Eligibility and Enrollment Changes Under the ACA

- Changes also available in Portable Document Format (PDF)

Overview

- Continuum of Coverage

- MAGI and non–MAGI Populations: Definitions

- Category Consolidation

- Application Modalities

- MAGI: Defining Household and Income

- Eligibility Verification

- Renewal

- Medicaid Benchmark Benefit

- Family Health Plus

- Child Health Plus

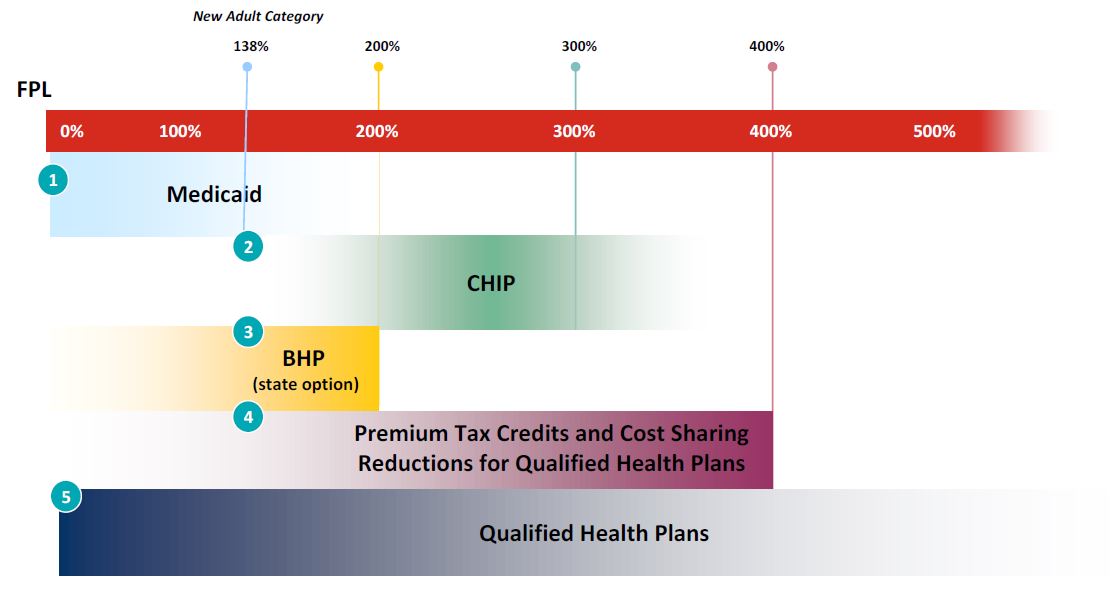

Continuum of Coverage in 2014

Source: Manatt Health Solutions

Collapsing Medicaid Eligibility Categories

- Current Medicaid mandatory and optional eligibility groups for children and parents collapsed into three main categories:

- Pregnant Women

- Children

- Parents/Caretakers Relatives

- Adds a new mandatory category for adults under age 65.

- Together the four groups comprise the MAGI populations.

- Article VII Part D Section 1 codifies the new eligibility categories into MAGI and non–MAGI groupings.

Non–MAGI Populations

- Categorically eligible (e.g., TANF, SSI, Foster Care)

- Individuals 65 and older when age is a condition of eligibility

- Individuals whose eligibility is based on being blind or disabled

- Individuals who request coverage for long–term care services

- Medicare Savings Program

- Medically Needy

- Medicaid Buy–In for Working Persons with Disabilities

- Cancer Services Program

- Former Foster Care Youth

- Residents of adult homes, residential treatment centers/community residences operated by OMH.

Seamless Eligibility and Enrollment Process

Real–time processing

Mandates integrated and simplified eligibility processes for "Insurance Affordability Programs" (IAPs) – the continuum of subsidized coverage including Medicaid, CHIP, Basic Health Program and Advance Premium Tax Credits (APTCs)/Cost Sharing Reductions (CSRs).

42 CFR 435.912, 435. 1200, 457.350,

45 CFR 155.302, 155.305, 155.310

Source: Manatt Health Solutions

Application: Modality

- The ACA requires states permit applications to be filed:

- Online

- In–person

- By mail

- By phone

- Or other electronic means

- ACA 1413(b)(1)(A)(ii); 42 CFR 435.907(a)

- Article VII Part D Section 7

Modified Adjusted Gross Income (MAGI)

- Medicaid "Family" is tax filing unit.

- Medicaid has some exceptions to the tax filing unit to avoid disruption in coverage for children:

- Children living with relatives who are not their parents;

- Children claimed as dependents by non–custodial parents;

- Children living with both parents, although the parents file separate returns.

- For non–filers: step–parents and step–siblings count as members of Medicaid households.

