Welcome

- Toolkit is also available in Portable Document Format (PDF)

Welcome to the Medicaid Buy-In program for Working People with Disabilities Toolkit!

Enclosed you will find everything you need to prepare to apply for the Medicaid Buy-In program for Working People with Disabilities (MBI-WPD).

The Medicaid Buy-In for Working People with Disabilities is a program that started on July 1, 2003 that allows working New Yorkers with disabilities to earn more income without the risk of losing their Medicaid coverage. In New York State, people with disabilities can continue working, or return to work without fear of losing their essential health care coverage through Medicaid.

Traditionally, New Yorkers with disabilities have had to limit their wages or pay high "spenddowns" in order to retain or access Medicaid. Through New York State´s Medicaid Buy-In program for Working People with Disabilities, they will no longer have to do either.

What this means for thousands of New Yorkers with disabilities is independence, recovery, and support in achieving goals. In the past, if you had a disability and worked, it was easy to earn too much and lose your health benefits. Now, the rules have changed.

This toolkit is designed to help you decide whether or not you would like to apply for the MBI-WPD program and assist you in completing some important steps of the application process. It can also give you some idea about whether or not you may be eligible.

If you complete the steps in this toolkit, your application will be ready before you step foot in a Department of Social Services office or in New York City, the Human Resources Administration (HRA)/Medicaid office, and you will be informed about the Medicaid Buy-In program for Working People with Disabilities and the process of applying for it.

The steps and information enclosed in this toolkit were steps used by people who applied and successfully obtained Medicaid Buy-In program for Working People with Disabilities benefits.

Section 1: Learn About the Program

Frequently Asked Questions

Why is the Medicaid Buy-In program for Working People with Disabilities important?

According to a national survey, the #1 reason that people with disabilities gave for not working was fear of losing their essential medical benefits. This program allows people to keep their benefits, meet their medical needs and to continue working. Medicaid coverage is more comprehensive than many other programs including private health insurance. Medicaid covers the medical costs of prescriptions, long-term care, and ongoing medical supplies. Medicare and some private health insurance companies do not cover all of these costs.

Why is it called the Medicaid Buy-In program for Working People with Disabilities?

The term "Buy-In" is used because you are buying in (paying a premium) to the Medicaid program. If your net available income is below 150% of the Federal Poverty Level (FPL), you will not have to pay any premium to get Medicaid through the MBI-WPD program. If your net available income is at least 150% but at or below 250% of the FPL, you will have to pay a premium to obtain your Medicaid through the MBI-WPD program. However, New York State is not collecting premiums at the present time.

What is the difference between the Basic Group and the Medical Improvement Group?

For both groups you must meet the age, work, citizenship or satisfactory immigration status, residency, income and resource requirements. Additionally, for the Basic Group you must have certification of a disability. To be eligible for the Medical Improvement Group, you must have lost eligibility under the Basic Group due to medical improvement. In the Medical Improvement Group, you must be working a minimum of 40 hours per month at no less than federal minimum wage.

How much money do I have to make in order to apply?

Under the Basic Group of the MBI-WPD program, there are no requirements on how many hours you work, or how much you are being paid. Under the Medical Improvement Group, you must work a minimum of 40 hours per month earning at least the federal minimum wage.

Can I get Medicaid through the Medicaid Buy-In program for Working People with Disabilities if I get Social Security Disability Insurance (SSDI) benefits?

If you are working, and meet all of the other eligibility requirements, yes, you can get the Medicaid Buy-In program for Working People with Disabilities.

How come 250% of the Federal Poverty Level is approximately $31,900*, yet I can earn up to $64,836?

