APG Implementation

Ambulatory Patient Groups (APGs) and Prenatal Care

- Presentation also available in Portable Document Format (PDF)

January 7, 2009

Today´s Objectives

- Provide overview of APG payment methodology and implementation schedule

- Review general payment and policy rules

- Review issues of special interest to prenatal care providers

- Review prenatal care payment examples

- Review billing and systems issues

- Identify resources to help you

- Answer your questions

Webinar Ground Rules

- Place Phone on Mute During Presentations

- Do Not Put Conference Call on Hold

- Please Hold Questions Until the Q and A Period

Speakers

Karen Kalaijian, Assistant Director

Division of Financial Planning and Policy

Office of Health Insurance Programs

New York State Department of Health

Ronald Bass, Director

Bureau of Policy Development and Coverage

Office of Health Insurance Programs

New York State Department of Health

Rita Guido, CSC Outreach Supervisor

Provider Relations

Computer Sciences Corporation

eMedNY

Introduction and Overview

- 08/09 Budget Began Ambulatory Care Payment Reform

- APGs– new outpatient payment methodology replaces threshold visit payment system

- Additional investments in primary care

- Primary care enhancements (expanded after–hours access, diabetes/asthma education by CDEs and CAEs, mental health counseling by licensed social workers, smoking cessation counseling for pregnant women)

APG Time Line

- Hospital Provider Training June/July 2008

- General DTC Training Oct. 29, 2008

- CMS Approval – Effective Date Dec. 1, 2008

- Final APG Regulations Dec. 3, 2008

- Implement APGs in Hospital OPDs and Amb Surg Units Dec. 1, 2008

- Implement APGs in Hospital EDs Jan. 1, 2009

- Implement APGs in D&TCs and in Amb Surg Centers March 1, 2009

APGs Now In Effect for Hospital OPD and Ambulatory Surgery Unit Claims

- APGs for hospital outpatient clinic and ambulatory surgery services in effect as of December 1, 2008.

- eMedNY will reprocess applicable paid outpatient clinic or ambulatory surgery claims for dates of service on or after December 1, received prior to January 1, 2009.

- Claims will be automatically reprocessed as adjustment transactions using the appropriate APG rate codes. Providers will not have to resubmit claims.

- Claims received on or after Jan 1, 2009 must use APG rate codes to be paid.

Key Messages

- See DOH website to learn more about APGs

- Improve coding on claims to ensure appropriate reimbursement through APGs

- Talk with your billing departments and billing/practice management vendors about APG implementation

- Prepare to use new rate codes on claims upon APG implementation.

Ambulatory Patient Groups

Ambulatory Patient Groups (APGs)

- APGs

- a patient classification system designed to detail the amount and type of resources used in an ambulatory visit.

- patients in each APG have similar clinical characteristics and similar resource use and costs

- developed by 3M Health Information Systems to encompass the full range of ambulatory settings including same day surgery units, hospital emergency rooms, and outpatient clinics.

THREE PRIMARY TYPES OF APGS

- SIGNIFICANT PROCEDURE

- A procedure which constitutes the reason for the visit and dominates the time and resources expended during the visit. Examples include: excision of skin lesion, stress test, treating fractured limb.

- MEDICAL VISIT

- A visit during which a patient receives medical treatment (normally denoted by an E&M code), but did not have a significant procedure performed. E&M codes are assigned to one of the 181 medical visit APGs based on the diagnoses shown on the claim (usually the primary diagnosis).

- ANCILLARY TESTS AND PROCEDURES

- Ordered by the primary physician to assist in patient diagnosis or treatment. Examples include: immunizations, plain films, laboratory tests.

APG Payment Definitions

- Consolidation or Bundling

- The inclusion of payment for a related procedure into the payment for a more significant procedure provided during the same visit.

- CPT codes that group to the same APG are consolidated.

- The inclusion of payment for a related procedure into the payment for a more significant procedure provided during the same visit.

- Packaging

- The inclusion of payment for related medical visits or ancillary services in the payment for a significant procedure.

- The majority of "Level 1 APGs" are packaged. (i.e. pharmacotherapy, lab and radiology)

- Uniform Packaging List is available online at the DOH APG website.

- The inclusion of payment for related medical visits or ancillary services in the payment for a significant procedure.

- Discounting

- A discounted payment for an additional, but unrelated, procedure provided during the same visit to acknowledge cost efficiencies.

- If two CPT codes group to different APGs, 100% payment will be made for the higher cost APG, and the second procedure will be discounted at 50%.

- A discounted payment for an additional, but unrelated, procedure provided during the same visit to acknowledge cost efficiencies.

APG Modifiers

- Six Modifiers are recognized in APGs

- 25 – distinct service

- Reimburses a medical visit (E&M) APG on the same day as a distinct and separate significant procedure

- 27 – Multiple E&M encounters

- Reimburses multiple non–related E&M visits on the same date of service.

- 52 and 73 – Terminated procedure

- Payment will be discounted.

- 59 – distinct procedure

- Reimburses two distinct significant procedures without consolidating

- 50 – bilateral procedure

- Flags proc code for additional payment – 150%

- 25 – distinct service

- Use of Modifiers 25 and 27 will not impact payment initially; important to code on claims nevertheless.

Provider Billing Changes

- New APG Grouper Access Rate Codes

- Effective 12/1/08

- Hosp Outpatient Clinic – 1400

- Hosp Based Amb Surg – 1401

- Effective 1/1/09

- Hosp Emergency Dept – 1402

- Effective 3/1/09

- DTC General Clinic Rate Code – 1407

- DTC Dental Rate Code – 1428

- DTC Renal Rate Code – 1438

- DTC MR/DD/TBI Patient – 1435

- Free–Standing Ambulatory Surgery Rate Code – 1408

- Effective 12/1/08

- Most Existing Rate Codes will become obsolete as of APG effective date

- For billing or adjusting for DOS prior to APG implementation, use old rate code.

- Essentially the minimum change required to insure appropriate reimbursement under APG payment methodology:

- Use APG grouper access rate codes

- Use valid, accurate ICD–9 CM Dx codes

- Use valid, accurate CPT4 and/or HCPCS procedure codes

- All services within the same DOS and rate code must be billed together on a single claim.

- If two claims are submitted, with the same rate code for the same DOS, only the first claim submitted will pay. The second will be denied.

APG Base Rates, Phasing and Blending, and Payment Methodology

Base Rates

- Base rates are established for peer groups

- e.g. DTC, hospital OPD, hospital ED, free standing ambulatory surgery centers, etc.

