FAQs from the Lessons Learned Outreach Session

- FAQs Also avalable in Portable Document Format (PDF)

| FAQs from the 2022 Home Care Cost Report Initial Kickoff Webinar held on June 8, 2023 |

|---|

| Topic: General |

| Q.1. Where can I access the 2022 Home Care Cost Report initial outreach session presentation after the session? A.1. The recording of the session and corresponding PDF is available in the Tool within the "Instructions" tab, under "Useful Links" on the right side of the screen. The PDF can also be found on the Department's website under "Home Care Cost Report Outreach Sessions." |

| Q.2. When does KPMG anticipate posting the pre-recorded webinar series modules to the Tool? A.2. As of the date of this webinar, three pre-recorded modules are available in the "Useful Links" section of the 2022 Tool:

|

| Q.3. If I have questions as I'm completing my cost report, should I contact my auditor from last year if I still have their contact information? A.3. No, for any questions regarding the 2022 Home Care Cost Report, please refer to the FAQ tab in the Tool or send an inquiry to the KPMG Home Care mailbox (us-advrisknyshc@kpmg.com). |

| Q.4. When will the Secure File Transfer Protocol (SFTP) site be available to upload supporting documentation? A.4. SFTP account passwords expire after 90 days of inactivity for security purposes. Since most accounts from the 2021 Home Care Cost Report submission have expired from the prior reporting year, we will be resetting all SFTP passwords during the 2022 Home Care Cost Report submission process (in July-August 2023) to help ensure they do not expire before the supporting documentation due date (September 6, 2023) . Once the new SFTP accounts are created, providers will be able to upload supporting documentation for the 2022 cost report. |

| Web-based Tool |

| Q.5. Will the ability to upload the cost report as an Excel file be possible this year? A.5. No, all data must be manually entered into the Tool and only cost reports completed within the Tool will be accepted; however, the agency will be able to upload Excel files used to help determine each Schedule's reporting to the Secure File Transfer Protocol (SFTP) site as supporting documentation. |

| Q.6. Is there a way to print out each tab of the Tool? A.6. There is a "Home Care Cost Report Template" available in the "Useful Links" section of the Instructions tab, which is a blank Excel download of the cost report schedules. There are also several print features in the "Reporting" tab, such as an Excel download of the cost report schedules, and PDFs of the "General Questionnaire," "Reporting Hierarchy" and "Cost Report Schedules" tabs. |

| Q.7. If I forget my username and/or password for the Tool, how I can recover it? A.7. If you forget your password to the Tool, please select the "Forgot Password? " button on the Web-based Tool login page. You should then receive an email with the steps to reset your password. If you forgot your username, please send an inquiry to the KPMG Home Care mailbox ( us-advrisknyshc@kpmg.com ) for assistance. |

| Q.8. How do I request login credentials to the Tool for my agency staff? A.8. To request login credentials for a member of your agency, please send an email to us-advrisknyshc@kpmg.com, including the individual's name and email address, the agency name, and the agency's Federal Tax-ID. |

| Cost Reporting |

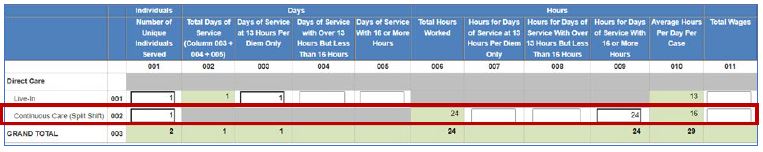

| Q.9. My agency's c ontinuous care split shifts are typically two 12-hour shifts or three 8-hour shifts, for a total of 24 hours; however, Schedule 14 asks agencies to report hours for days of service for continuous care (split shift) in categories of 13 hours, in between 13 and 16 hours, or over 16 hours. Since my agency's split shift hours are less than 13, how should Continuous Care (Split Shift) be reported on this schedule? A.9. Continuous Care (Split shift) hours reported in Columns 007-009 on Schedule 14 should include the total hours of care the patient received during that day of service. This would be the sum of the hours each aide provided. In your example, since the patient received a total of 24 hours across the different aides, 24 would be entered in the "Hours for days of service with 16 or more hours" Column 009, as shown below.  |