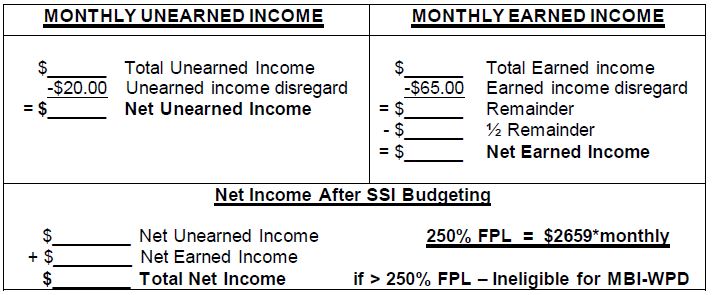

When you apply for the MBI-WPD program, your income is put through a budgeting methodology used by the Social Security Administration. In that test, there are deductions from both your earned and unearned income. During this process, much more of your earned income is deducted in order to attain your net available income, while very little is deducted from your unearned income. This allows people to work more, and still keep their benefits. If all of your income comes from earned income, you can earn up to $64,836 gross. If most of your income is unearned, then you would only be able to make $31,900* per year to qualify.

*The dollar amounts quoted are the Federal Poverty Levels for 2020; these amounts change annually.

Will I have to pay Medicaid co-pays and deductibles?

All of the standard Medicaid co-pays and deductibles apply with the Medicaid Buy-In program for Working People with Disabilities.

Is this the same as the Medicare "Buy-In" Program (Medicare Savings Program)?

No. The Medicaid Buy-In program for Working People with Disabilities (MBI-WPD) is a program that launched July 1, 2003. The MBI-WPD program provides Medicaid health care coverage for working people with disabilities. The Medicare Savings Program (MSP) assists people who are on Medicare through age or disability by paying their monthly Medicare premiums. See the comparison chart included in this toolkit for more information.

How do I go about getting the MBI-WPD program?

You can apply for the MBI-WPD at your Local Department of Social Services (LDSS). This toolkit will help you in the process of preparing to apply for the Medicaid Buy-In program for Working People with Disabilities.

What if I am working and have not been on any benefits for some time?

It is not a requirement that you be on any kind of assistance or receive any kind of benefits in order to qualify for the MBI-WPD. As long as you are working and meet the Social Security guidelines for disability, you may qualify for the MBI-WPD.

What if I am working, have a disability, and have never received SSI or SSDI?

You can still qualify for the MBI-WPD program if you are determined disabled by the Local or State Disability Review Team and you meet all the other eligibility requirements.

How much can I have in resources?

You can have countable resources up to $20,000 for a one-person household and $30,000 for a two-person household. This does NOT include your home or vehicle. Your Local Department of Social Services can tell you what other resources are exempt. See the Resources Worksheet in this toolkit for further information about resources.

What if I am already getting Medicaid through spenddown?

If you are on the spenddown program and working, you should talk with your Social Services caseworker about the MBI-WPD program. In most cases, you will save money by enrolling in the MBI-WPD program. If you apply for the MBI-WPD program, you should keep meeting your spenddown while you are waiting for a decision on your MBI-WPD application.

What application can I use to apply for the Medicaid Buy-In program for Working People with Disabilities?

The following application forms will be accepted for the MBI-WPD program provided the application form is completed and signed by the applicant

- The Access New York Health Care Form DOH-4220 (3/15) and the Access NY Supplement A form DOH-4495A (2/10). Be sure to check the box for MBI-WPD on page 1 under section B. of the Access NY Supplement A form.

- Medicaid Renewal (Recertification) Form

It is recommended that you write "MBI-WPD" on the top right-hand corner of the application to help route your application.

Is there follow-up I need to do after handing in my application to a specific worker at social services?

If you receive a request for missing information, you need to get all requested information to the LDSS office as quickly as possible (within 10 days) in order for your application to be processed. You can call your eligibility worker at the LDSS and make sure your application is complete.

How long does the application process take?

You should receive your notification within 90 days.

What do I need to apply for the MBI-WPD program?

You need to submit to the LDSS the application forms described above and any required documentation. Please refer to the "Medicaid Documentation List" enclosed in this toolkit. It will be a guide to what you will need when applying for the MBI-WPD program. Your application may be submitted in person or by mail to the LDSS. Certain documents will also need to be submitted. In some cases, original documents or certified copies may need to be seen by the LDSS. Please contact your LDSS or call 1-800-541-2831 to find out where you can bring identity and U.S. citizenship documents if required by the LDSS. A local district worker can guide you as to the best way to submit original documents should they be required for an eligibility decision for the MBI-WPD program. Other documents may be mailed with the application.