- Within each peer group there are downstate and upstate regions that have differing rates

- Peer group base rates are calculated based on case mix, visit volume, cost, and targeted investment.

- Base rates represent a conversion factor for multiplication by APG weights on a claim to arrive at the APG payment amount

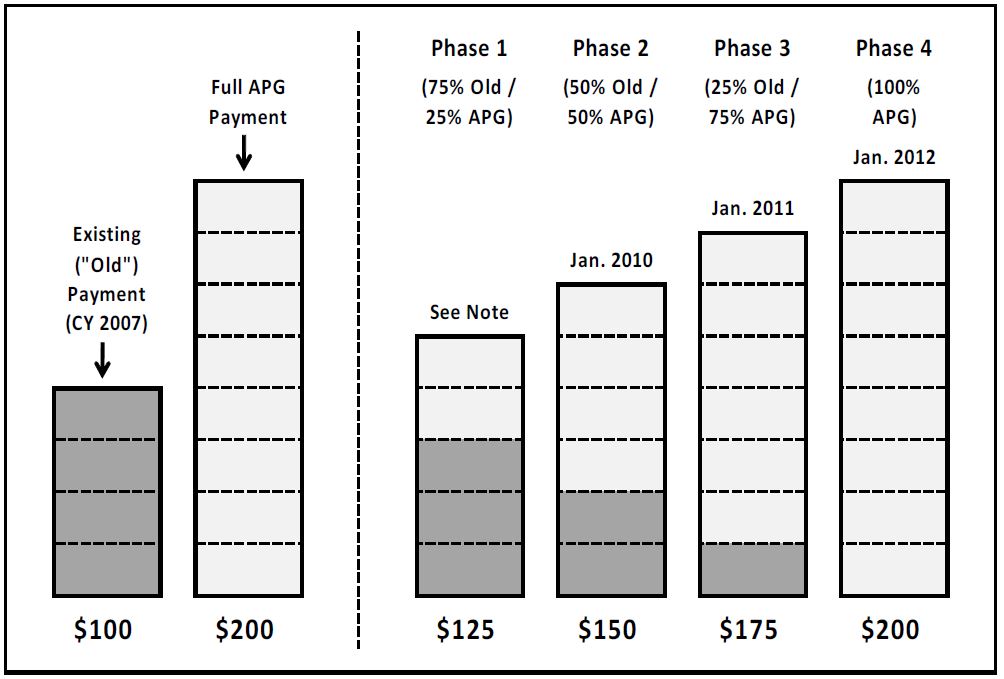

Phasing and Blending

- Phasing: APG payments will be phased–in over time through blending

- Blending: The Medicaid payment for a visit will include a percentage of the payment amount based on APGs and a complementary percentage of the payment amount based on the average facility clinic rate in 2007 as defined by DOH.

Hospital OPD and DTC Transition and "Blend" (Dates Subject to Change)

Note: Blend goes into effect on 12/1/08 for Hospital OPDs and 3/1/09 for Free–Standing Clinics and Ambulatory Surgery. Sample of ICD–9 Codes Grouping To APG 765 & 766

Sample of ICD–9 Codes Grouping To APG 765 & 766

| APG | APG Description | ICD–9 Code | ICD–9 Code Description |

|---|---|---|---|

| 765 | OTHER ANTEPARTUM DIAGNOSES | 64683 | Preg compl NEC–antepart |

| 64703 | Syphilis–antepartum | ||

| 64713 | Gonorrhea–antepartum | ||

| 64723 | Other vd–antepartum | ||

| 64763 | Oth viral dis–antepartum | ||

| 64803 | Diabetes–antepartum | ||

| 766 | ROUTINE PRENATAL CARE | V220 | Supervis normal 1st preg |

| V221 | Supervis oth normal preg | ||

| V222 | Preg state, incidental |

Sample APGs and Weights Relating To Prenatal Care

| APG | APG Description | APG Type | Weight |

|---|---|---|---|

| 393 | BLOOD AND TISSUE TYPING | Ancillary | 0.1548 |

| 394 | LEVEL I IMMUNOLOGY TESTS | Ancillary | 0.1688 |

| 396 | LEVEL I MICROBIOLOGY TESTS | Ancillary | 0.1687 |

| 397 | LEVEL II MICROBIOLOGY TESTS | Ancillary | 0.2270 |

| 401 | LEVEL II CHEMISTRY TESTS | Ancillary | 0.2411 |

| 402 | BASIC CHEMISTRY TESTS | Ancillary | 0.0838 |

| 410 | URINALYSIS | Ancillary | 0.1139 |

| 470 | OBSTETRICAL ULTRASOUND | Ancillary | 0.9504 |

| 764 | FALSE LABOR | Medical Visit | 1.8375 |

| 765 | OTHER ANTEPARTUM DIAGNOSES | Medical Visit | 1.0761 |

| 766 | ROUTINE PRENATAL CARE | Medical Visit | 0.7566 |

APG Payment Methodology

APG PAYMENT CALCULATION OVERVIEW

| APG Group Category | Weights | Packaging/Bundling or Discounting | Base Rate | Capital Add‐on Payment | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| CPT/HCPCS codes grouped according to procedure and/or diagnosis | → | Avg. cost for each APG visit/avg. cost for all APG visits | × | Weight multiplier applied to each APG | × | Established base rate by setting and peer group | + | Capital add–on for each patient visit | = | FINAL APG PAYMENT |

Weight Multiplier (Consolidating or Discounting Logic)

• 100% for primary (highest–weighted) APG procedure

• 100% unrelated ancillaries

• 150% for bilateral procedures

• 10%–50% for discounted lines (unrelated significant procedures performed in a single visit).

• 0% for bundled/consolidated lines (related ancillaries are included in the APG significant procedure payment)

