Additional High Performance Program (AHPP)

Frequently Asked Questions

- FAQs is also available in Portable Document Format (PDF)

As of 4/12/2017

I. Additional High Performance Program (AHPP) Frequently Asked Questions

| Item # | Category | Question | Response | Date Added/ Modified |

|---|---|---|---|---|

| 1 | Contracting | Can AHPP be added as an amendment to an EP contract or will a new contract be required? | If an MCO is partnered with the same PPS for both the EP and AHPP, the MCO and PPS may determine whether they want to amend their existing EP contract or develop a separate contract for AHPP. There are differences between the two programs which may make separate contracts favorable. Additionally, PPS may or may not be partnered with the same MCOs as EP depending on rate room. |

9/20/16 |

| 2 | Contracting | When are AHPP contracts expected to be in place? | AHPP contracts are expected to be in place by December 31, 2016. AHPP funds cannot be made to PPS until contracts are in place and the IA has notified MCO/PPS partners of AHPP performance | 9/20/16 |

| 3 | Contracting | What is the reason for contracting with MCOs? It is unclear how the inclusion of MCOs will affect the ultimate PPS payout. | Similar to other Supplemental Programs, AHPP is administered by MCOs. The MCOs will also be the parties responsible for flowing $50M/year, so contracts are expected for there to be consensus and accountability between partners in the program. MCOs will not be able to flow funds to the PPS without a contract in place. | 9/20/16 |

| 4 | Contracting | What happens if a PPS cannot contract with an MCO? | DOH hopes that the partnerships will work out any questions or issues amongst themselves. However, parties should notify DOH immediately if they cannot find a solution. | 9/20/16 |

| 5 | Contracting | What kind of contract is required for fund distribution? Who has the most recent version of the contract template? | The contract for Additional High Performance Program is similar to the contract for Equity Programs (EP) that includes items such as parameters of the contracts and deliverables. To obtain the contract template or for questions on the contract, please reach out to DOH or the Associations [Greater New York Health Association (GNYHA) or the Healthcare Association of New York State (HANYS)]. | 3/15/17 |

| 6 | Funds Flow | If a PPS achieves less than 50% of the AHPP measures, is the PPS eligible for a portion of the award? | AHPP award eligibility is based on meeting a 50% threshold. PPS will need to meet performance for at least half of the PPS eligible AHPP measures in a year. PPS will not receive partial awards for achieving less than 50% of the AHPP measures. | 9/20/16 |

| 7 | Funds Flow | Are AHPP Year 1 payments made based on MY1? | Yes. AHPP Year 1 payments will be based on MY1 performance. Additionally, in AHPP Year 1, all measures are P4R. In later AHPP years, payments will continue to be based on the performance from the appropriate Measurement Year. This means that AHPP Year 2 payments will be made based on the results of MY2, AHPP Year 3 payments will be made based on the results of MY3, and so on. See the AHPP timelines below. | 9/20/16 |

| 8 | Funds Flow | How often will PPS receive payments? | If AHPP awards are earned for the year, DOH will include an AHPP add–on into the PMPM rates to participating MCOs. – AHPP Year 1: Funds added in the April 2016 rates. (12 Payments) – AHPP years 2–5: Funds added in July rates (9 payments) MCOs should distribute earned funds to PPS immediately after receipt of annual AHPP performance reports from IA and receipt of funds from DOH. DOH guidance states that AHPP payments be made on a monthly basis once AHPP awards are earned and rates are approved. However, the PPS and MCO may agree to a quarterly payment arrangement if they desire to do so. This must be stated in the contract. Note: Due to delays in the rate approval process, the funds flow process at the beginning of each year may be delayed. Once approved, payments will be retroactive to AHPP Year start date. | 3/15/17 |

| 9 | Funds Flow | The Department of Health (DOH) contract template requires Managed Care Organizations (MCOs) to make monthly payments which can be burdensome. Can payments be made quarterly instead? | DOH guidance is monthly payments. However, PPS and MCOs may agree to a quarterly payment. This should be documented in their contract. | 3/15/17 |

| 10 | Funds Flow | How will AHPP award weightings be determined for AHPP participants? For EP participants? | Initial AHPP awards are pre–determined for participants based on the DSRIP Attribution for Performance figures. Unearned AHPP awards are then redistributed to those participants who have met the program requirements in the given year based on their relative award weightings within AHPP. The additional money rolled over from EP will be distributed to all AHPP participants also participating in EP who have met the AHPP program requirements within the given year, based on their relative award weighting within EP. | 9/26/16 |