Does the MBI-WPD cover my children or other family members?

No. The MBI-WPD program is only for individuals or couples who are disabled and working. There are other programs that cover children and other family members offered online through the New York State of Health, New York´s health insurance marketplace. Go online or call 1 (855) 355-5777 or TTY 1 (800) 662-1220.

Section 2: Are You Eligible?

This questionnaire can help you decide if you may be eligible for the MBI-WPD program. Please remember that the final determination of eligibility is made by the LDSS.

To qualify for the MBI-WPD program you must:

- Work in an activity for which you receive payment; and

- Live in New York State; and

- Be at least 16 but under 65 years of age; and

- Be certified disabled by either the Social Security Administration (SSA) or the State or Local Disability Review Team; and

- Be a U.S. Citizen, a National, a Native American or an immigrant with satisfactory immigration status; and

- Meet the income and resource limits; and

- Pay a premium, if required.

If you think you meet these qualifications, take the Self-Interview.

Part A: Self-Interview Worksheet

- Are you working? ☐ Yes ☐No

- Are you a resident of New York State? ☐ Yes ☐No

- Are you between the ages of 16 and 64? ☐ Yes ☐No

- If you answered No to any of questions 1 - 3, you are not eligible.

If you answered Yes to questions 1 - 3, please continue.

- If you answered No to any of questions 1 - 3, you are not eligible.

- Have you been determined to be disabled by the Social Security

Administration´s guidelines? ☐ Yes ☐No- If No, you must be reviewed by the State Disability Review Team in order to determine your disability status.

You can use the Medical Evidence List enclosed in this toolkit for items that will be needed to support your disability status.

- If No, you must be reviewed by the State Disability Review Team in order to determine your disability status.

- Are you a U.S. Citizen, a National, a Native American? ☐ Yes ☐No

- If No, you must bring immigration documents to the LDSS so they can determine if you have satisfactory immigration status.

Part B: The Income Test Worksheet

When completing this section of your toolkit, remember, you must report all income to the LDSS. Income is any payment received from any source. Income may be recurring, a one- time payment, earned or unearned. Keep in mind that when the LDSS is determining your eligibility, the amount of your income that is counted may be considerably less than your gross income. Remember only a LDSS worker can determine which income deductions you may be eligible for.

Your Earned Income:

Earned income is a payment received as a result of work activity. Examples of earned income are wages and salaries, tips, commissions, bonuses, earned income credit and income from casual employment. This would include any earnings from self-employment. Refer to the enclosed "Medicaid Documentation List" for examples of proof of income (i.e. current pay stubs/checks, a written statement from an employer, income tax return, etc.).

Your Unearned Income:

Unearned income is any income that you receive that you have not worked for. This includes any bank interest, annuity payments, lottery winnings or any other income that you are receiving that is not connected to work activity including Social Security Disability, Veterans benefits or retirement benefits.

The last number is your approximate net available income. If that figure is at or below $2,659.00*, you meet the income eligibility requirements for the MBI-WPD.

If that figure is over $2,659.00*, you are still encouraged to apply for the MBI-WPD program, as there are other Impairment-Related Work Expenses (IRWEs) or income deductions you may qualify for. Only the Medicaid eligibility worker can tell you for sure.

*The dollar amounts quoted are the Federal Poverty Levels for 2020. The figure for couples is $3,592 monthly.

*These amounts change annually and can be found on the Department of Health´s website

Part C: Resources Worksheet

What They Are and How They Affect Me

Countable Resources include stocks, bonds, vacation homes, bank accounts, etc. Their value is determined and then added up. With the Medicaid Buy-In program for Working People with Disabilities, you can keep up to $20,000 for a one-person household and $30,000 for a two-person household.