Prenatal Care Payment Examples

PCAP Payment Example #1

| DTC Example 1: Initial Visit (low risk) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| HCPCS | HCPCS Description | APG | APG Description | Payment Element | Payment Action | Full APG Weight | Pct. Paid | Allowed APG Weight | Sample Base Rate | Paid Amount |

| Low Risk | ||||||||||

| 99205 | Office/outpatient visit, new | 766 | ROUTINE PRENATAL CARE | Medical Visit | Full Payment | 0.7566 | 100% | 0.7566 | $ 170 | $ 129 |

| 82947 | Assay, glucose, blood quant | 402 | BASIC CHEMISTRY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.0838 | 0% | 0.0000 | $ 170 | $ – |

| 86580 | TB intradermal test | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 170 | $ – |

| 86592 | Blood serology, qualitative | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 170 | $ – |

| 86762 | Rubella antibody | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 170 | $ – |

| 86850 | RBC antibody screen | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 170 | $ – |

| 87340 | Hepatitis b surface ag, eia | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 170 | $ – |

| 87081 | Culture screen only | 396 | LEVEL I MICROBIOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1687 | 0% | 0.0000 | $ 170 | $ – |

| 87088 | Urine bacteria culture | 396 | LEVEL I MICROBIOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1687 | 0% | 0.0000 | $ 170 | $ – |

| 87206 | Smear, fluorescent/acid stai | 396 | LEVEL I MICROBIOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1687 | 0% | 0.0000 | $ 170 | $ – |

| 86900 | Blood typing, ABO | 393 | BLOOD AND TISSUE TYPING | Ancillary | Full Payment | 0.1548 | 100% | 0.1548 | $ 170 | $ 26 |

| 86901 | Blood typing, Rh (D) | 393 | BLOOD AND TISSUE TYPING | Ancillary | Discounted | 0.1548 | 50% | 0.0774 | $ 170 | $ 13 |

| 88150 | Cytopath, c/v, manual | 392 | PAP SMEARS | Ancillary | Full Payment | 0.1464 | 100% | 0.1464 | $ 170 | $ 25 |

| 81015 | Microscopic exam of urine | 410 | URINALYSIS | Uniformly Pkgd Ancillary | Packaged | 0.1139 | 0% | 0.0000 | $ 170 | $ – |

| 85025 | Complete cbc w/auto diff wbc | 408 | LEVEL I HEMATOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.0857 | 0% | 0.0000 | $ 170 | $ – |

| Calculated APG Operating Payment | 2.8461 | 1.1352 | $ 193 | |||||||

| Existing Operating Payment | $ 248 | |||||||||

| Blended Operating Payment (25%/75%) | $ 234 | |||||||||

| Net Difference | ($ 14) | |||||||||

| Percent Difference | –6% | |||||||||

NOTE:

The original low risk PCAP payment example had a gene test, (Tay–sachs, S3847) procedure listed in the low risk initial visit. This test was removed from the example because it is only administered when patient history warrants.

Rate Code 3101 Initial Prenatal Care visit pays $321

PCAP Payment Example #2

| DTC Example 1: Initial Visit (high risk) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| HCPCS | HCPCS Description | APG | APG Description | Payment Element | Payment Action | Full APG Weight | Pct. Paid | Allowed APG Weight | Sample Base Rate | Paid Amount |

| Low Risk Total (displayed in previous slide) | $ 234 | |||||||||

| High Risk Visit (showing only procedures in addition to those of the low risk example) | ||||||||||

| 87535 | Hiv–1, dna, amp probe | 397 | LEVEL II MICROBIOLOGY TESTS | Ancillary | Full Payment | 0.2270 | 100% | 0.2270 | $ 170 | $ 39 |

| 87536 | Hiv–1, dna, quant | 397 | LEVEL II MICROBIOLOGY TESTS | Ancillary | Discounted | 0.2270 | 50% | 0.1135 | $ 170 | $ 19 |

| 83020 | Hemoglobin electrophoresis | 401 | LEVEL II CHEMISTRY TESTS | Ancillary | Full Payment | 0.2411 | 100% | 0.2411 | $ 170 | $ 41 |

| 76801 | Ob us < 14 wks, single fetus | 470 | OBSTETRICAL ULTRASOUND | Ancillary | Full Payment | 0.9504 | 100% | 0.9504 | $ 170 | $ 162 |

| High Risk Procedure Sub Total | $ 260 | |||||||||

| Calculated APG Operating Payment (including procedures from low risk visit) | 1.6456 | 1.5321 | $ 555 | |||||||

| Existing Operating Payment | $ 248 | |||||||||

| Blended Operating Payment (25%/75%) | $ 325 | |||||||||

| Net Difference | $ 77 | |||||||||

| Percent Difference | 31% | |||||||||

NOTE:

Rate Code 3101 Initial Prenatal Care visit pays $321

PCAP Payment Example #3

| HOPD Example 2: Initial Visit (low risk) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| HCPCS | HCPCS Description | APG | APG Description | Payment Element | Payment Action | Full APG Weight | Pct. Paid | Allowed APG Weight | Sample Base Rate | Paid Amount |

| Low Risk | ||||||||||

| 99205 | Office/outpatient visit, new | 766 | ROUTINE PRENATAL CARE | Medical Visit | Full Payment | 0.7566 | 100% | 0.7566 | $ 276 | $ 209 |

| 82947 | Assay, glucose, blood quant | 402 | BASIC CHEMISTRY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.0838 | 0% | 0.0000 | $ 276 | $ – |

| 86580 | TB intradermal test | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 276 | $ – |

| 86592 | Blood serology, qualitative | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 276 | $ – |

| 86762 | Rubella antibody | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 276 | $ – |

| 86850 | RBC antibody screen | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 276 | $ – |

| 87340 | Hepatitis b surface ag, eia | 394 | LEVEL I IMMUNOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1688 | 0% | 0.0000 | $ 276 | $ – |

| 87081 | Culture screen only | 396 | LEVEL I MICROBIOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1687 | 0% | 0.0000 | $ 276 | $ – |

| 87088 | Urine bacteria culture | 396 | LEVEL I MICROBIOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1687 | 0% | 0.0000 | $ 276 | $ – |

| 87206 | Smear, fluorescent/acid stai | 396 | LEVEL I MICROBIOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.1687 | 0% | 0.0000 | $ 276 | $ – |

| 86900 | Blood typing, ABO | 393 | BLOOD AND TISSUE TYPING | Ancillary | Full Payment | 0.1548 | 100% | 0.1548 | $ 276 | $ 43 |

| 86901 | Blood typing, Rh (D) | 393 | BLOOD AND TISSUE TYPING | Ancillary | Discounted | 0.1548 | 50% | 0.0774 | $ 276 | $ 21 |

| 88150 | Cytopath, c/v, manual | 392 | PAP SMEARS | Ancillary | Full Payment | 0.1464 | 100% | 0.1464 | $ 276 | $ 40 |

| 81015 | Microscopic exam of urine | 410 | URINALYSIS | Uniformly Pkgd Ancillary | Packaged | 0.1139 | 0% | 0.0000 | $ 276 | $ – |

| 85025 | Complete cbc w/auto diff wbc | 408 | LEVEL I HEMATOLOGY TESTS | Uniformly Pkgd Ancillary | Packaged | 0.0857 | 0% | 0.0000 | $ 276 | $ – |

| Calculated APG Operating Payment | 2.8461 | 1.1352 | $ 313 | |||||||

| Existing Operating Payment | $ 328 | |||||||||

| Blended Operating Payment (25%/75%) | $ 324 | |||||||||

| Net Difference | ($ 4) | |||||||||

| Percent Difference | –1% | |||||||||

NOTE:

The original low risk PCAP payment example had a gene test, (Tay–sachs, S3847) procedure listed in the low risk initial visit. This test was removed from the example because it is only administered when patient history warrants.

