 of this document for a description of allocation methodology). Note that an edit check exists within the Web-based Tool that will warn agencies if the values in Column 004 on Schedule 3 and Column 004 on Schedule 4 are not equal (at both the agency and entity level).

Note: Also recorded here should be the proportional expenditures for administrative services of professional staff (i.e., nurses) who spend less than 100 percent of their time performing administrative services that apply to the total program. Included in this cost center are the expenditures for administrative supervision of aides.

- Criminal Background & Fingerprinting

- Employee physicals/uniforms/immunizations

- Medical supplies

- Other

- Criminal Background & Fingerprinting

- Employee physicals/uniforms/immunizations

- Other

- Criminal Background & Fingerprinting

- Employee physicals/uniforms/immunizations

- Medical Supplies

- Other

For the line items in Schedule 4a, Schedule 4b, and Schedule 4c, please reference the below guidance for details surrounding appropriate inclusion of costs. All items in this section deal largely with non-personnel expenses.

- Criminal Background Check & Fingerprinting - Expenditures related to conducting background check and fingerprinting of potential employees prior to hiring.

- Capital Related: Building & Fixtures - In this category, report the acquisition cost, freight, delivery, and installation charges to maintain or improve fixed assets, such as buildings.

- Capital Related: Movable Equipment - In this category, report the acquisition cost, freight, delivery and installation charges of minor equipment and furnishings, such as typewriters, adding machines, chairs, tables. Minor equipment and furnishings defined as costing less than $1,000. Individual items costing $1,000 or more are to be capitalized and the resultant depreciation charged to the "Depreciation: Equipment & Furnishings" line.

- Plant Operations & Maintenance - Include in this category, report all costs of operations, maintenance, and repairs to the provider entity facility. Expenditures for repairs costing $1000 or more, which prolong the useful life of an asset, increase its value, or adapt it to a different use shall be capitalized with the allowable depreciation and reported on the "Depreciation-Plant" line.

- Rent: Building - Rental charges as specified in the lease agreement are to be reported on this line.

- Rent: Furnishings - Include in this category all rental costs, including installation charges, if any, of leased equipment or furnishings, such as desks, chairs, computers, and copier machines. This account is restricted to items that are necessary for operating the provider entity.

- Rent: Vehicles - Include in this category rental costs of entity vehicles used in the provision of patient care services. Include any service or maintenance expenses if they are part of the rental/lease agreement.

- Interest: Property - Interest expense on bank loans, bonds, mortgages, or similar instruments is allowable if such expense was incurred to finance the purchase of fixed assets, major equipment, furnishings, or vehicles for providing patient care services.

- Depreciation: Plant - An allowance for depreciation of buildings based on accepted accounting principles using the original acquisition cost or donated value if title is held by the provider entity. The straight-line method should be used in conformity with the useful lives stated in "American Hospital Association Estimated Useful Lives of Depreciable Hospital Assets," latest edition.

- Depreciation: Equipment & Furnishings - An allowance for depreciation of equipment and furnishings using the same guidelines as stated above for buildings.

- Depreciation: Vehicles - An allowance for depreciation of vehicles using the same guidelines as stated above for buildings.

- Transportation - Expenditures for travel expenses incurred for administrative purposes only. These expenditures should include items such as gas and mileage, and not travel time wages paid to employees.

- Utilities - Expenditures for items such as gas, electricity, fuel and water necessary for the operation of the provider entity's facility.

- Office Supplies & Materials - Expenditures for consumable office supplies such as pencils/pens, folders, note pads, and the printing of office forms, letterhead and envelopes. Postage costs should also be included in this row.

- Insurance - Include in this category insurance costs including liability, fire and theft, burglary, plate glass, automobile, etc. Credit this line with any dividends, refunds, and rebates received from insurance carriers or agents. Insurance relating to employees' benefits should not be entered on this line.

- Administration & General - Expenditures for maintaining the daily operations of the provider entity. Specific examples of items that can be reported in this row can be found within the instructions for each of the columns.

- Medical supplies - Include any medical supplies such as masks and gloves.