- Cash on Hand ______________________

Checking/Savings Account ______________________

Stocks/Bonds ______________________

Other ______________________

Exempt resources are not counted. These exempt resources include:

- Your homestead

- Your vehicle

- Approved Plan for Achieving Self-Support (PASS)

- Term life insurance policies with no cash surrender value

- Whole life insurance policies with a combined face value of $1,500 or less

Retirement accounts that previously would have been counted as a resource will no longer be counted when eligibility for the MBI-WPD program is determined. Retirement accounts that will no longer be counted are annuities or work-related plans for providing income when employment ends. They include but are not limited to: pensions; Individual Retirement Accounts (IRAs); 401(k) plans and Keogh plans.

There are other resources that are not counted. It is best to check with your Local Department of Social Services to see which resources are exempt.

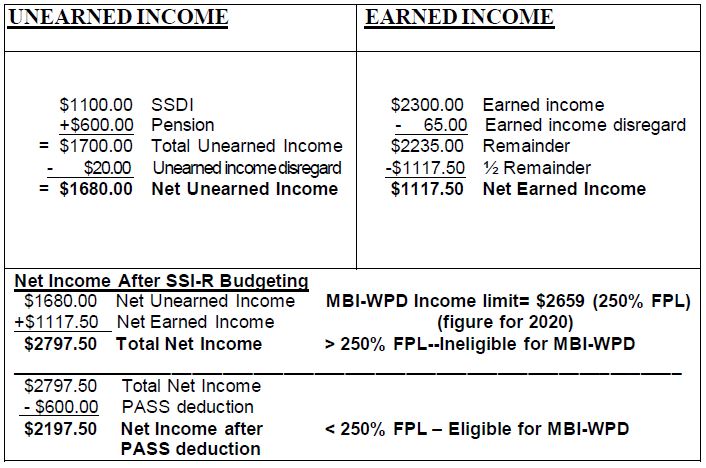

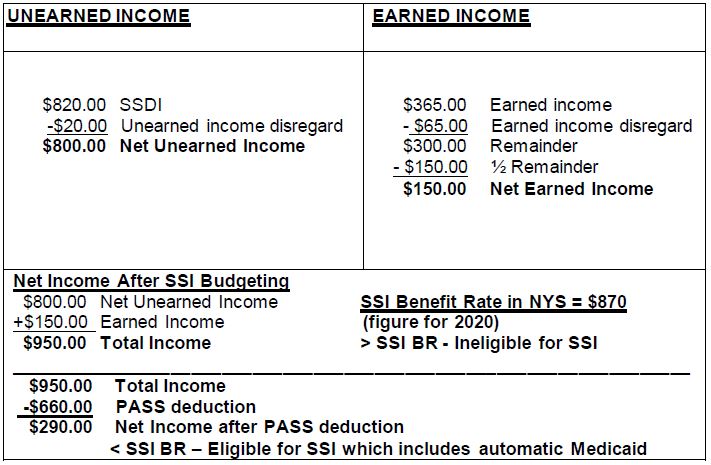

PASS Plan

A Plan to Achieve Self-Support (PASS) is a work incentive that allows an individual with a disability to set aside and exclude income and/or resources to meet an occupational objective.

PASS can be used to reduce countable income for eligibility for the SSI program or for Medicaid programs, including the MBI-WPD program.

PASS allows an individual to set aside money for short-term objectives like saving money for education, vocational training, starting a business or for a work-related item such as a computer or even a custom van. A PASS plan is simply a way to get the services and items needed for work, not the way to make income available for everyday expenses. The SSA PASS can ensure eligibility for SSI as well as the automatic Medicaid that SSI provides. It may even allow individuals to receive higher SSI payments as they work towards self- sufficiency. For further information on the PASS used by SSA, see SSA´s Red Book on work incentives, SSA´s pamphlet entitled Working While Disabled - A Plan for Achieving Self-Support (SSA Publication No. 05-11017), or visit your local SSA office.