Rate Code 3101 Initial Prenatal Care visit pays $321

PCAP Payment Example #4

| HOPD Example 2:Initial Visit (high risk) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| HCPCS | HCPCS Description | APG | APG Description | Payment Element | Payment Action | Full APG Weight | Pct. Paid | Allowed APG Weight | Sample Base Rate | Paid Amount |

| Low Risk Total (displayed in previous slide) | $ 324 | |||||||||

| High Risk Visit (showing only procedures in addition to those of the low risk example) | ||||||||||

| 87535 | Hiv–1, dna, amp probe | 397 | LEVEL II MICROBIOLOGY TESTS | Ancillary | Full Payment | 0.2270 | 100% | 0.2270 | $ 276 | $ 63 |

| 87536 | Hiv–1, dna, quant | 397 | LEVEL II MICROBIOLOGY TESTS | Ancillary | Discounted | 0.2270 | 50% | 0.1135 | $ 276 | $ 31 |

| 83020 | Hemoglobin electrophoresis | 401 | LEVEL II CHEMISTRY TESTS | Ancillary | Full Payment | 0.2411 | 100% | 0.2411 | $ 276 | $ 67 |

| 76801 | Ob us < 14 wks, single fetus | 470 | OBSTETRICAL ULTRASOUND | Ancillary | Full Payment | 0.9504 | 100% | 0.9504 | $ 276 | $ 262 |

| High Risk Procedure Sub Total | $ 423 | |||||||||

| Calculated APG Operating Payment (including procedures from low risk visit) | 1.6456 | 1.5321 | $ 718 | |||||||

| Existing Operating Payment | $ 328 | |||||||||

| Blended Operating Payment (25%/75%) | $ 425 | |||||||||

| Net Difference | $ 97 | |||||||||

| Percent Difference | 30% | |||||||||

NOTE:

Rate Code 3101 Initial Prenatal Care visit pays $321

PCAP Payment Example #5

| Example 3: Follow Up Visit (low risk) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| HCPCS | HCPCS Description | APG | APG Description | Payment Element | Payment Action | Full APG Weight | % Paid | Allowed APG Weight | Sample Base Rate | Amount Paid |

| Low Risk | ||||||||||

| 99213 | Office/outpatient visit, est | 766 | ROUTINE PRENATAL CARE | Medical Visit | Full Payment | 0.7566 | 100% | 0.7566 | $276 | $176 |

| Calculated APG Operating Payment | 0.7566 | 0.7566 | $ 176 | |||||||

| Existing Operating Payment | $ 328 | |||||||||

| Blended Operating Payment (25%/75%) | $ 290 | |||||||||

| Net Difference | ($ 38) | |||||||||

| Percent Difference | –12% | |||||||||

NOTE:

The original low risk PCAP payment example had a gene test, (Tay–sachs, S3847) procedure listed in the low risk initial visit. This test was removed from the example because it is only administered when patient history warrants.

Rate Code 3102 Initial Prenatal Care visit pays $162.

PCAP Payment Example #6

| Example 3: Follow Up Visit (high risk) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| HCPCS | HCPCS Description | APG | APG Description | Payment Element | Payment Action | Full APG Weight | % Paid | Allowed APG Weight | Sample Base Rate | Amount Paid |

| High Risk | ||||||||||

| 57452 | Exam of cervix w/scope | 201 | COLPOSCOPY | Significant Procedure | Full Payment | 2.1330 | 100% | 2.1330 | $276 | $495 |

| 59025 | Fetal non–stress test | 191 | LEVEL I FETAL PROCEDURES | Unrelated Procedure | Discounted | 1.4708 | 50% | 0.7354 | $276 | $171 |

| 76801 | Ob us < 14 wks, single fetus | 470 | OBSTETRICAL ULTRASOUND | Ancillary | Full Payment | 0.9504 | 100% | 0.9504 | $276 | $221 |

| 82105 | Alpha–fetoprotein, serum | 401 | LEVEL II CHEMISTRY TESTS | Ancillary | Full Payment | 0.2411 | 100% | 0.2411 | $276 | $56 |

| 82677 | Assay of estriol | 399 | LEVEL II ENDOCRINOLOGY TESTS | Ancillary | Full Payment | 0.2470 | 100% | 0.2470 | $276 | $57 |

| 82731 | Assay of fetal fibronectin | 401 | LEVEL II CHEMISTRY TESTS | Ancillary | discounted | 0.2411 | 50% | 0.1206 | $276 | $28 |

| 90659 | Flu vaccine whole, im | 414 | LEVEL I IMMUNIZATION AND ALLERGY | Ancillary | Full Payment | 0.1155 | 100% | 0.1155 | $276 | $27 |

| 87653 | Strep b, dna, amp probe | 397 | LEVEL II MICROBIOLOGY TESTS | Ancillary | Full Payment | 0.2270 | 100% | 0.2270 | $276 | $53 |

| 90384 | Rh ig, full–dose, im | 415 | LEVEL II IMMUNIZATION | Ancillary | Full Payment | 0.2358 | 100% | 0.2358 | $276 | $55 |

| Calculated APG Operating Payment | 5.8618 | 5.0059 | $ 1,161 | |||||||

| Existing Operating Payment | $ 328 | |||||||||

| Blended Operating Payment (25%/75%) | $ 536 | |||||||||

| Net Difference | $ 208 | |||||||||

| Percent Difference | 64% | |||||||||

NOTE:

Rate Code 3102 Initial Prenatal Care visit pays $162.

High Risk visits may also include the following procedures: 97803, 82951, 83036, 84702, 85025, and 87880. (Packaged into the weight of the visit).

PCAP Payment Example #7

| HOPD Example 4: Initial Visit (low risk) Potential Add–ons | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| HCPCS | HCPCS Description | APG | APG Description | Payment Element | Payment Action | Full APG Weight | Pct. Paid | Allowed APG Weight | Sample Base Rate | Paid Amount |

| Low Risk | ||||||||||

| Primary Care Enhancement Add‐ons | ||||||||||

| 90806 | Clinical Social Worker Billing – Individual* | N/A | Billed via Rate Code | N/A | N/A | N/A | N/A | N/A | N/A | $ 62 |

| 99406 | Smoking Cessation – 3 to 10 minutes | 451 | SMOKING CESSATION | Ancillary | Full Payment | 0.1090 | 100% | 0.1090 | $ 276 | $ 30 |

| 99050 | After Hours Services | 448 | After Hours Services | Ancillary | Full Payment | 0.0356 | 100% | 0.0356 | $ 276 | $ 10 |

| Calculated Primary Care Enhancement Add–on | $ 102 | |||||||||

*This rate code can only be billed if the service is delivered by a LCSW or a LMSW.