- Employee physicals/uniforms/immunizations - Expenditures for employee physicals, uniforms, and immunizations.

- Other - Include any general service cost center expenditures that do not fall into one of the above categories. If an amount is entered into this line, an explanation/description to indicate the nature of the cost may be required.

Schedule 5a.1, Schedule 5a.2, Schedule 5b, and Schedule 5c - Service Statistics

E Note: Schedule 5a.1, 5a.2, 5b, and 5c require entity-level information.

Schedule 5a.1, Schedule 5a.2, Schedule 5b, and Schedule 5c include the service statistics broken down by service type and payor source at the entity level. Note that an agency is required to complete more than one of the following schedules if they operate more than one of these entity types:

- Schedule 5a.1 (for CHHA Pediatric service statistics) - A separate Schedule 5a.1 table should be completed for each unique CHHA entity reporting CHHA Pediatric service statistics.

- Schedule 5a.2 (for CHHA Episodic service statistics) - A separate Schedule 5a.2 table should be completed for each unique CHHA entity reporting CHHA Episodic service statistics.

- Schedule 5b (for LHCSA service statistics) - A separate Schedule 5b table should be completed for each unique LHCSA entity.

- Schedule 5c (for FI service statistics) - A separate Schedule 5c table should be completed for each unique FI entity.

Schedule 5a.1, Schedule 5a.2, Schedule 5b, and Schedule 5c are used to aggregate units of service by program type for all individual entities operated by the agency as related to CHHAs, LHCSAs, and FIs by cost reporting period. This section should not include units of service related to non-certifiable programs. Agencies should report all visits/hours on Schedule 5 within the appropriate payor source column and service type row, regardless of whether the provider was reimbursed for the visit.

Please follow the below instructions while completing Schedule 5a.1, Schedule 5a.2, Schedule 5b, and Schedule 5c:

Note that in order to best complete these schedules, you should reference your facilities' statistical payor data report that includes patients, visits, and hours and is separated by payor and service type.

Please review the below information related to Medicaid FFS and Medicaid Managed Care before completing Schedule 5a.1, Schedule 5a.2, Schedule 5b, and/or Schedule 5c.

- For Medicaid FFS, New York State provides direct reimbursement for the services provided (e.g., you receive a check or direct deposit from New York State).

- For Medicaid Managed Care, reimbursement is provided through contracts that providers have with MLTCs/MCOs (e.g., Empire, BlueCross, AgeWell, Aetna Better Health, etc.).

- Columns 001, 004, 013, 016, and 019: Patients - Data entered into these columns should represent the number of patients associated with the given column header (Medicaid Fee-for-Service [FFS], Medicaid Managed Care [MC], Medicare, Private Pay, or Other). Note the following:

- You should use the primary payor to determine where to report a patient (e.g., Medicaid versus Medicare for a dual-eligible patient).

- Note that the "Other" column should include commercial, government (such as Veterans Affairs and New York State Office for the Aging), workers' compensation, and no-fault insurance items. If any other items are included, agencies may be required to provide an explanation.

- Columns 002, 005, 014, 017, and 020: Visits/Days - Data entered in these columns should represent the total number of billable/paid visits or days of service associated with their given column header (Medicaid Fee-for-Service [FFS], Medicaid Managed Care [MC], Medicare, Private Pay, or Other). Note the following:

- You should use the primary payor to determine where to report the applicable visits/days (e.g., Medicaid versus Medicare for a dual-eligible patient).

- Note that the "Other" column should include commercial, government (such as Veterans Affairs and New York State Office for the Aging), workers' compensation, and no-fault insurance items. If any other items are included, agencies may be required to provide an explanation.

- Columns 003, 006, 012, 018, 021: Hours - Data entered in this column should represent the total hours for each service provided during the report period associated with their given column header (Medicaid Fee-for-Service [FFS], Medicaid Managed Care [MC], Medicare, Private Pay, or Other). Note the following:

- You should use the primary payor to determine where to report the applicable hours (e.g., Medicaid versus Medicare for a dual-eligible patient).