As with the SSI program, the Medicaid program allows the use of a PASS. The PASS used by the Medicaid program is based on similar principles and requirements as the SSA PASS, which is used to create eligibility for the Supplemental Security Income (SSI) program.

PASS Requirements for the Medicaid Program

- A PASS must be approved by the Commissioner of the Local Department of Social Services, who must review and approve the plan and any subsequent plan changes. The SSA-545-BK form must be used.

- A self-paced tutorial on PASS and an on-line application can be found at www.passonline.org. Note: The on-line application for a Medicaid PASS cannot be transmitted electronically; a hard copy must be printed and submitted to the Local Department of Social Services.

- The plan must indicate exactly how the money will be set aside and the specific time period in which the goal is to be achieved.

- The plan must be current.

- The individual must perform in accordance with the plan.

- A PASS approved by the Local Department of Social Services Commissioner is limited to 18 months with the possibility of an extension for an additional 18 months. A further extension of 12 months may be allowed in the case of a lengthy training program. The PASS must have a reasonable start and end date and must contain target milestone dates. The end date may be adjusted depending on the progress toward the goal and the earnings-level reached.

- The applicant should also keep in mind that progress on the PASS will be monitored. If the applicant fails to comply with all terms and conditions of the approved plan, the PASS may be discontinued.

SSA PASS APPLICATION for the SSI Program

- If you have any questions about PASS, you can reach a Social Security PASS Specialist in the New York City area at 1-866-348-5403 (A-M ext. 23648) (N-Z ext. 23645. Outside the New York City area, call toll free 1-855-248-0232.

- You will find a detailed explanation of the PASS program as well as a helpful guide here.

- If you would like further assistance in completing the PASS application, you should contact SSA at 1-800-772-1213 or 1-800-325-0778 (TTY)

- If you do not receive either SSI or SSDI, you should contact ACCES-VR at 1-800- 222-5627 for assistance with benefits planning services. At ACCES-VR you can work with a very knowledgeable vocational rehab counselor in developing a detailed, goal directed plan that will address your specific needs.

The following are some examples of how a PASS plan can help with eligibility for MBI-WPD or SSI.

Example I - Eligibility for MBI-WPD:

Bob is an SSDI recipient who is a paraplegic. He is receiving an SSDI payment of $1,100 per month as well as a pension of $600 per month. He works 60 hours per month as a CPA and earns $2,300 monthly. Bob has decided that he would like to start his own business. He applied for a PASS account and was approved. He is planning on putting $600 per month into the PASS account. This money will be put toward the initial start-up costs for his business, which will include the purchase of office equipment, the rental of office space, advertising, etc.

In this example, Bob and his Medicaid eligibility worker applied for a PASS through the Commissioner of their Local Department of Social Services. While Bob´s income was too high to qualify for SSI, this did not prohibit him from applying for and being accepted for a PASS through the LDSS. Once the PASS deduction is made from the net total income, Bob becomes eligible for the MBI-WPD program. Keep in mind though that for a PASS to be approved, there must be a reasonable chance the individual can achieve his/her vocational goal and there must also be a clear connection between the vocational goals and the increased or maintained earning capacities.

Example II - Eligibility for SSI and Automatic Medicaid:

Jan is an SSDI recipient who has muscular dystrophy and is confined to a wheelchair. Jan receives a monthly SSDI check of $820. She is currently working and earning $365 per month. Jan would like to attend college and become a teacher. The amount that she will have to pay per semester is $2,000. Jan applied to SSA for a PASS and was approved. She is planning on putting $660 per month into her PASS account to put toward the cost of her education.

These examples illustrate how a PASS can benefit an individual by making it possible for the individual to pursue a work goal and eventually move from benefit dependence to financial independence.

Navigating the Local Department of Social Services System

To apply for the Medicaid Buy-In program for Working People with Disabilities, you will need to submit your application to your Local Department of Social Services (LDSS).

Here are some tips to help you with the application process:

Know your facts about the MBI-WPD program. This toolkit will help you learn all you need to know about the MBI-WPD. Learn all you can about the program.