APG Carve–Outs and Other Special Payment Rules

APG Carve–Outs

- Services currently carved out of the threshold visit rate will continue to be carved out and should be claimed using the ordered ambulatory services fee schedule – with a single exception –

- MRIs will no longer be carved–out of the threshold visit, but instead must be billed under APGs.

- For a complete list of all APG carve–outs, see provider manual and implementation materials on the DOH APG website.

Procedure Specific APG Carve–Outs

- Chemo drugs

- Specific designated therapeutic injections

- Botulinum Toxin A and B

- Neupogen, Neulasta

- Aranesp, Epogen, Procrit (for dialysis)

- Specific designated lab tests

- Lead screen

- HIV viral load testing

- HIV drug resistance tests

- Hep C virus, genotype tests

- Blood Factors for Hemophilia

Billing for Physician Administered Drugs in APGs

- For physician administered drugs that are carved out of APGs

- Bill ordered ambulatory

- For physician administered drugs included in APGs

- Class 1 Pharmacotherapy drugs are packaged

- costs are included in the weight of the primary APG (significant procedure or medical visit)

- Drugs in Pharmacotherapy Classes 2 through 5

- will receive a line item payment

- Class 1 Pharmacotherapy drugs are packaged

- Drugs that are not physician administered (e.g., oral contraceptives, Plan B) are not reimbursable under APGs (this is a pharmacy benefit).

Physician Billing Under APGs

- Payment for physician services provided in DTCs is included in the APG payment (with limited exceptions).

- Exceptions include:

- Abortion clinics

- Designated family planning clinics (NYC area) where physician was previously carved out of the clinic rate.

- Exceptions include:

- Payment for physician professional services in hospital OPDs will be similar to existing payment policy:

- If physician is salaried by facility, APG payment to OPD clinic is considered payment in full. Physician is prohibited from submitting a claim.

- If physician is not salaried by facility, and has been previously been billing Medicaid, the physician may submit claims for professional services based on the Medicaid fee schedule.

- 09/10 proposed budget includes funds for a full carve–out of OPD physician services.

Lab and Radiology Billing Under APGs

- Lab and radiology services are included in the APG payment to clinic provider (excluding the aforementioned exceptions)

- Clinic is responsible for payment for ordered lab and radiology services to provider of those services.

- Therefore, other providers actually performing the lab/radiology service may not bill Medicaid.

"Never Pay" APGs

- "Never Pay" APGs are those services that are not covered by NY Medicaid and are therefore not reimbursed under APGs.

- Examples include:

- Respiratory Therapy

- Cardiac Rehabilitation

- Nutrition Counseling

- Artificial Fertilization

- Biofeedback

- For a complete list of "Never Pay" APGs, see the provider manual and implementation materials on the DOH APG website.

"If Stand Alone, Do Not Pay" APGs

- "If Stand Alone, Do Not Pay" APGs are lab tests, radiology, immunizations, and other ancillary procedures performed as follow–up to an initial clinic visit.

- Separate APG payments are not available for follow–up ancillaries.

- Costs are incorporated into the APG payment to the clinic for the initial patient encounter.

- Providers should still claim for these procedures in order to maximize the available data that can be used for future APG reweighting and rebasing.

- For complete list of "Stand Alone, Do Not Pay" APGs, see the provider manual and other materials on the DOH APG website.

Rate Codes Carved Out of APGs

FQHC Rate Code Carve–Outs

- The following rate codes that are currently used to bill Medicaid for FQHC services will be carved out of APGs. They will continue to be billable under the existing rate codes and may occur on the same date of service (but not the same claim) as an APG visit.

- 4011 – FQHC Group Therapy

- 4012 – FQHC Offsite Services (Individual)

Other Rate Code Carve–Outs

- The following rate codes that are currently used to bill Medicaid will be carved out of APGs. They will continue to be billable under the existing rate codes and may occur on the same date of service (but not the same claim) as an APG visit.

- 3107 – Monthly Dialysis Service (Medicare Crossover)

- 1604 – MOMS Health Supportive Services

- 5301 – Medical Evaluation (SSHP)

- 5388 – Pre–school Supportive Health Program (IEP)

- 5389 – School–age Supportive Health Program (IEP)

School Based Health Center Carve–Out for MMC Enrollees

- Rate codes currently used for billing FFS Medicaid for MMC enrollees will remain active following the implementation of APG reimbursement.

- When SBHC services are provided to an MMC enrollee, existing SBHC rate codes must be used.

- SBHC carved–out rate codes include 1627,1628, 2888, 2889.

- When SBHC services are provided to a FFS recipient, APG rate codes must be used.

- Plan to implement new APG grouper access rate codes March 1, 2009 enabling uniform SBHC billing for both FFS and MMC enrollees.

Other APG Implementation Issues

PACS

- Products of Ambulatory Care (PACS)

- PACs will be replaced by APGs (except for PAC FQHCs not converting to APGs).

- When ancillaries (i.e. lab, radiology) are provided subsequent to the initial visit, providers should bill all ancillaries using the date of the initial visit.

FQHCs

- FQHCs may choose to be paid under the APG methodology, or under their existing payment methodology

- FQHCs that opt for APG reimbursement must sign a written agreement provided by DOH

- FQHCs that opt for APGs:

- will receive a supplemental payment for any shortfalls in APG payment relative to what they would have received under the PPS methodology.

- will continue to receive MMC wraparound (shortfall) payments –which will be paid using the existing FQHC shortfall rate codes.

Ambulatory Surgery

- The PAS grouper will be replaced by the APG grouper.

- For facilities with both clinic /OPD and ambulatory surgery rate codes:

- Visits which include a procedure on the DOH ambulatory surgery procedure list must be billed under the ambulatory surgery APG rate code.

- Ambulatory surgery claims may contain non–ambulatory surgery procedures, but if even one DOH–designated ambulatory surgery procedure is coded on a claim, the ambulatory surgery base rate must be used.

- The DOH ambulatory surgery procedure list is available on the DOH APG website.

- When performed in the ED, procedures on the amb surg procedures list must be billed using the ED APG grouper access rate code.