| 11 | Funds Flow | Are there guaranteed minimum payments for PPS that meet their measures? | Yes. In Demonstration Year 1 (DY1), all PPS met their performance. This is the lowest payment in DY1 any PPS should expect to get. There is potential in future years for unearned AHPP amounts for PPS who do not meet performance thresholds to be distributed to PPS that met their performance thresholds. | 3/15/17 |

| 12 | Funds Flow | Are AHPP funds considered Medicaid funds? Is the Safety Net 95/5 rule applicable to AHPP funds? | AHPP funds are state–funded performance– based payments being administered through the MCOs. These funds include state funds with a federal match. AHPP funds fall under the same 95/5 Safety Net/ Non–Safety Net rule as regular DSRIP payments. The 95/5 Safety Net Rule is applied twice to each PPS (once for DSRIP, once for the aggregate supplemental programs). | 3/15/17 |

| 13 | Program Measurement | Does AHPP allow PPS to choose the measures they are evaluated on? | No. Unlike EP, PPS are not allowed to choose measures for evaluation in AHPP. PPS will be measured against all qualifying AHPP measures within the annual time period (9 measures at most) and are required to achieve performance on at least 50% of those measures. | 9/20/16 |

| 14 | Program Measurement | Does the denominator for each AHPP measure have to be a minimum value? What is meant by a ´qualifying´ AHPP measure? | If a denominator for an AHPP measure falls below 30 in a given year, that measure will not qualify as an AHPP measure and will be removed from the AHPP denominator calculation. The PPS is required to achieve performance for at least 50% of the remaining AHPP measures. For example, if the denominator of one measure falls below 30 in a given year, the PPS must achieve performance for four out of eight of the remaining qualifying AHPP measures. If the denominators of two measures fall below 30 in a given year, the PPS must achieve performance for four out of seven of the remaining qualifying AHPP measures. Once a measure is removed from the AHPP performance threshold calculation due to a low denominator, two years of denominators over 30 are required for it to be included once more. This is due to the fact that the first year with a sufficient denominator will serve as a baseline to measure future year improvement, while only the second year will provide sufficient information for the PPS to be evaluated on the measure. This means that if a PPS is disqualified from a measure in AHPP Year 1, its denominator must rise above 30 in both AHPP Years 2 and 3 for it to be included in AHPP Year 3. | 9/20/16 |

| 15 | Program Measurement | Are the measures based on DSRIP MYs or DSRIP program years? | The measures will be evaluated based on DSRIP MYs. For example, AHPP Year 1 awards (April 2016–March 2017) are based upon DSRIP MY1 (July 2014–June 2015) performance. See the AHPP timelines below. | 9/20/16 |

| 16 | Program Measurement | Since MY1 performance is already known, can PPS determine if they will receive their AHPP Year 1 awards? | Yes. MY1 results are based on P4R and therefore may be calculated by PPS. See the AHPP timelines below. | 9/20/16 |

| 17 | Program Measurement | As DY1 was pay–for– reporting, were AHPP DY1 payments based on claims data? | Yes, claims data was used for AHPP DY1 payments. | 3/15/17 |

| 18 | Reporting | Will there be quarterly reports required for AHPP similar to those used in EP? | No. Measures are reported on similar to Delivery System Reform Incentive Payment Program (DSRIP). In the fourth quarter, the Independent Assessor (IA) will review the overall performance of the nine (9) AHPP measures. | 3/15/17 |

| 19 | Reporting | Once funds are distributed, are Performing Provider Systems (PPS) required to report AHPP dollars in Medicaid Analytics Performance Portal (MAPP)? | Yes. DOH needs to track funds through MAPP to make sure the 95/5 split occurs. AHPP funds fall under the same 95/5 Safety Net/ Non–Safety Net rule as regular DSRIP payments. The 95/5 Safety Net Rule is applied twice to each PPS (once for DSRIP, once for the aggregate supplemental programs). | 3/15/17 |

| 20 | Reporting | Since AHPP funding goes through March 31, 2021, will PPS be required to report measurement post DSRIP? Many PPS do not have full access to these metrics. | Two (2) supplemental programs (Equity Performance Program (EPP) and AHPP) lag one year behind DSRIP. There is no current requirement to sustain the PPS post DSRIP. If the PPS does not plan to work together post DSRIP, please notify DOH so they can work with the Associations (GNYHA and HANYS) and paired MCOs to get your party´s AHPP Year 5 funds. | 3/15/17 |

| 21 | Timeline | Are the AHPP results based on the July 1st to June 30th MY? For example, is the July 2017 AHPP award determination based on MY 2 (July 1, 2015–June 30, 2016)? | Yes. The annual AHPP results are based on the corresponding MY. See the AHPP timelines below. | 9/20/16 |