Be Prepared - A personal interview is no longer required for application; however, if you would like an interview, you may request one by calling your LDSS. You may also call your LDSS with any questions you have regarding the application form and ask them for assistance if you need it.

Gather Documentation to establish your eligibility for the MBI-WPD program. Carefully review the "Medicaid Documentation List" found in this document or the list in the Access New York DOH 4220 form to determine the documents that you will need to submit with your application. You may bring the required documents when you go to the Local Department of Social Services or you may contact the LDSS to find out how to submit the documentation by mail with your application.

Document Your Actions. Make sure you take names of everyone you speak with, or meet with, and make sure that you write down any problems you experience along with the dates and times they occur. Try to get the problem resolved with your eligibility worker, if necessary, ask to speak with a supervisor.

Know your rights. An applicant should not accept a verbal decision from a worker. A Medicaid eligibility determination must be in writing. An applicant has the right to:

- Be told about the programs and help they can get.

- Be told what they need to do to get these programs.

- Apply for these programs.

- Get an application when they ask for one.

- Have an interview if preferred.

- Get written notice telling them if their application is approved or denied.

Follow-up. Make sure that your application is complete. It is recommended that you follow-up with your eligibility worker 10 days after your application is submitted to make sure that nothing further is required.

If you need help with the process, contact your Local Department of Social Services. If you already have assistance with your benefits, go to the person with whom you are the most comfortable.

If your application for Medicaid/MBI-WPD program is denied, you have the right to request a Fair Hearing. Instructions on how to ask for a Fair Hearing are on the denial form issued by the local Medicaid office. An applicant can ask for a Fair Hearing in writing, in person, over the internet or by calling the State-wide toll-free number at 1-800-342-3334.

NOTES

Part D: Documentation to Establish Disability

Medical Evidence

If you have not been determined to have a disability, the State Disability Review Team will have to review medical information about you that supports your disability claim.

You must provide:

- All available medical information from physicians, psychologists, hospitals, therapists, counselors, etc.

- Medical evidence (medical records including office notes, treatment records, lab results and medications) for a period up to 12 months prior to the date of application and covers the timeframe for which the disability determination is being sought.

DOCTORS SEEN SINCE YOUR IMPAIRMENTS BEGAN:

Physician´s Name ____________________________________ Phone # ( ) ________________________

Address ______________________________________________________________________________________

City __________________________________________ State/Zip code ____________________________________

Physician´s Name ____________________________________ Phone # ( ) ________________________

Address ______________________________________________________________________________________

City __________________________________________ State/Zip code ____________________________________

Physician´s Name ____________________________________ Phone # ( ) ________________________

Address ______________________________________________________________________________________

City __________________________________________ State/Zip code ____________________________________

Physician´s Name ____________________________________ Phone # ( ) ________________________

Address ______________________________________________________________________________________

City __________________________________________ State/Zip code ____________________________________

Physician´s Name ____________________________________ Phone # ( ) ________________________

Address ______________________________________________________________________________________

City __________________________________________ State/Zip code ____________________________________

HOSPITALIZATION OR TREATMENT AT A CLINIC FOR YOUR IMPAIRMENTS:

Name of Hospital or Clinic __________________________________________________________________________________

Contact Person: ______________________________________________________ Phone # ( ) ________________________

Address ________________________________________________________________________________________________

City _________________________________________________ State/Zip code _______________________________________

Name of Hospital or Clinic __________________________________________________________________________________

Contact Person: ______________________________________________________ Phone # ( ) ________________________

Address ________________________________________________________________________________________________

City _________________________________________________ State/Zip code _______________________________________

Name of Hospital or Clinic __________________________________________________________________________________

Contact Person: ______________________________________________________ Phone # ( ) ________________________

Address ________________________________________________________________________________________________

City _________________________________________________ State/Zip code _______________________________________

Name of Hospital or Clinic __________________________________________________________________________________

Contact Person: ______________________________________________________ Phone # ( ) ________________________

Address ________________________________________________________________________________________________