Medicare / Medicaid Dual Eligibles

- Medicaid will continue to pay the full annual deductible as well as the full 20% Medicare Part B coinsurance amount for all APG Medicare / Medicaid "crossover" claims.

- For FQHCs and Peer Group 41 clinics, Medicaid will continue to pay the higher of:

- the full Medicare Part B coinsurance amount,

or - the difference between the Medicare paid amount and the calculated APG payment.

- the full Medicare Part B coinsurance amount,

Issues of Interest to Prenatal Care Providers

HPV and Hep–B Vaccines

- Under Age 19

- Immunization is available through the Vaccines for Children Program.

- Clinics should bill for administration fee only as a ordered ambulatory service.

- J code with –SL modifier

- Medicaid payment –$17.85 (administrative cost)

- Age 19 and over

- HPV and Hep B vaccine map to APG 416

- Initial visit will pay (E&M APG plus J–code)

- Subsequent visits for vaccine administration – not presently reimbursed under APGs since APG 416 is a "stand alone, do not pay".

- HPV and Hep B vaccine map to APG 416

Ultrasound

- Ultrasound is an "if stand alone, do not pay" procedure

- Ultrasound services, when billed in conjunction with a significant procedure or medical visit, are included in the APG payment to clinic provider as a non–packaged ancillary.

- Clinic is responsible for all costs associated with the ordered ultrasound services.

- Other providers actually performing the ultrasound service may not bill Medicaid.

Genetic Testing

- Genetic testing services, when billed in conjunction with a significant procedure or medical visit, are included in the APG payment to the clinic provider.

- Clinic is responsible for all costs associated with the genetic testing services.

- Other providers actually performing the genetic testing service may not bill Medicaid.

Lead Testing

- Lead screen testing is currently carved out of the threshold visit rate and will continue to be paid using the ordered ambulatory services fee schedule.

Clinic Payment for HIV Services

- The following rate codes that are currently used to bill Medicaid for HIV services will be carved out of APGs. They will continue to be billable under the existing rate codes and may occur on the same date of service (but not on the same claim) as an APG visit.

- 1695 – DTC HIV Counseling and Testing Visit

- 1802 – DTC Post–Test HIV Counseling Visit (Positive Result)

- 1850 – DTC Day Health Care Service (HIV)

- 2961– OPD AIDS Clinic, therapeutic visit

- 2983– OPD HIV Counseling and Testing Visit

- 3111– OPD Post Test HIV Counseling Visit–positive result

- 3109 – DTC and OPD HIV Counseling (No Testing)

- For all other HIV and HIV–related services that are not included in the list of carved out HIV rate codes (previous slide) –

- These services are included in APGs

- Clinics should bill the APG grouper access rate codes, 1400 (OPD) or 1407 (D&TC), and the appropriate CPT codes

APG Payment for Multiple Clinic Visits on the Same Date of Service

- If a patient is seen in multiple clinics operated by different providers on the same date of service, each provider may submit an APG claim.

- e.g., a patient goes to a D&TC for a prenatal care visit and also visits a dental clinic operated by a different provider – both APG claims will be paid.

- Services provided by the same clinic provider on the same date of service

- One APG claim should be submitted listing all procedures provided the patient.

Presumptive Eligibility/Application Assistance, Interpreter Services, Care Coordination and Psycho–Social Screening

- These services previously have been provided by PCAP providers within the construct of the all–inclusive clinic rate and should continue to be provided.

- These services were not separately reimbursable as a threshold clinic visit.

- These services are not considered medical services and are not separately reimbursed under APGs.

- Since APGs will be increasing the overall Medicaid payment that providers receive, a facility´s ability to provide these services may be enhanced.

PCAP Rate Codes to be End Dated

- Providers who currently bill the PCAP clinic rate codes will need to use new APG grouper access rate codes.

- Rate codes 3101, 3102, and 3103 will be end dated and replaced with APG grouper access rate code 1400 (hospital based OPD) or 1407 (DTC).

- Payment will be based on the APG reimbursement methodology, and all procedures performed during the patient encounter must be reported on a claim.

- The standards of care applicable to prenatal care providers will remain in effect.

What Does This Mean for PCAP Providers?

- Under APGs, PCAPs will bill Medicaid as any other clinic provider of prenatal care services using APG grouper access rate codes.

- NY Medicaid is committed to the provision of comprehensive prenatal care to pregnant women in accordance with current standards of care.

- Providers need to code all procedures that are performed during a visit.

Prenatal Care APGs

- APG assignment will be determined by the primary diagnosis code and procedure codes claimed.

- Most prenatal medical visits will map to the following two APGs:

- 765 (Other Ante Partum Diagnoses)

- 766 (Routine Prenatal Care)

Prenatal Care APG Transition and Blend

- Current statute requires that:

- Year 1– 25% of the provider payment will be based on APG´s and 75% will be based on the provider´s current average operating payment amount.

- Year 2– the APG percentage will be 50%

- Year 3– the APG percentage will be 75%

- Year 4–the APG percentage will be 100%

- Article VII budget bill for 2009/2010 proposes an acceleration of this schedule.

Payment for Non–stress Tests and Fetal Biophysical Profiles

- These tests are considered to be significant procedures and will map to an APG for payment.

- Procedure codes for these services should be reported on the claim.

Prenatal Clinic Referral to a Specialist for Consult

- Prenatal clinics can refer a woman to a specialist and continue to keep that woman as a clinic patient for routine prenatal care.

- There is no limit on the number of specialist referrals that are medically necessary.

Primary Care Enhancements

Primary Care Enhancements

Effective dates: 1/1/09 for Hospitals and 3/1/09 for DTCs, Social Worker Counseling effective for Hospitals and DTCs on 3/1/09

| Initiative | Description |

|---|---|

| Diabetes/Asthma Education Art. VII Section 18 (f) (ii) (A) | Establish coverage for diabetes and asthma education by certified educators in clinic and office–based settings. |

| Expanded 'After Hours' Access Art. VII Section 18 (f) (ii) (B) | Provide enhanced payment for expanded 'after hours' access in both clinic and office– based settings. |

| Social Worker Counseling Art. VII Section 18 (f) (ii) C | Reimburse for individual psychotherapy services provided by a social worker for children, adolescents, and pregnancy related counseling. |

| Smoking Cessation | Reimburse for pregnant women in the clinic or the office. Must be provided with a medical visit. |

Mental Health Counseling

- Eligible enrollees

- Children and adolescents under 19 years of age

- Pregnant women up to 60 days post–partum

- Billing Requirements:

- Clinic must have the appropriate specialty on their operating certificate

- Psychology

- Psychiatry

- 073 Licensed Clinical Social Worker

- 072 Licensed Master Social Worker

- 4257 Individual Brief Counseling (approx.20–30 min. face–to–face)

- 4258 Individual Comprehensive Counseling (approx. 45–50 min. face–to–face)

- 4259 Family Counseling (counseling with or without patient)

Diabetes and Asthma Self– Management Training

- Eligible enrollees:

- Must have diabetes diagnosis for diabetes education

- Must have asthma diagnosis for asthma education

- Billing Requirements:

- Ordered by physician, physician assistant, nurse practitioner, licensed midwife

- Must be provided by NYS licensed, registered or certified health care professional

- Certified as an educator by CDE or CAE

- Employed or contract with a billing Medicaid provider

Billing Requirements for Diabetes and Asthma Self– Management Education

- HCPCS Codes for Diabetes:

- G0108 – Diabetes outpatient self–management training services, individual, per 30–min.