II. Additional High Performance Timelines

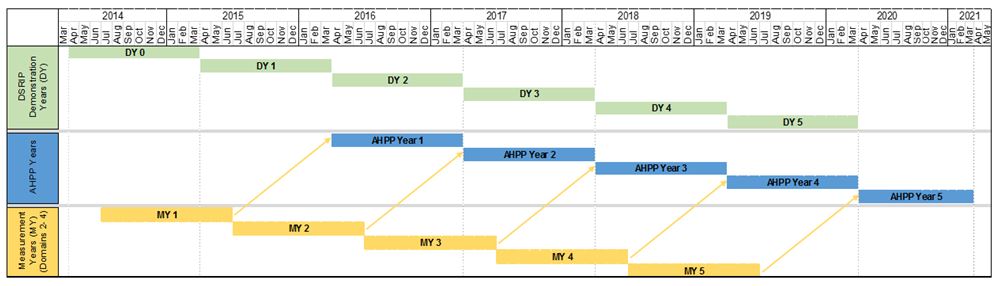

AHPP is a five–year program, starting on April 1, 2016 and ending on March 31, 2021. AHPP awards are determined based on the achievement of specific DSRIP measures (that have been chosen for the AHPP) in the prior year. Hence, AHPP Year 1 payments (April 2016–March 2017) are based upon DSRIP Demonstration Year (DY) 1 (April 2015–March 2016) performance during Measurement Year (MY) 1 (July 2014–June 2015). In other words, AHPP lags the DSRIP program by one year.

The relationship between DSRIP DYs, AHPP Program Years, and DSRIP MYs is illustrated below:

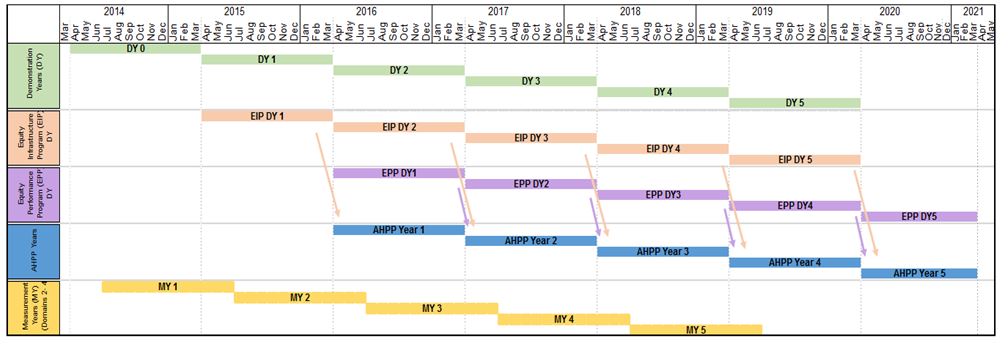

The timing of funds flow of unearned EIP and EPP funds into AHPP is illustrated below. Note that unearned EPP DY5 funds do not flow to AHPP.

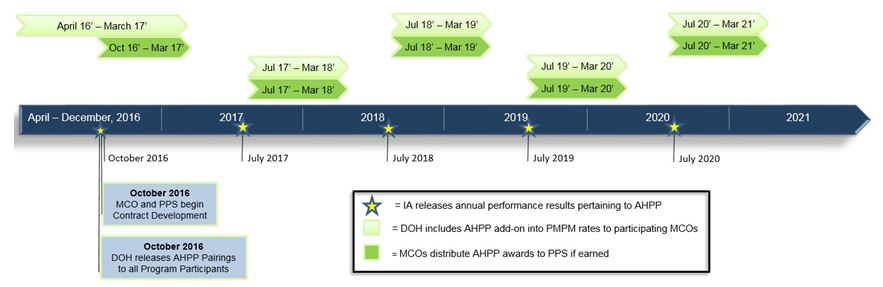

The AHPP timeline with milestones and due dates is detailed below.

| Milestone | Due Date |

|---|---|

| DOH releases AHPP Pairings to program participants | October 2016 |

| Paired Managed Care Organizations (MCOs) and PPS develop AHPP contracts | October 2016 – December 31, 2016 |

| Independent Assessor (IA) releases annual performance results pertaining to AHPP | AY 1 results released: October 2016 AY 2 results released: July 2017 AY 3 results released: July 2018 AY 4 results released: July 2019 AY 5 results released: July 2020 |

DOH includes AHPP add–on into per member per month (PMPM) rates to participating MCOs:

Due to CMS delays in rate approval process, funds flow process at the beginning of each year may be delayed. Once approved, payments will be retroactive to AHPP Year start date.Full award amounts will be paid out over 12 months in AHPP Year 1 and over 9 months in AHPP Years 2–5 |

DY1 payments time period: April 2016 – March 2017 (12 months) DY2 payments time period: July 2017 – March 2018 (9 months) DY3 payments time period: July 2018 – March 2019 (9months) DY4 payments time period: July 2019 – March 2020 (9 months) DY5 payments time period: July 2020 – March 2021 (9 months) |

III. Additional High Performance Program Pairings

| AHPP Annual Award | |||||

|---|---|---|---|---|---|

| Performing Provider System | NYS Catholic Health Plan Inc. | Healthfirst PHSP Inc. | United Healthcare of NY Inc. | Amerigroup New York LLC | |

| Adirondack Health Institute | $ 767,436 | $ – | $ – | $ – | $ 767,436 |

| Advocate Community Providers | $ – | $ 6,103,489 | $ – | $ – | $ 6,103,489 |

| Albany Medical Center Hospital | $ 661,373 | $ – | $ – | $ – | $ 661,373 |

| Alliance for Better Health Care (Ellis) | $ 1,168,653 | $ – | $ – | $ – | $ 1,168,653 |

| Bronx–Lebanon Hospital Center | $ – | $ 1,346,085 | $ – | $ – | $ 1,346,085 |

| Central New York Care Collaborative | $ 1,767,346 | $ – | $ – | $ – | $ 1,767,346 |

| Finger Lakes PPS | $ 2,801,440 | $ – | $ – | $ – | $ 2,801,440 |

| Lutheran Medical Center | $ – | $ 1,099,822 | $ – | $ – | $ 1,099,822 |

| Maimonides Medical Center | $ – | $ – | $ 4,299,479 | $ – | $ 4,299,479 |

| Millennium Collaborative Care (ECMC) | $ 2,391,904 | $ – | $ – | $ – | $ 2,391,904 |

| Mohawk Valley PPS (Bassett) | $ – | $ – | $ 394,800 | $ – | $ 394,800 |

| Montefiore Hudson Valley Collaborative | $ 2,167,361 | $ – | $ – | $ – | $ 2,167,361 |

| Mount Sinai Hospitals Group | $ – | $ 3,498,247 | $ – | $ – | $ 3,498,247 |

| Nassau Queens PPS | $ – | $ – | $ – | $ 3,948,024 | $ 3,948,024 |

| New York City Health Hospitals Corporation | $ – | $ 6,412,413 | $ – | $ – | $ 6,412,413 |

| Refuah Community Health Collaborative | $ 399,192 | $ – | $ – | $ – | $ 399,192 |

| Samaritan Medical Center | $ – | $ – | $ 376,478 | $ – | $ 376,478 |

| SBH Health System (St. Barnabas) | $ – | $ 3,382,663 | $ – | $ – | $ 3,382,663 |

| Sisters of Charity Hospital of Buffalo (Catholic Medical) | $ 807,072 | $ – | $ – | $ – | $ 807,072 |

| Southern Tier Rural Integrated PPS (United Health) | $ 968,840 | $ – | $ – | $ – | $ 968,840 |

| Staten Island PPS | $ – | $ – | $ – | $ 721,545 | $ 721,545 |

| Stony Brook University Hospital | $ 2,009,085 | $ – | $ – | $ – | $ 2,009,085 |

| The New York and Presbyterian Hospital | $ – | $ – | $ 849,366 | $ – | $ 849,366 |

| The New York Hospital Medical Center of Queens | $ – | $ – | $ – | $ 284,535 | $ 284,535 |

| Westchester Medical Center | $ 1,373,350 | $ – | $ – | $ – | $ 1,373,350 |

| Total | $ 17,283,054 | $ 21,842,718 | $ 5,920,124 | $ 4,954,104 | $ 50,000,000 |

The highlighted PPS are participating in the Equity Programs (EP). These PPS are eligible to receive supplemental AHPP payments from unearned EP awards. See Section G, Payment Conditions, for more detail.

|top of page|IV. Additional High Performance Program Acronym List

| Acronym | Definition |

|---|---|

| AHPP | Additional High Performance Program |

| DOH | Department of Health |

| DSRIP | Delivery System Reform Incentive Payment |

| DY | DSRIP Demonstration Year |

| EP | Equity Programs |

| FAQs | Frequently Asked Questions |

| MCO | Managed Care Organization |

| MY | Measurement Year |

| PPS | Performing Provider System |

| P4P | Pay For Performance |

| P4R | Pay For Reporting |

Follow Us