City _________________________________________________ State/Zip code _______________________________________

Name of Hospital or Clinic __________________________________________________________________________________

Contact Person: ______________________________________________________ Phone # ( ) ________________________

Address ________________________________________________________________________________________________

City _________________________________________________ State/Zip code _______________________________________

Name of Hospital or Clinic __________________________________________________________________________________

Contact Person: ______________________________________________________ Phone # ( ) ________________________

Address ________________________________________________________________________________________________

City _________________________________________________ State/Zip code _______________________________________

Conversation Form

When talking with someone involved with your application process for the MBI-WPD program, it is important to document everything, including phone calls. If you experience any kind of problem applying for the MBI-WPD program, it is essential to have proper documentation of all the actions you have taken. This form allows you space to document all the phone conversations you have with people involved with your application process. Bring this form if you go anywhere to report problems you have been having.

Date: ______________ Time: ______________ Person I spoke with: _______________________________________

Describe your conversation:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Date: ______________ Time: ______________ Person I spoke with: _______________________________________

Describe your conversation:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Date: ______________ Time: ______________ Person I spoke with: _______________________________________

Describe your conversation:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Date: ______________ Time: ______________ Person I spoke with: _______________________________________

Describe your conversation:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Date: ______________ Time: ______________ Person I spoke with: _______________________________________

Describe your conversation:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Date: ______________ Time: ______________ Person I spoke with: _______________________________________

Describe your conversation:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Date: ______________ Time: ______________ Person I spoke with: _______________________________________

Describe your conversation:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

MEDICAID DOCUMENTATION LIST

This is a list of documents that the Medicaid programs accept. Please review the list and refer to the DOH-4220B (3/15) form entitled "Documents Needed When You Apply for Health Insurance" that is contained within the DOH-4220 online to determine what documents you need to provide in order to apply for the MBI-WPD program. A complete list of acceptable documentation can be found here. If you have questions, contact your LDSS or call 1-800-541-2831 for assistance.

IDENTITY **

-U.S. State or territory driver´s license/Non-driver´s license photo ID

-U.S. School identification card (with photo)

-U.S. military card or draft record

-U.S. Coast Guard Merchant Mariner Card

-Identity card issued by a federal, state, or local government with the same information as a driver´s license

-Certificate of degree of Indian blood issued by the Bureau of Indian Affairs or U.S. Native American/Native Alaskan native tribal document/card with photo

-A combination of two or more documents such as marriage certificates, divorce decrees, employer id cards, property deeds/titles

CITIZENSHIP **

U.S. passport book/passport card*

Certificate of U.S. Citizenship*

New York State Enhanced Identity Card*

New York State Enhanced Learner´s Permit*

Certificate of Naturalization*

New York State Enhanced Driver´s License*

Native American tribal or membership document (issued by a federally recognized tribe)*

*Satisfies both the identity and citizenship documentation requirements (see your Local Department of Social Services for additional documents that verify citizenship and/or identity).

**Note: Proof of identity, citizenship and date of birth are not needed at application if you are a U.S. Citizen and supply your Social Security Number. Your Social Security Number will be matched against a federal system to verify your citizenship. After that, birth verification will be performed electronically. If either of these matches or the birth verification fails, you may be asked to send proof of your identity, citizenship and/or date of birth.

CURRENT IMMIGRATION STATUS (Must be provided for any immigrant applying or for an immigrant renewing whose status has changed in the past 12 months.)

Permanent Resident Card USCIS Form I-551

Arrival/Departure Record USCIS Form I-94

Employment Authorization Card or I-766

Other documentation or correspondence to and or from one of the federal immigration agencies (USCIS, ICE, EOIR)

DATE OF BIRTH**

U.S. Birth Certificate

U.S. baptismal certificate

Official U.S. hospital/doctor birth records

CERTIFICATION OF DISABILITY (Everyone must provide certification of disability, if you have no certification of disability or blindness, the LDSS may help you obtain certification.)