- G0109 – Diabetes outpatient self–management training services, group (2–8), per 30–min.

- HCPCS Codes for Asthma:

- 98960 – Individual education for 30 min

- 98961 – Group education, for a 30 min. session, 2–4 patients

- 98962 – Group education, for a 30 min. session, 5–8 patients

Smoking Cessation Counseling for Pregnant Women

- Eligible Enrollees:

- Females with a diagnosis of pregnancy

- Billing requirements:

- SCC services are to be provided face–to–face by a physician, registered physician assistant, registered nurse practitioner, or licensed midwife during a medical visit (no group sessions).

- Coverage includes up to six counseling sessions within any 12–continuous month period.

- CPT procedure codes:

- 99406 – Smoking Cessation Counseling 3 to 10 minutes

- 99407 – Smoking Cessation Counseling greater than 10 minutes

Enhanced Payment for "After Hours" Access

- Supplemental payment for ambulatory care scheduled to occur on evenings (after 6pm), week–ends (Saturday or Sunday), and holidays (designated national holiday)

- Reimbursement for physician office visits and clinic visits

- Billing requirements:

- Use CPT–4 code 99050 and 99051

Billing Instructions and System Issues

Provider Billing Changes

- New Rate Codes Effective 12/1/08 Dates of Service

- New APG Grouper Access Rate Codes:

- Hospital Based Outpatient Rate Code 1400

- Hospital Based Ambulatory Surgery Rate Code 1401

- New APG Grouper Access Rate Codes:

- New Rate Codes Effective 1/1/09 Dates of Service

- New APG Grouper Access Rate Code:

- Hospital Emergency Room Rate Code 1402

- New APG Grouper Access Rate Code:

- New Rate Codes Effective 3/1/09 Dates of Service

- New APG Grouper Access Rate Codes:

- DTC General Clinic Rate Code 1407

- DTC Dental Rate Code is 1428

- DTC Renal Rate Code is 1438

- DTC MR/DD/TBI Clinic is 1435 & Dental is 1432

- Free–Standing Ambulatory Surgery Rate Code 1408

- New APG Grouper Access Rate Codes:

- Most current Rate Codes will become obsolete as of APG effective date

- For billing or adjusting dates prior to APG effective dates use old rate code.

- Essentially, the minimum change required to bill and get paid under APGs is to code one of the new APG rate codes rather than one of the existing rate codes.

- Code and Bill to Medical Record Documentation

- Complete and accurate reporting

- Procedure and diagnosis code(s)

- All services within the same DOS and rate code (based on service category – General Clinic, Free–standing Ambulatory Surgery) must be billed together on a single claim.

- If two claims are submitted, with the same rate code for the same DOS, only the first claim submitted will pay. The second will be denied.

- Ambulatory Surgery

- Rate codes 3089 and 1804(primary procedure) and 3090 and 1805(additional procedure) become obsolete as of 12/1/08 DOS for Hospital Based and 3/1/09 DOS for DTC and are replaced by new APG rate codes 1401 (Hospital Based) and 1408 (DTC)

- Since only a single amb surg rate code will exist under APGs, claims can no longer be split (If procedures are not combined, second APG amb surg claim will "duplicate" and deny)

- Rate codes 3089 and 1804(primary procedure) and 3090 and 1805(additional procedure) become obsolete as of 12/1/08 DOS for Hospital Based and 3/1/09 DOS for DTC and are replaced by new APG rate codes 1401 (Hospital Based) and 1408 (DTC)

- Managed Care Client Carve–outs

- When services performed for managed care patient, use old/current rate codes

- APG Rate Code will deny for Prepaid Cap Recipient Service Covered By Plan (Edit 1172)

Editing Changes

- MMIS Edit 2001

- Prior payer paid amounts Claim Header and Line Payments must balance

- HIPAA 835/277 Mapping

- Adjustment Reason Code 125: Payment adjusted due to a submission/billing error(s)

- Remit Remark Code N4: Missing/incomplete/invalid prior insurance carrier EOB

- Status Code 400: Claim is out of balance

- MMIS Edit 1136

- Rate Code invalid for clinic (Do not submit add–on rate codes)

- HIPAA 835/277 Mapping

- Adjustment Reason Code 16: Claim/Service lacks information which is needed for adjudication

- Remit Remark Code M49: Missing/incomplete/invalid value code(s) or amount(s)

- Status Code: 463: NUBC value code(s) and/or amount(s)

- MMIS Edit 2081

- All APG claim lines paid zero

- Ungroupable lines

- Paid zero lines

- HIPAA 835/277 Mapping

- Adjustment Reason Code 125: Payment adjusted due to a submission/billing error(s)

- Remit Remark Code N19: Procedure incidental to primary procedure

- Status Category Code: F1: Finalized/Payment. The claim line has been paid

- Claim Status Code: 65: Claim Line Has Been Paid

Processing Changes

- "Family Planning Benefit Program ONLY" Client Claims

- Procedures not included in FP covered list will not group to an APG nor have a price applied

- (Submit all procedures & non–FP procedures ignored)

