2022 Institutional Cost Report (ICR)

NYS Department of Health

Division of Finance & Rate Setting

Bureau of Hospital & Clinic Rate Setting

- Presentation is also available in Portable Document Format (PDF)

April 12, 2023

Agenda

- ➣ Software, Support & Filing Procedures

- ➣ 2022 ICR Audit Fees

- ➣ Health Commerce System (HCS)

- ➣ Department of Health (DOH) Public Website

- ➣ 2022 ICR Updates

- ➣ Questions

Software, Support & Filing Procedures

- ➣ Obtaining Software and Support

- The Institutional Cost Report (ICR) Software will be available for download from the Health Financial Systems (HFS) website.

- The Department will provide hospitals with the URL, Username and Password using the Health Commerce System (HCS) - Hosp Institutional Cost Rpt application.

- ICR problem resolution and questions:

- Send email to: Hospital.ICR@health.ny.gov

- Include in subject line: "2022 ICR - hospital name"

- For problem resolution, send your "four-pack" files (CR, IC, B_, T_) to this address (ED_ file may also be sent). The files will then be forwarded to HFS, if necessary.

Note: The Department prefers that hospitals do not email these files via secure email (only necessary when HIPAA or PHI data are included)

- ➣ Electronic Filing Procedures

- DH file: Electronic submission through Health Commerce System (HCS) - Hosp Institutional Cost Rpt application):

- Due date: Friday, June 16, 2023

- Supporting documents due within 5 business days of ICR submission to be considered a valid cost report submission:

- Signed CFO/CEO certification (verify DCN matches the submitted ICR)

- Edit Report (Initialed with explanations)

- Final Audited Financial Statements

- ✤ "Draft" statements cannot be used for audit purposes

- Audit Fee Form (NEW for 2022 ICR submissions)

- Email files to: AFS@health.ny.gov

- Signed CFO/CEO Certification:

- File named with 7-digit operating certificate number and "_CFO"

- Example: 1234567_CFO

- File named with 7-digit operating certificate number and "_CFO"

- Audited Financial Statements:

- File named with 7-digit operating certificate number and "_AFS"

- Example: 1234567_AFS

- File named with 7-digit operating certificate number and "_AFS"

- Audit Fee Form (NEW):

- File named with 7-digit operating certificate number and "_AFF"

- Example: 1234567_AFF

- File named with 7-digit operating certificate number and "_AFF"

- DH file: Electronic submission through Health Commerce System (HCS) - Hosp Institutional Cost Rpt application):

- The Institutional Cost Report (ICR) Software will be available for download from the Health Financial Systems (HFS) website.

2022 ICR Audit Fees

- Due within 5 business days of filing ICR

- Same banking information as previous years

- Same fee schedule as previous years

- Fee schedule: http://www.health.ny.gov/facilities/hospital/audit_fee/

- Email notification to be released for facility-specific audit fees

- Additional fees may be assessed when # of submissions exceeds 2

- New form with payment information needs to be emailed

Health Commerce System (HCS)

- ➣ Website

- ➣ Communication Tool

- Secure network for posting provider information

- Important to keep email address current to receive notifications

- Facility's responsibility

- Email list is separate from the DOH public website electronic mailing lists

- ➣ HCS Help Contact

- Commerce Accounts Management Unit Help Desk: 1-866-529-1890 or camu@its.ny.gov

- HCS accounts

- Password resets

- Removal of employee

- Commerce Accounts Management Unit Help Desk: 1-866-529-1890 or camu@its.ny.gov

- ➣ HCS Access Contact

- Hospital Fee-for-Service Rate Unit: HospFFSunit@health.ny.gov

- Receiving access to the ICR (or other hospital applications)

- Rate related questions

- Hospital Fee-for-Service Rate Unit: HospFFSunit@health.ny.gov

Department of Health Public Website

- ➣ Institutional Cost Report (ICR) web page:

- ➣ Information posted for Inpatient Rates and Weights

- ➣ Information posted for APG Rates and APGs

- ➣ Electronic Mailing List Subscriptions (DOH web pages):