- Note that the "Other" column should include commercial, government (such as Veterans Affairs and New York State Office for the Aging), workers' compensation, and no-fault insurance items. If any other items are included, agencies may be required to provide an explanation.

- Dual-Eligible (Columns 010, 011, and 012) - Dual-eligible patients need to be captured in a specific way in Schedule 5a.1, Schedule 5a.2, Schedule 5b, and Schedule 5c. When reporting the patients (Column 010), visits/days (Column 011), and hours (Column 012) statistics for dual-eligible individuals, they should be reported in the Dual-eligible columns as well as the columns that are associated with the primary payor (e.g., Medicaid or Medicare). Since the Total Unique columns (022, 023, and 024) do not factor the dual-eligible columns into the calculation, this schedule can track dual-eligible statistics while also calculating the total unique patients, visits/days, and hours.

- Note that reporting a patient in the dual-eligible column would mean that the patient had Medicaid and Medicare dual coverage. A patient and the associated unit of service reported in the dual-eligible column should also be reported in either the Medicaid or Medicare columns. Reporting in this manner allows the dual-eligible information to be captured and also allows the automated calculated totals columns (022, 023, and 024) to calculate the total unique values since these automated calculations do not include the information from the dual-eligible columns.

- Column 007: Total Medicaid Patients - Column 007 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 001 (Medicaid Fee-for-Service Patients) and Column 004 (Medicaid Managed Care Patients).

- Column 008: Total Medicaid Visits/Days - Column 008 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 002 (Medicaid Fee-for-Service Visits/Days) and Column 005 (Medicaid Managed Care Visits/Days).

- Column 009: Total Medicaid Hours - Column 009 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 003 (Medicaid Fee-for-Service Hours) and Column 006 (Medicaid Managed Care Hours).

- Columns 022: Total Unique Patients - Column 022 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 001 (Medicaid Fee-for-Service Patients), Column 004 (Medicaid Managed Care Patients), Column 013 (Medicare Patients), Column 016 (Private Pay Patients), and Column 019 (Other Patients). Note that this column does not include the number of dual-eligible patients in the calculation. As such, Column 022 represents the total number of unique patients.

- Column 023: Total Unique Visits/Days - Column 023 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 002 (Medicaid Fee-for-Service Visits/Days), Column 005 (Medicaid Managed Care Visits/Days), Column 014 (Medicare Visits/Days), Column 017 (Private Pay Visits/Days), and Column 020 (Other Visits/Days). Note that this column does not include the number of dual-eligible visits/days in the calculation. As such, Column 023 represents the total number of unique visits/days.

- Column 024: Total Unique Hours - Column 024 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 003 (Medicaid Fee-for-Service Hours), Column 006 (Medicaid Managed Care Hours), Column 015 (Medicare Hours), Column 018 (Private Pay Hours), and Column 021 (Other Hours). Note that this column does not include the number of dual-eligible hours in the calculation. As such, Column 024 represents the total number of unique hours.

- Report Fields - There are some fields in Schedule 5a.1, Schedule 5a.2, Schedule 5b, and Schedule 5c that aren't applicable to certain parties that will be filling out the cost report. For example, for specific services, the unit of service is only measured by visits, not hours. All columns that should not have data entered in them are highlighted in gray.

If your agency tracks Home Health Registered Nurse services or Sign Language/Oral Interpreter units of service in hours, you will need to convert the service hours to visits to be able to report in the “visits/days” columns on Schedule 5. DOH determined the conversions for these two service types:- Home Health Registered Nurse - Assume that one RN visit/day is equal to one hour

- Sign Language/Oral Interpreter - Assume that one SL/OI visit/day is equal to one hour

When submitting supporting documentation for Schedule 5a.1, Schedule 5a.2, Schedule 5b, and/or Schedule 5c, agencies should note that this statistical data should be substantiated by third-party/system-generated reports to demonstrate the completeness and accuracy of the data included in the cost report. Additionally, agencies should clearly label the payor types (e.g., Medicaid Fee-for-Service versus Medicaid Managed Care) within the supporting documentation files submitted.