| Q.10. Why are Home Health Aide (HHA) Services provided by a LHCSA entity through a contact with the NYC Human Resources Administration (HRA) considered non-reimbursable on the Cost Report? Q.10. HHA is not reimbursed by NYS DOH as a discrete rate within, or as a component of the calculation of NYS-set Personal Care rates, and therefore is considered a non-reimbursable service type for LCHSAs on the Home Care Cost Report. LHCSAs that contract with NYC HRA may receive reimbursement for HHA services from NYC HRA; however, they are still considered non-reimbursable on the Home Care Cost Report since they do not impact NYS rate setting. |

| Q.11. Are there any examples of the proper way to document the agency's cost allocation methodology across entities or service types? A.11. Yes, there are supporting documentation templates available in the Tool within the "Instructions" tab under "Useful Links" on the right side of the screen. In the supporting documentation templates, you will find an "allocation" tab that has an example of allocation calculations and documentation. A pre-recorded webinar module will also be available on this topic in the same section of the Tool. |

| Q.12. Where can I find more information on how to report Workers' Recruitment and Retention (WR&R) revenue and costs? A.12. Please review the detailed WR&R reporting guidance included on pages 16-19 of the 2022 Home Care Cost Report Instructions document, which is available within the "Useful Links" section of the "Instructions" tab. Additionally, DOH and KPMG have provided three WR&R revenue estimation templates that provider may leverage to help estimate WR&R revenue and determine the portion of reimbursable versus non- reimbursable WR&R costs. There is one template for each entity type (CHHA, LHCSA, and FI). These templates are available in the "Useful Links" section, under the "Supporting documentation templates" sub-section. Lastly, KPMG and DOH will be posting a pre-recorded webinar module related to WR&R reporting guidance. This will be uploaded to the "Useful Links" section of the Instructions tab in the Tool. |

| Q.13. Should WR&R revenue be estimated and offset for both Medicaid Fee- F or-Service (FFS) and Medicaid Managed Care (MC) covered services? A.13. Yes, if you offer both Medicaid FFS and MC plans, you are required to estimate the WR&R revenue received for both Medicaid FFS and MC covered services. The only exceptions are entities contracted with the NYC HRA and CHHA episodic entities, as a WR&R rate add-on is not included in the rates for those entities. For more details, refer to the WR&R reporting guidance included on pages 16-19 of the 2022 Home Care Cost Report Instructions document, which is available within the "Useful Links" section of the "Instructions" tab. |

| Q.14. During the session, DOH and KPMG indicated that General Questionnaire question G.14a will ask agencies to identify their contracted Managed Care Organization (MCO) or Managed Long Term Care (MLTC) plans, if applicable. What will be the source of the MCO/MLTC names on this question? A.14. The drop-down menu for question G.14a will include the list of 64 Plan Legal Names for the MCO/MLTCs operating in New York State from eMedNY. |

| Q.15. If my agency has an entity that did not provide any FFS or MC covered Medicaid services in the calendar year being reported, may we omit that entity from the Home Care Cost Report? A.15. Yes, if an agency operates an entity that did not provide any Medicaid services, that entity may be omitted from the Home Care Cost Report. However, the agency will need to provide a reconciliation from the 'Total Entity Cost' value reported on Schedule 3 to the total expenses per its Financial Statements by completing the Financial Reconciliation tab to show that the variance is due to the entity that was omitted from Schedule 3. |

| Q.16. Are costs related to Traumatic Brain Injury (TBI) and Nursing Home Transition & Diversion (NHTD) services considered non-reimbursable? A.16. Yes, TBI and NHTD services are considered non-reimbursable services on the Home Care Cost Report, as they are not reimbursed through the NYS DOH Medicaid CHHA, Personal Care, or Consumer Directed Programs. Costs related to these services should be reported within column 002 "Non-reimbursable Costs on Schedule 3, within the "Other Non-reimbursable services" row. |