2022 ICR Updates

- ➣ Exhibits (changes, additions & clarifications)

- Cost Centers

- Opioid Treatment Program

- ✤ Per CMS T18 - Effective on or after January 1, 2022, CMS line 102

- ✤ Previously CMS line 90.40

- ✤ Will maintain ICR Cost Center 262

- Opioid Treatment Program

- Exhibit 3 (S-3 Part I) - Complex Statistical Data

- Temporary Expansion COVID-19 PHE Acute Care

- ✤ Addition of CMS Line #34, ICR Line #618

- ✤ Refer to Medicare instructions - Section 4005.1

- Temporary Expansion COVID-19 PHE Acute Care

- Exhibit 26A (G-3) - Statement of Revenue & Expenses

- COVID-19 Revenue - Not included in CMS line 24.50

- ✤ Addition of CMS Line #24.51 - 24.60, ICR lines 131 - 140

- ✤ Specify the type/source of funding

- COVID-19 Revenue - Not included in CMS line 24.50

- Health Care Worker Bonus (HWB)

- Exhibit 27 - Appropriations from Special Funds

- ✤ New lines 212-214, report both inpatient & outpatient

- Exhibit 27 - Appropriations from Special Funds

- Health Care Worker Bonus (HWB)

- Exhibit 12 - (A-6) Reclassifications

- ✤ Reclassify bonus and FICA to Cost Center 003 - Employee Benefits

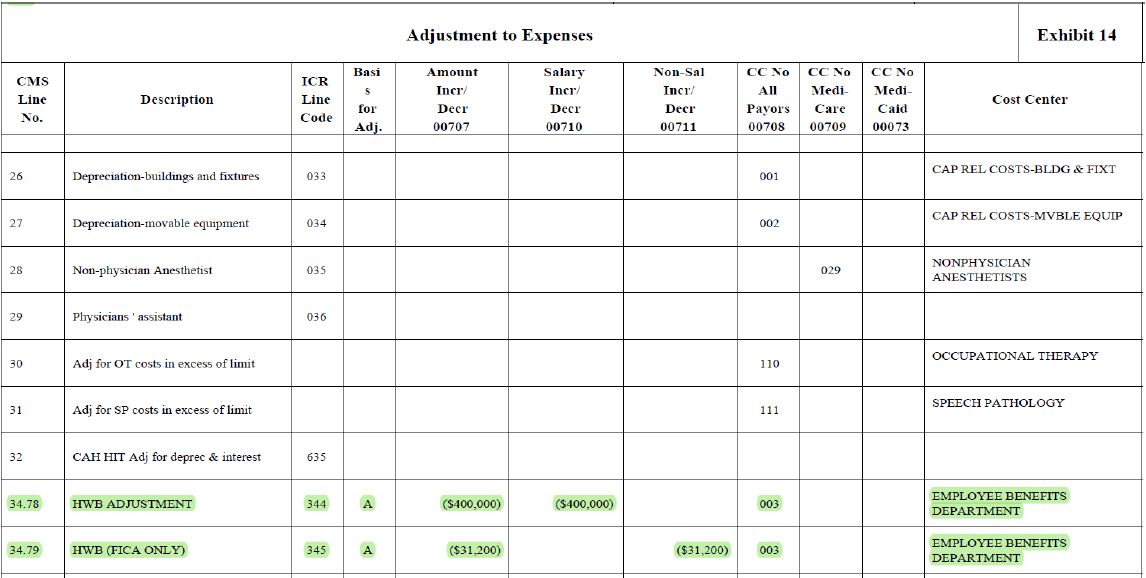

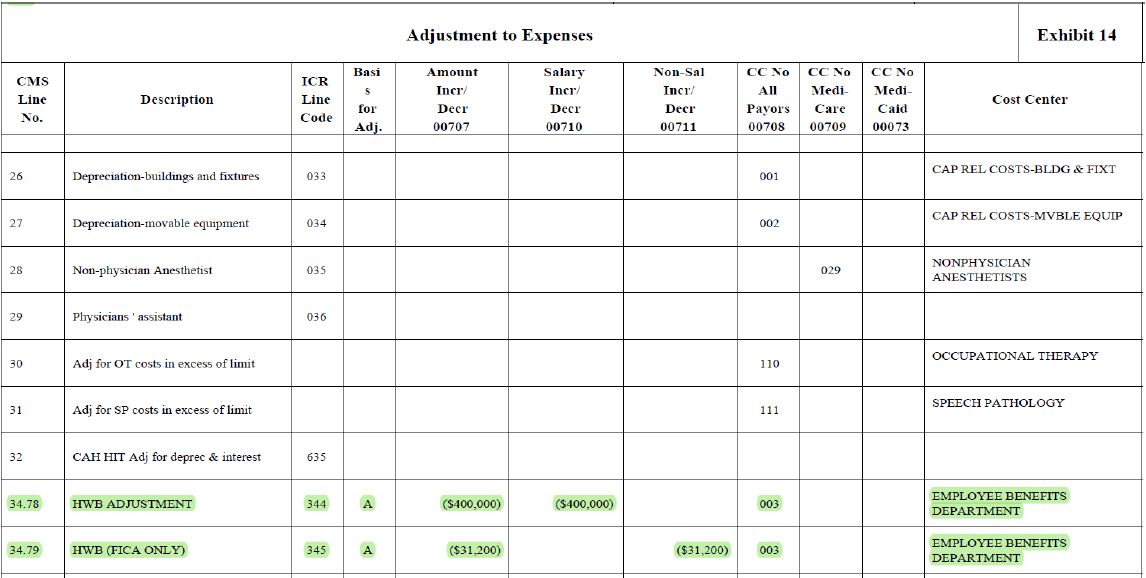

- Exhibit 14 - (A-8) Adjustments to Expenses

- ✤ All-payor adjustment (Negative) from Cost Center 003- Employee Benefits

- ✤ Bonus paid and NYS reimbursement of employer FICA

- ✤ Use CMS line #34.78, ICR line # 344, - HWB or HWB/FICA

- ✤ Use CMS line #34.79, ICR line # 345, - FICA

- Exhibit 12 - Reclass Example