Family Examples

Sophia is a single mother with 2 children, Ben age 4 and Isabelle age 2. Sophia is employed, earning $24,000 a year. She also receives $4,000 per year in child support and pays $3,000 per year for child care

| Current Medicaid Rules | MAGI Rules |

|---|---|

|

|

Mike and Rachel have 3 children ages 14, 18, and 22. Mike works and earns $45,000 a year. The two older children work, are full–time students, and earn $3,000 and $10,000 a year respectively.

| Current Medicaid Rules | MAGI Rules |

|---|---|

|

|

Verification

- Data–matching: States must develop secure, electronic interfaces to allow for data matching and eligibility determination for IAPs. States must use data matching to the maximum extent practicable. ACA 1411, 1413(c)

- Self–attestation: Medicaid and CHIP may accept attestation of information and conduct database verification needed to determine eligibility without further documentation. 42 CFR 435.945

- Reasonable Compatibility: Standard for assessing whether verification can be considered complete, or if additional information is necessary. When data obtained is "reasonably compatible" with an applicant's attestation, State agencies are prohibited from requiring additional documentation. 42 CFR 435.952(c)

- Article VII Part D Sections 12 and 26.

Renewal and Change Reporting

- Annual Renewal: Re–determine eligibility for IAPs no more frequently than every 12 months. 42 CFR 435.916

- Administrative Renewal: State Medicaid/CHIP Agencies must use available information to facilitate annual redetermination process. 42 CFR 435.916

- Change Reporting: Individuals must report changes with respect to eligibility standards through the same modalities they can apply for coverage. 42 CFR 435.916(c)

Administrative Renewal

- Use available information from electronic sources and if sufficient:

- Renew without requiring information from the enrollee;

- Notify applicant of renewal and provide an applicant with opportunity to correct information.

- If unable to administratively renew:

- Provide enrollee with pre–populated renewal form;

- Enrollee must have at least 30 days from date of renewal form to respond and provide necessary information;

- Provide at least a 90–day grace period where the beneficiary could be reconsidered and renewed without a new application if the enrollee fails to return form.

- Article VII Part D Section 10.

Medicaid Benchmark

- The new adult category is required to be enrolled in a benchmark benefit. 42 USC 1396a (k)

- The benchmark benefit must include the 10 Essential Health Benefits, EPSDT services, non–emergency transportation, services provided by rural health clinics and FQHCs and provide full mental health parity.

- Individuals with disabilities, special health care needs, or who are medically frail cannot be mandated into a benchmark benefit.

- Approximately 1 million adults subject to the benchmark benefit are already enrolled in Medicaid or Family Health Plus. 77,000 adults are estimated to be newly eligible.

- Article VII Part D Section 6 proposes to define the benchmark benefit as the Medicaid benefit without institutional long–term care services.

- The proposed benchmark is the least disruptive to current enrollees, preserves continuity of coverage as income fluctuates, is the easiest to administer, and most importantly, eliminates the needs to identify persons with disabilities, special health care needs, or who are medically frail, and move them to another eligibility category.

- Proposed benchmark will received enhanced federal match (100% for newly eligible and 75% for currently eligible childless adults).

Family Health Plus

- The Family Health Plus (FHP) program is repealed by January 2015. Nearly all FHP enrollees are subsumed under the new Medicaid adult category.

- The Family Health Plus Buy–In Program is repealed by January 2014.

- No new FHP applications will be taken after December 31, 2013.

- Current FHP enrollees will transition to Medicaid during 2014.

- FHP enrollees between 133% and 150% of FPL who enroll in a QHP (silver plan) will have their premiums and cost–sharing paid by the State.

- Article VII Part D Sections 14, 14a, 15, and 16.

CHIP–Specific Provisions

- CHIP programs are subject to the same provisions as Medicaid with respect to the MAGI eligibility rules, electronic verification, and administrative renewal.

- In addition, the CHPlus program proposes to centralize eligibility determinations with all IAP programs and eliminate audits of health plan eligibility determinations.

- Article VII Part D Sections 17–33.

Questions?

- If you have questions from today´s presentation, please join us on Twitter for an opportunity to ask questions and have them answered in real time.

- When: Thursday, February 14, 12:30 PM – 1:30 PM

- How to participate in the live Twitter chat:

- If you´re not already on Twitter, join at www.twitter.com

- Follow the MRT on Twitter: @NewYorkMRT

- Login to Twitter between 12:30 PM and 1:30 PM on Thursday, February 14

- Ask questions by including @NewYorkMRT and #NYMRT in your tweets

- You don´t have to tweet – you can watch the conversation just by following @NewYorkMRT on Twitter – updates will show up in your news feed.

- Additional information can be found at http://www.healthbenefitexchange.ny.gov/

- This power point is available, and an archived version of the webinar will be made available on the MRT Website: http://www.health.ny.gov/health_care/medicaid/redesign/

- Sign up for our listserv: http://www.health.ny.gov/health_care/medicaid/redesign/listserv.htm

- Like us on Facebook: http://www.facebook.com/NewYorkMRT

- Follow us on Twitter: @NewYorkMRT

Follow Us