Schedule 6 - FI Tier Statistics

E Note: Schedule 6 requires entity-level information.

Schedule 6 includes the Fiscal Intermediary Medicaid tier statistics broken down by service type. As it pertains to Schedule 6, a member month is defined as a count of months that a patient has utilized services.

Please follow the below instructions while completing Schedule 6:

Note that in order to best complete this schedule, you should reference your facilities' statistical payor data report that includes member month hour ranges separated by Medicaid Fee-for-Service versus Medicaid Managed Care payors and service type.

- Column 001: Tier 1 FFS Member Months for 1–159 hours - Data entered into this column should represent the FFS Tier 1 member months for 1–159 hours.

- Column 002: Tier 2 FFS Member Months for 160–479 hours - Data entered into this column should represent the Tier 2 FFS member months for 160–479 hours.

- Column 003: Tier 3 FFS Member Months for 480+ hours - Data entered into this column should represent the Tier 3 FFS member months for 480+ hours.

- Column 004: Tier 1 MC Member Months for 1–159 hours - Data entered into this column should represent the Tier 1 Managed Care member months for 1–159 hours.

- Column 005: Tier 2 MC Member Months for 160–479 hours - Data entered into this column should represent the Tier 2 Managed Care member months for 160–479 hours.

- Column 006: Tier 3 MC Member Months for 480+ hours - Data entered into this column should represent the Tier 3 Managed Care member months for 480+ hours.

- Column 007: Tier 1 FFS + MC Member Months for 1–159 hours - Column 007 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 001 (Tier 1 FFS member months for 1–159 hours) and Column 004 (Tier 1 MC member months for 1–159 hours).

- Column 008: Tier 2 FFS + MC Member Months for 160–479 hours - Column 008 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 002 (Tier 2 FFS member months for 160–479 hours) and Column 005 (Tier 2 MC member months for 160–479 hours).

- Column 009: Tier 3 FFS + MC Member Months for 480+ hours - Column 009 does not require any information to be entered. This column is an automated calculation and reflects the sum of Column 003 (Tier 3 FFS member months for 480+ hours) and Column 006 (Tier 3 MC member months for 480+ hours).

Schedule 7a, Schedule 7b, and Schedule 7c - Current Charge to the General Public

E Note: Schedule 7a, 7b, and 7c require entity-level information.

Schedule 7a, Schedule 7b, and Schedule 7c include the current charge to the general public. Note that an agency is required to complete more than one of the following schedules if they operate more than one of these entity types:

- Schedule 7a (for CHHA Current Charge to the General Public) - A separate Schedule 7a table should be completed for each unique CHHA entity.

- Schedule 7b (for LHCSA Current Charge to the General Public) - A separate Schedule 7b table should be completed for each unique LHCSA entity.

- Schedule 7c (for FI Current Charge to the General Public) - A separate Schedule 7c table should be completed for each unique FI entity.

Please follow the below instructions while completing Schedule 7a, Schedule 7b, and Schedule 7c:

The Current Charge to the General Public information should be as of December 31st of the cost report year.

Note that in order to best complete these schedules, you should reference your facilities' chargemaster. Please ensure the unit of service from the chargemaster that is reported is consistent with the unit of service listed (i.e., hours, days, or visits).

- Column 001: Current Charge to the General Public - For each service that your entity provides, enter the public charges which have been approved by the governing authority. These charges are what an individual with no coverage would pay for a service and should reflect the charge per unit of service (i.e., visit, hours, days).

For any information entered in the "Other" line, an explanation may be required to indicate what service this amount relates to.

Schedule 8a, Schedule 8b, and Schedule 8c - Employee Compensation Analysis

E Note: Schedule 8a, 8b, and 8c require entity-level information.

Schedule 8a, Schedule 8b, and Schedule 8c include the compensation analysis for employees. Note that an agency is required to complete more than one of the following schedules if they operate more than one of these entity types:

- Schedule 8a (for CHHA employee compensation analysis) - A separate Schedule 8a table should be completed for each unique CHHA entity.

- Schedule 8b (for LHCSA employee compensation analysis) - A separate Schedule 8b table should be completed for each unique LHCSA entity.