- FP List – See Medicaid Update February 2008

- Allocating Medicare/Other Insurance

- Deductible, coinsurance, copays

- If only reported at header of claim

- Amounts from header allocated to lines

- Sum of APG payments for all lines

- Individual line payments divided by Sum of all line payments = line percentage

- Header Amounts allocated to each line by percentage

- Bundling Other Insurance Information for zero paid lines

- Reported payments, deductible, coinsurance and/or copays

- Amounts moved to line with highest adjusted weight for zero paid line

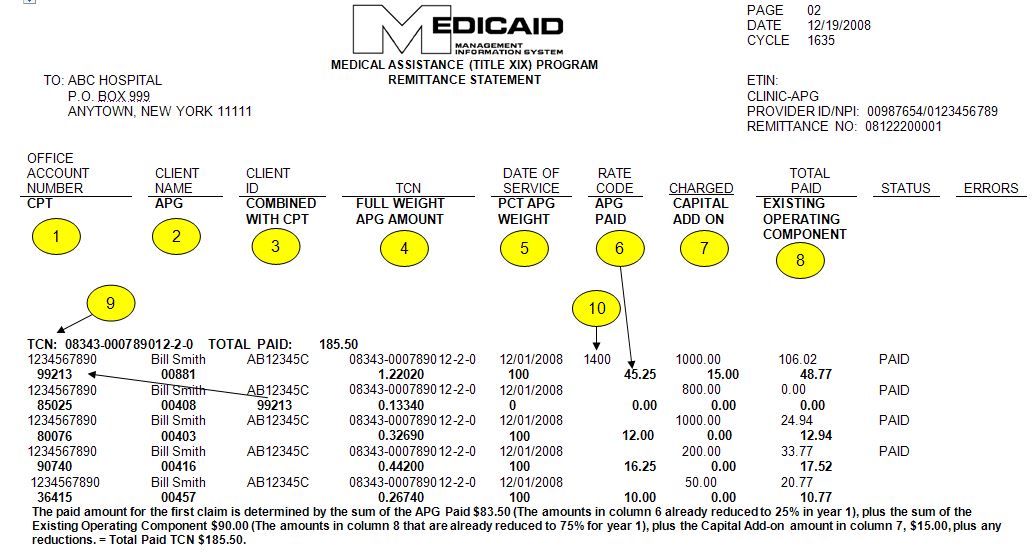

Remittance Changes

- 835 Supplemental files will contain line level detail

- Line Level processing of APG claims

- Line level COB

- Line level detail included in remittances

- 835 Changes

- Line level detail

- New data elements

- Bundling

- New 835 Remittance Data

- All new data mapped to Loop 2110

- APG Code – REF02 Qualifier 1S

- APG Full Weight – QTY02 Qualifier ZK

- APG Allowed Percentage – QTY02 Qualifier ZL

- APG Paid Amount – AMT02 Qualifier ZK

- Existing Operating Amount – AMT02 Qualifier ZK

- Combined With CPT – SVC06–2 Qualifier HC

- Line Number – REF02 Qualifier Q6

- CPT – SVC01–3 Qualifier HC

- Capital Add–on amount – CAS CO94

- Total payment for claim – CLP04

- All new data mapped to Loop 2110

- Paper remittance example handout

- Total paid TCN above line payments

- New data elements indented for easier reading

- "Combined With CPT" links packaged CPT to significant procedure

- NPI included

- Locater Code removed

NEW APG DATA ELEMENTS:

- CPT: Reported procedure code

- APG: APG code assigned by grouper

- Combined With CPT: Pointer to other significant procedure that caused the packaging and therefore zero payment on this line

- Full Weight APG Amount: Assigned grouper weight

- PCT APG Weight: Related to grouper assigned Payment Action Code. This is additional weight factor applied to Full Weight

- APG Paid: APG Paid Amount for outpatient is the amount after the 25%, 50% or 75% is applied over each of the first three years.

- Capital Add–an: Amount added to Claim Payment (Hne 1).

- Existing Operating Component: Amount added to outpatient payments after the 75%, 50%, 25% is applied over each of the first 3 years and disbursed over paid lines.

- Figure above EOC –Total line payment – includes reductions for Medicaid co–payments, reported or prorated/bundled other insurance payments and prorated spend downs, if any. Total line payments will equal Total TCN paid amount.

- Total Paid TCN: Total Claim Payment

- Rate Code: Will appear only on line 1 of claim

Electronic Testing

- Test System was deployed 2nd week of September 2008

- Available 24X7

- Test Environment will support the following transactions:

- 270/271 Eligibility

- 276/277 Claim Status

- 278 PA & Service Authorizations

- 835 Remittance Advice

- 837 Claims (Inst, Prof, Dental)

- Test Submissions

- Providers can submit up to 50 claims per test file (50 CLM Segments)

- Up to 2 test files per day

- Test files submitted and retrieved through providers´ production communication method

- Test indicator on incoming file "T" ISA15

- Test Remit Delivery

- Test Remit delivered in providers´ production method (eXchange, iFTP, Paper or FTP)

- Deliver providers´ production remit type (paper/835 + Supplemental)

- Weekly Test cycle close Fridays 2 PM

- Remits delivered weekly for sum of all test claims submitted for that week by following Monday

- Test indicator "T" ISA15

- 835 Supplemental remit file name "TEST"

- Paper remits "TEST" has watermark on each page

- No History editing

- No capability to do adjustments

- No Edits that pend a claim

- No Edits for PA and Service Auths.

Handouts & Contact Information

Supporting Materials

- The following is available on the DOH website

- Provider Manual and Implementation Schedule

- APG Documentation

- APG Types, APG Categories, APG Consolidation Logic

- Payment Examples

- Uniformly Packaged APGs

- Inpatient–Only Procedure List

- Never Pay and If Stand Alone Do Not Pay Lists

- Carve–Outs List

- List of Rate Codes Subsumed in APGs

- Paper Remittance Sample

- Frequently Asked Questions

- Ambulatory Surgery Procedure List

- Hospital Base Rates, Capital Add-Ons, Operating Payment for Blend

Contact Information

- Grouper / Pricer Software Support

- 3M Health Information Systems

- Grouper / Pricer Issues 1–800–367–2447

- Product Support 1–800–435–7776

- http://www.3mhis.com

- 3M Health Information Systems

- Billing Questions

- Computer Sciences Corporation

- eMedNY Call Center: 1–800–343–9000

- Send questions to: eMedNYProviderRelations@csc.com

- Computer Sciences Corporation

- Policy and Rate Issues

- New York State Department of Health

Office of Health Insurance Programs

Div. of Financial Planning and Policy 518–473–2160- Send questions to: apg@health.ny.gov

- New York State Department of Health

Access to EAPG Definitions Manual

- The EAPG Definitions Manual is available at no cost from the 3M Definitions Manual Website.

- Click on New York Customers Only portal (highlighted in red)

- Download, complete, and sign the one–page Order Form–– and send back to 3M

- You will receive access instructions in 2–3 working days and be able to download the Definitions Manual

- Definitions Manual will be kept current with each update to the EAPG software

- The Manual will be available at no cost thru 3/31/09