| Social Security Disability Insurance | Award letter/certificate, benefit check or correspondence from Social Security Administration |

| Social Security Administration (SSA) | Letter from SSA placing you in a 36-month Extended Period of Eligibility or a letter stating that you are no longer eligible for the 1619(b) program due to excess income or resources |

| Railroad retirement benefits | Award letter listing the disability as total and permanent |

| State/Local Disability Review Team Certificate | Disability Review Team Certificate (LDSS-639/DOH-5144) |

| Certification of blindness | Certification from the Commission for the Blind and Visually Handicapped |

RESIDENCY/HOME ADDRESS (Everyone must provide proof of residency.)

| ID card with address | Postmarked envelope, postcard, or magazine label with name and date |

| Driver´s license issued within past 6 months | Utility bill (gas, electric, cable), bank statement or correspondence from a government agency |

| Letter/lease/rent receipt from the landlord, with home address | Property tax records or mortgage statement |

INCOME (Everyone must provide proof of income.)

| Earned Income from Employer | Current paycheck/stubs or letter from employer |

| Self-Employment Income | Current signed income tax return or record of earnings and expenses |

| Rental/Roomer-Boarder Income | Letter from roomer, boarder, tenant or check stub |

| Unemployment Benefits | Award letter/certificate, benefit check, correspondence from NYS Department of Labor |

| Private Pensions/Annuities | Statement from pension/annuity |

| Social Security | Award letter/certificate, benefit check or correspondence from SSA |

| Child Support/Alimony | Letter from the person providing support, letter from court, child support/alimony check stub |

| Workers´ Compensation | Award letter, check stub |

| Veteran´s Benefits | Award letter, benefit check stub, correspondence from Veteran´s Administration |

| Military Pay | Award letter, check stub |

| Interest/Dividends/Royalties | Statement from bank, Credit Union, or financial institution. Letter from broker |

| Support from other Family Members | Signed statement or letter from a family member |

| Income from a Trust | Trust document |

RESOURCES

Resources include: money in a bank or credit union, stocks, bonds, mutual funds, certificates of deposit, money market accounts, trusts, the cash value of life insurance, or property that someone owns. Do not include your home.

If you do not require long-term care services, you may attest to the amount of your resources. If you require community-based long-term care services, you must provide proof of your current resources.

Bank statements

Copy of the deed and appraisal for real estate other than your home

Burial agreement

Life insurance policy

Copies of stocks, bonds, securities

Trust document

HEALTH INSURANCE PREMIUMS (Provide, if applicable.)

Letter from employer Premium statement Pay stub

PRIVATE OR EMPLOYER BASED HEALTH INSURANCE (Provide, if applicable.)

Insurance policy Premium statement Insurance card Termination letter

CHILDCARE/DEPENDENT CARE EXPENSES (Provide, if applicable.)

Written statement from day care center or other child/adult care provider.

SPECIAL WORK EXPENSE FOR BLIND/DISABLED

If you are blind or disabled and must pay special non-medical expenses in order to work (for example, you need special equipment or transportation), provide the receipts that show what the expense is and who provides it.

| COMPARISON CHART | |

|---|---|

| MEDICAID BUY-IN PROGRAM FOR WORKING PEOPLE WITH DISABILITIES (MBI-WPD) |

MEDICARE SAVINGS PROGRAM (MSP) |

| Refer to 04 OMM/ADM-5 for more details of this program. | Refer to 00 OMM/ADM-7 for more details of this program. |

| The MBI-WPD program offers working people with disabilities the opportunity to retain Medicaid health care coverage despite increased income. Certain Medicaid recipients with a spenddown may benefit by switching to this program. BENEFIT: Regular Medicaid Coverage ELIGIBILITY REQUIREMENTS: To qualify, an applicant must:

|

The Medicare Savings Program administered by Medicaid assists low income people with costs associated with the Medicare Program. BENEFIT: Payment of Medicare Premiums and in some cases Medicare deductibles and coinsurance ELIGIBILITY REQUIREMENTS: To qualify, an applicant must:

The categories under the Medicare Savings Program are:

|