- Schedule 8c (for FI employee compensation analysis) - A separate Schedule 8c table should be completed for each unique FI entity.

Please follow the below instructions while completing Schedule 8a, Schedule 8b, and Schedule 8c:

Note that in order to best complete these schedules, you should reference your facilities' FTE report with employee ID number, salaries/wages and hours by department and cost center grouping, pay code, and job type. In addition, you should reference your facilities' trial balance, general ledger detail, and employee benefits report with employee ID number by department and cost center grouping, and job type.

Additionally, the information entered on Schedule 8a, Schedule 8b, and Schedule 8c is similar but not identical to the information to Schedule 3a, Schedule 3b, and Schedule 3c. Information reported on 8a, 8b, and 8c should be reported on 3a, 3b, and 3c, but there will not be a direct tie out because the schedules are requesting information in a different manner.

Schedule 8a (CHHA) and Schedule 8b (LHCSA)

The FTE, Salary, and Employee Benefits columns should be completed for the applicable job title headers (Supervisors, Nurses, Aides, Clinical/Therapy, and Other) of employees who perform home care service-related duties. Employees who perform job duties for your agency that are not related to home care services should not be included in Schedule 8a or Schedule 8b. Any data reported as "Other" will need to be accompanied by documentation for supporting the nature of the work being reported.

- Columns 001, 004, 007, 010, and 013: FTE - Report the result of the total number of employee hours paid divided by the product of your entity's standard work week (e.g., 37.5 hours, 40 hours, etc.) times 52 weeks per year. Report FTE(S) to three decimal places.

- Columns 002, 005, 008, 011, and 014: Salary - This is the base salary amount and any other wages (e.g., overtime wages) paid to all employees in the job type title for the reporting period. The amount must be reported in whole dollars.

- Columns 003, 006, 009, 012, and 015: Employee Benefits - Report all costs for mandated and not mandated benefits made available to all employees that correspond to the job type title for the reporting period.

- Column 016: Total FTE - This column is an automated calculation and reflects the sum of Column 001, Column 004, Column 007, Column 010, and Column 013.

- Column 017: Total Salary - This column is an automated calculation and reflects the sum of Column 002, Column 005, Column 008, Column 011, and Column 014.

- Column 018: Total Employee Benefits - This column is an automated calculation and reflects the sum of Column 003, Column 006, Column 009, Column 012, and Column 015.

Schedule 8c (FI)

The FTE and Salary columns should be completed for the applicable job title headers (Assistant and Other) of employees who perform home care service-related duties. Employees who perform job duties for your agency that are not related to home care services should not be included in Schedule 8c. Any data reported as "Other" will need to be accompanied by documentation supporting the nature of the work being reported.

- Columns 001 and 004: FTE - Report the result of the total number of employee hours paid divided by the product of your entity's standard work week (e.g., 37.5 hours, 40 hours, etc.) times 52 weeks per year. Report FTE(S) to three decimal places.

- Columns 002 and 005: Salary - This is the base salary amount and any other wages (e.g., overtime wages) paid to all employees in the job type title for the reporting period. The amount must be reported in whole dollars.

- Columns 003 and 006: Employee Benefits - Report all costs for mandated and not mandated benefits made available to employees that correspond to the job type title for the reporting period.

- Column 007: Total FTE - This column is an automated calculation and reflects the sum of Column 001 and Column 004.

- Column 008: Total Salary - This column is an automated calculation and reflects the sum of Column 002 and Column 005.

- Column 009: Total Employee Benefits - This column is an automated calculation and reflects the sum of Column 003 and Column 006.

Schedule 9a and Schedule 9b - Contracted Staff Compensation Analysis

E Note: Schedule 9a and 9b require entity-level information.

Schedule 9a and Schedule 9b include the compensation analysis for contracted staff. Note that an agency is required to complete more than one of the following schedules if they operate more than one of these entity types:

- Schedule 9a (for CHHA contracted staff compensation analysis) - A separate Schedule 9a table should be completed for each unique CHHA entity.