Columns Entry Explanation HWB/FICA Entered the increased amount Cost Ctr - 00700/001 Cost Center 003 Salaries - 00701/001 Total of all HWB and FICA(if combined) to be reclassed from Dept. Fringe Benefits -00704/001 Total FICA (if recorded separate) to be reclassed from Dept. Entered the decreased amounts Cost Ctr - 00700/xxx Cost center xxx where HWB and its FICA is recorded Salaries - 00701/xxx (Negative of) HWB and its FICA, if combined, Fringe Benefits - 00704/xxx (Negative of) FICA, if recorded separate

- Health Care Worker Bonus (HWB)

- Exhibit 14 - Adjustment example

Columns Entry Description HWB or HWB/FICA All Payors - 00708/344 (CMS 34.78) Cost center 003 Amount - 00707/344 Amount of HWB (negative amount) Salary - 00710/344 Amount of HWB (negative amount) Description HWB( FICA Only), if needed All Payors - 00708/345 (CMS 34.79) Cost center 003 Amount - 00707/345 Amount of FICA (negative amount) Non-Salary - 00710/345 Amount defaults to Non-Salary - Exhibit 41 - Funded Depreciation Schedule

- Home Office Amounts Assigned or Allocated to Hospital

- ✤ Column for hospital-only costs that reconciles to AFS

- ✤ Column for Home Office assigned or allocated values

- Inclusion of Home Office amounts (Form 287)

- Home Office Amounts Assigned or Allocated to Hospital

- Exhibit 46 - Hospital Service Revenue

- Clinic Line 002

- ✤ "Article 28 General Clinic, MSC 235, Visit Fees - Outpatient"

- Clinic Line 002

- Exhibit 14 - Adjustment example

➣ Edits

- Importance

- Improves Data Integrity

- ✤ Budgetary Analysis

- ✤ DSH Model

- Explains data anomalies

- ✤ Low Utilization

- ✤ Positive values entered as negatives & vice versa

- ✤ Charge Structure

- Reduce ICR Audit findings and/or questions

- ✤ Prevents errors to avoid audit findings

- ✤ Edit explanations provided to Auditors

- Types of Edits

- Fatal (3xxxx)