- Schedule 9b (for LHCSA contracted staff compensation analysis) - A separate Schedule 9b table should be completed for each unique LHCSA entity.

Please follow the below instructions while completing Schedule 9a and Schedule 9b:

The FTE and Compensation columns should be completed for the applicable job title headers (Supervisors, Nurses, Aides, Clinical/Therapy, and Other) of contracted staff who perform home care service-related duties. Contracted staff who perform job duties for your agency that are not related to home care services should not be included in Schedule 9a or Schedule 9b. Any data reported as "Other" will need to be accompanied by documentation for supporting the nature of the work being reported.

Note that in order to best complete these schedules, you should reference your facilities' trial balance, general ledger detail, contracted staff invoices for dollars and hours, and contracts that specifies wage costs, hours, and non-labor costs.

Additionally, the information entered on Schedule 9a and Schedule 9b is similar but not identical to the information to Schedule 3a, Schedule 3b, and Schedule 3c. Information reported on 9a and 9b should be reported on 3a and 3b, but there will not be a direct tie out because the schedules are requesting information in a different manner.

- Columns 001, 003, 005, 007, and 009: FTE - Report the result of the total number of contracted staff hours paid divided by the product of your entity's standard work week (e.g., 37.5 hours, 40 hours, etc.) times 52 weeks per year. Report FTE(S) to three decimal places.

- Columns 002, 004, 006, 008, and 010: Compensation - This is the compensation amount paid to all contracted staff in the job type title for the reporting period. The amount must be reported in whole dollars.

- Column 011: Total FTE - This column is an automated calculation and reflects the sum of Column 001, Column 003, Column 005, Column 007, and Column 009.

- Column 012: Total Compensation - This column is an automated calculation and reflects the sum of Column 002, Column 004, Column 006, and Column 008, and Column 010.

Schedule 10a, Schedule 10b, and Schedule 10c - WR&R and Staff Turnover

E Note: Schedule 10a, 10b, and 10c require entity-level information.

Schedule 10a, Schedule 10b, and Schedule 10c include the WR&R and staff turnover analysis broken down by entity service type.

Note that an agency is required to complete more than one of the following schedules if they operate more than one of the below entity types.

- Schedule 10a (for CHHA WR&R and Staff Turnover) - A separate Schedule 10a table should be completed for each unique CHHA entity.

- Schedule 10b (for LHCSA WR&R and Staff Turnover) - A separate Schedule 10b table should be completed for each unique LHCSA entity.

- Schedule 10c (for FI WR&R and Staff Turnover) - A separate Schedule 10c table should be completed for each unique FI entity.

Please follow the below instructions while completing Schedule 10a, Schedule 10b, and Schedule 10c.

Note that in order to best complete these schedules, you should reference your facilities' payroll register run to include recorded date, employee ID number, job/pay code, and department description, etc. In addition, you should reference your facilities' trial balance, general ledger detail, and facility onboarding and termination report from HR.

Schedule 10a (CHHA)

- Column 001: WR&R Costs to Entity - Enter all allowable entity costs related to Worker Recruitment and Retention. The costs reported in this Schedule should directly relate to the recruitment and retention of non-supervisory home care service workers or any worker with direct patient care responsibility. Any funds determined to be used for activities other than recruitment, training, and retention of non-supervisory home care service workers or any worker with direct patient care responsibility shall be recouped. This recoupment will be in addition to any other penalties provided by law.

Reporting should be in accordance with Public Health Law 3614, Section 8:

" 8. (b) (i) Providers which have their rates adjusted pursuant to this subdivision shall use such funds solely for the purposes of recruitment and retention of non-supervisory home care services workers or any worker with direct patient care responsibility. Such purposes shall include the recruitment and retention of non-supervisory home care services workers or any worker with direct patient care responsibility employed in licensed home care services agencies under contract with such providers. Providers are prohibited from using such funds for any other purpose.

(ii) Each such provider shall submit, at a time and in a manner determined by the commissioner, a written certification attesting that such funds will be used solely for the purpose of recruitment and retention of non-supervisory home care services workers or any worker with direct patient care responsibility. The commissioner is authorized to audit each such provider to ensure compliance with the written certification required by this subdivision and shall recoup any funds determined to have been used for purposes other than recruitment and retention of non-supervisory home care services workers or any worker with direct patient care responsibility. Such recoupment shall be in addition to any other penalties provided by law.

(iii) In the case of services provided by such providers through contracts with licensed home care services agencies, rate increases received by such providers pursuant to this subdivision shall be reflected, consistent with the purposes of subparagraph (i) of this paragraph, in either the fees paid or benefits or other supports provided to non- supervisory home care services workers or any worker with direct patient care responsibility of such contracted licensed home care services agencies and such fees, benefits or other supports shall be proportionate to the contracted volume of services attributable to each contracted agency. Such agencies shall submit to providers with which they contract written certifications attesting that such funds will be used solely for the purposes of recruitment and retention of non-supervisory home care services workers or any worker with direct patient care responsibility and shall maintain in their file's expenditure plans specifying how such funds will be used for such purposes. The commissioner is authorized to audit such agencies to ensure compliance with such certifications and expenditure plans and shall recoup any funds determined to have been used for purposes other than those set forth in this subdivision. Such recoupment will be in addition to any other penalties provided by law.

(iv) Funds under this subdivision are not intended to supplant support provided by local government." - Columns 002: WRT&R Costs to Entity - Enter all allowable costs related to Worker Recruitment, Training and Retention. The costs reported in this Schedule should directly relate to the recruitment, training, and retention of non-supervisory home care service workers or any worker with direct patient care responsibility. Any funds determined to be used for activities other than recruitment, training, and retention of non-supervisory home care service workers or any worker with direct patient care responsibility shall be recouped. This recoupment will be in addition to any other penalties provided by law.

Reporting should be in accordance with Public Health Law 3614, Section 9:

"9. Notwithstanding any law to the contrary, the commissioner shall, subject to the availability of federal financial participation, adjust medical assistance rates of payment for certified home health agencies for such services provided to children under eighteen years of age and for services provided to a special needs population of medically complex and fragile children, adolescents and young disabled adults by a CHHA operating under a pilot program approved by the department, long term home health care programs, AIDS home care programs established pursuant to this article, hospice programs established under article forty of this chapter and for managed long term care plans and approved managed long term care operating demonstrations as defined in section forty-four hundred three-f of this chapter. Such adjustments shall be for purposes of improving recruitment, training and retention of home health aides or other personnel with direct patient care responsibility…"

- Column 003: Employees as of 1/1 - Enter the number of people employed by the entity as of January 1st of the reporting year.

- Column 004: Employees as of 12/31 - This column is an automated calculation and reflects the sum of Column 003 and Column 006 less Column 007.

- Column 005: Employees retained as of 12/31 who were employed on 1/1 - Enter the number of people employed by the entity as of December 31st of the reporting year who were also employed by the entity on January 1st of the same reporting year.

- Column 006: Employees Hired between 1/1 and 12/31 - Enter the number of employees hired between January 1st and December 31st of the reporting year.

- Column 007: Employees Separated from Entity During the Year - Enter the number of employees who were separated from the entity during the cost reporting period under review. Note that this column should include employees who were terminated or who voluntarily departed.

Schedule 10b (LHCSA) and Schedule 10c (FI)

- Column 001: WR&R Costs to Entity - Enter all allowable entity costs related to Worker Recruitment and Retention. The costs reported in this Schedule should directly relate to the recruitment and retention of non-supervisory home care service workers or any worker with direct patient care responsibility. Any funds determined to be used for activities other than recruitment, training, and retention of non-supervisory home care service workers or any worker with direct patient care responsibility shall be recouped. This recoupment will be in addition to any other penalties provided by law.