- ✤ Identify the cause and make appropriate correction(s)

- ✤ Notify ICR mailbox when edit is believed non-applicable and cannot be cleared

- Non-Fatal (4xxxx)

- ✤ Intent is to identify unexpected data or combinations

- ✤ Only change data if an entry is incorrect or omitted

- ✤ Do not make changes to unsupported values to clear Edit(s)

- Edits comparing Exhibit 3 (S-3, Part I) versus Exhibits 32, 33, & 34 (Utilization)

- PS&R versus Patient Financial System

- Fatal (3xxxx)

- ✤ All non-fatal edits require an explanation

- Improves Data Integrity

- Exhibit 12 - (A-6) Reclassifications

- Edit Responses

- Explanation should provide insight

- ✤ Should not be left blank

- ✤ Should not state “confirmed”, except for edits requesting confirmation (ex - edit 41806)

- Should not state deferment until audit

- New / Updated Edits

- Exhibit 52 - Medicaid Service Code (MSC) Assignment

- ✤ Each long-term care MSC limited to one cost center

- Tighter criteria on edits based review of 2020 & 2021 ICRs and hospital comments

- Explanation should provide insight

- Cost Centers

Note: Any Edits that are to be cleared should be done BEFORE filing either the Medicare or Medicaid cost report

- ➣ Employee Discount Days vs. Courtesy Days

- Employee Discount Days on Exhibit 3 (S-3, Part I)

- IRF reported separately

- Courtesy Days reported on Exhibit 32 (Utilization)

- Employee Discount Days

- Other - Example: Related Physicians, Clergy, etc.

- Employee Discount Days on Exhibit 3 (S-3, Part I)

- ➣ Primary Payor

- After posting the Explanation of Benefit (EOB), self-responsible amounts are still the primary payor

- Not the secondary payor, if different from primary

- Not self-pay or uninsured

- Charity Care Primary Payor

- Only if entire account does not have third-party coverage and was or is to be written off

- HFAL when other primary payor to Lines 382, 383, 386 and 391

- After posting the Explanation of Benefit (EOB), self-responsible amounts are still the primary payor

- Payor changes for later eligibility qualification

- ➣ Offsets

- Typically would reduce revenue or expense to zero

- Unless limited, like interest restricted in use by donor of principal

- Should not result in negative expense

- Reminders

- When including ending accrual, consider beginning accrual

- Use hard-coded lines on Exhibit 18, when available

- ✤ Parking, 068 and 069

- ✤ Malpractice, 025

- Typically would reduce revenue or expense to zero

- ICR Submissions

- Non-Compliance

- CEO/CFO certification, audited financials or audit fees not received

- Edit Report

- ✤ At least one explanation blank

- ✤ At least one explanation shows intent to address later

- ✤ Explanation(s) do not provide insight

- Improper reporting

- ✤ Voluntary Hospitals

- Type of control not reported correctly

- Exhibit 25 (Statement of Cash Flows) - not completed

- Exhibit 42 (Unfunded Depreciation Waiver Override) - only with DOH approval

- ✤ Voluntary Hospitals

- May result in rejection & required resubmission of ICR (counts toward 1st audit fee)

- Non-Compliance

- 2022 ICR Submissions

- Please review past audit findings and/or adjustments to avoid similar reporting errors

- Backup documentation for various exhibits should be kept on-hand for audit purposes

- All remaining non-fatal edits must include adequate explanations and initials

- DCN's all agree - ICR submission and CFO certification

- Recommended - submit financial statements and CFO certifications same day as ICR submission

- Initial ICR submission should always include the most accurate data

- ✤ Unaudited data may be used by the Department at any time

- ✤ Ready to be audited (do not plan to fix exhibits during audit)

Questions?

ICR Questions: Hospital.ICR@health.ny.gov

|top of page|