Reporting should be in accordance with Section 367-q of the Social Services Law:

" 4. Personal care services providers which have their rates adjusted pursuant to this section shall use such funds for the purpose of recruitment and retention of non- supervisory personal care services workers or any worker with direct patient care responsibility only and are prohibited from using such funds for any other purpose. Each such personal care services provider shall submit, at a time and in a manner to be determined by the commissioner of health, a written certification attesting that such funds will be used solely for the purpose of recruitment and retention of non-supervisory personal care services workers or any worker with direct patient care responsibility. The commissioner of health is authorized to audit each such provider to ensure compliance with the written certification required by this subdivision and shall recoup any funds determined to have been used for purposes other than recruitment and retention of non- supervisory personal care services workers or any worker with direct patient care responsibility. Such recoupment shall be in addition to any other penalties provided by law." - Column 002: Employees as of 1/1 - Enter the number of people employed by the entity as of January 1st of the reporting year.

- Column 003: Employees as of 12/31 - This column is an automated calculation and reflects the sum of Column 002 and Column 005 less Column 006.

- Column 004: Employees retained as of 12/31 who were employed on 1/1 - Enter the number of people employed by the entity as of December 31st of the reporting year who were also employed by the entity on January 1st of the same reporting year.

- Column 005: Employees Hired between 1/1 and 12/31 - Enter the number of employees hired between January 1st and December 31st of the reporting year.

- Column 006: Employees Separated from Entity During the Year - Enter the number of employees who were separated from the entity during the cost reporting period under review. Note that this column should include employees who were terminated or who voluntarily departed.

Schedule 11a, Schedule 11b, and Schedule 11c - Labor Costs

E Note: Schedule 11a, 11b, and 11c require entity-level information.

Schedule 11a, Schedule 11b, and Schedule 11c include the labor cost figures broken down by entity-level job type. Note that an agency is required to complete more than one of the following schedules if they operate more than one of these entity types:

- Schedule 11a (for CHHA Labor Costs) - A separate Schedule 11a table should be completed for each unique CHHA entity.

- Schedule 11b (for LHCSA Labor Costs) - A separate Schedule 11b table should be completed for each unique LHCSA entity.

- Schedule 11c (for FI Labor Costs) - A separate Schedule 11c table should be completed for each unique FI entity.

Please follow the below instructions while completing Schedule 11a, Schedule 11b, and Schedule 11c.

The information in these schedules should be completed for employees who perform home care service related duties. Employees who perform job duties for your agency that are not related to home care services should not be included in Schedule 11a, Schedule 11b, or Schedule 11c.

Note that in order to best complete these schedules, you should reference your facilities' trial balance, general ledger detail, and payroll register run to include employee ID number, pay codes, and department description, etc.

Additionally, the information entered on Schedule 11a, Schedule 11b, and Schedule 11c is similar but not identical to the information to Schedule 3a, Schedule 3b, and Schedule 3c. Information reported on 11a, 11b, and 11c should be reported on 3a, 3b, and 3c, but there will not be a direct tie out because the schedules are requesting information in a different manner.

- Column 001: Base Wages for Hours Worked - Enter the base wages for employee hours worked. No other wages should be included in this column (i.e., travel wages, overtime wages, holiday wages, differentials should not be included in Column 001)

- Column 002: In-Service Wages - Enter the wages associated with employer sponsored trainings, such as continuing education or other mandated activities, for which employees are paid for the time spent completing.

- Column 003: Travel Wages - Enter the wages paid associated with traveling as part of the defined job function. For example, 1 hour of travel time to a client site would be captured in this column. Items such as gas and mileage should not be reported in this column.

- Column 004: Overtime Wages - Enter the wages paid to employees for hours worked greater than your entity's standard work week.

- Column 005: Weekend and Mutual Differentials - Dollars - Enter the wages paid to employees for weekend and mutual differentials resulting from non-standard shifts.

- Column 006: Holiday Worked Wages - Enter the wages paid to employees for hours worked on days considered to be Holidays. Any Holiday wages paid to employees where services were not physically provided should be reported in Column 007 of this Schedule (Other Wages).

- Column 007: Other Wages - Enter the wages paid to employees for hours worked other than the categories listed for Column 001 through Column 006. Included in this column should be any Holiday wages paid to employees where services were not physically provided. If an amount is entered into this line, an explanation/description may be required to indicate the nature of the wage.